Bears got plenty to eat ahead of the Thanksgiving holiday, gobbling up crops. But bulls were stocking up on meat contracts according to data out Monday.

Here’s what funds were up to through Tuesday, November 20, when the CFTC collected data for its latest Commitment of Traders. The report, normally issued Friday, was delayed due to the holiday.

Black Friday

Big speculators sold corn, soy, wheat and cotton last week as prices mostly swooned. But these hedge fund traders went the other way in cattle and hogs, buying those contracts. In all, the specs added 42,140 contracts to their net short position in crops and livestock. Investors using index funds to gain exposure to commodities also trimmed their holdings, cutting 6,817 net contracts.

Not ready

Big speculators looked like they might be ready to start buying corn outright as November began, instead of just covering short positions. Instead they sold for the second straight week, adding 27,508 contracts to their modest bearish bet.

Near the summit

Big speculators sold a few soybeans last week, adding 2,490 contracts to their net short position. But trading was cautious ahead of the holiday and talks between President Trump and China’s President Xi at the G-20 summit at the end of the week.

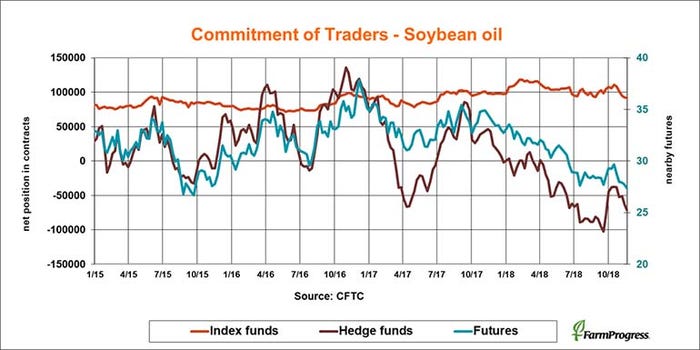

No tractions

Big speculators sold soybean oil last week, adding 8,104 net contracts to their overall short position as weak palm on prices weighed on sentiment in the vegetable oil market.

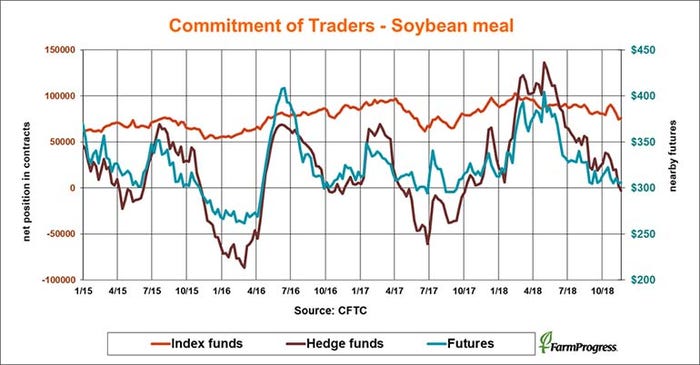

Over the edge

Big speculators had a bullish bet on soybean meal for most of 2018, but that position ended last week. Hedge funds sold a net 5,060 contracts to turn short for the first time since January.

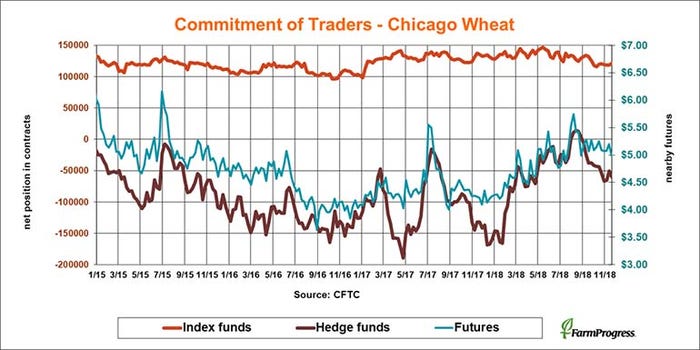

Buyer beware

Egypt bought soft red winter wheat recently but funds weren’t yet feeling the love as of Tuesday of last week. The big speculators extended their net short position in SRW by another 9,352 contracts though index traders were buying a little.

Adding it on

After turning bearish on hard red winter wheat earlier in November, big speculators sold more last week, adding 5,256 lots to their net short position as futures made new contract lows.

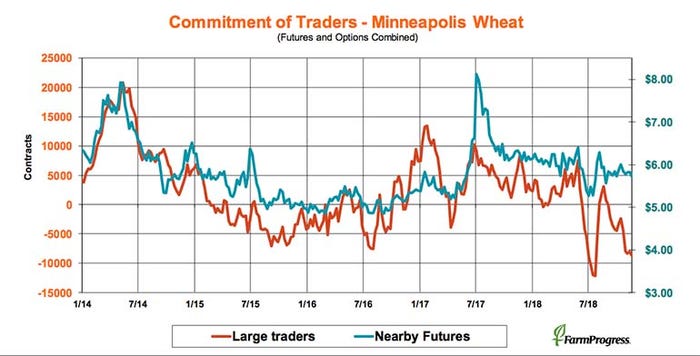

No spring

Large traders in spring wheat returned to selling last week, adding 700 lot back to their bearish bets in Minneapolis.

Out of cash

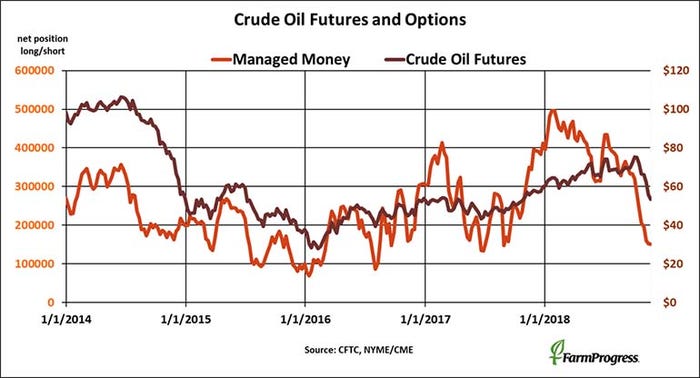

Money managers sold last week as crude lost more ground, but only cut $48 million in futures and options off their net long position as prices headed towards $50 a barrel.

About the Author(s)

You May Also Like