Grain futures traded mixed after USDA released mixed results this morning, cutting corn inventories more than expected but raising stocks of wheat and soybeans. Soybean and wheat futures slipped slightly following the report’s release, with corn prices adding more than 1% in late morning trading.

“USDA’s numbers don’t change the underlying themes that drove prices higher this winter, so it will be interesting now to see how quickly the market fades the report,” says Farm Futures senior grain market analyst Bryce Knorr.

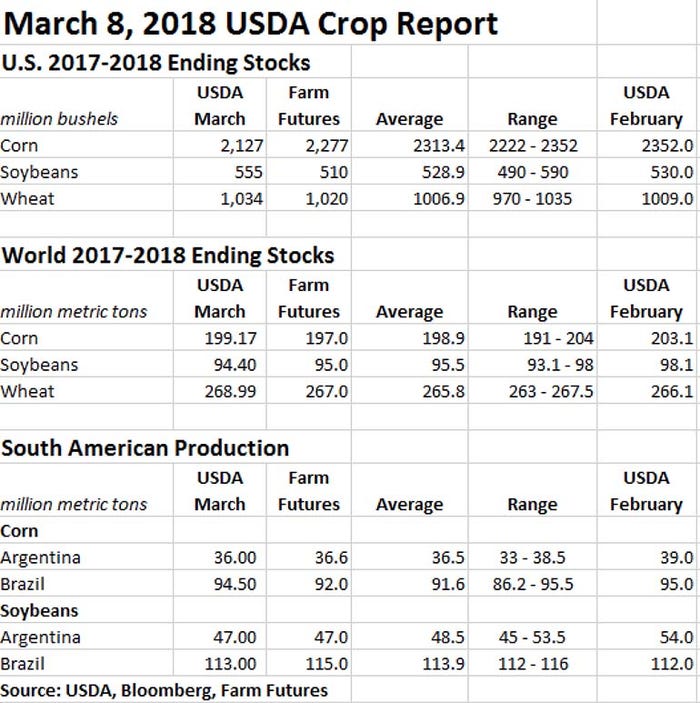

USDA pegs U.S. corn ending stocks at 2.127 billion bushels, down 225 million bushels from the agency’s February estimates. It was also completely below the range of all trade estimates between 2.222 billion and 2.352 billion, averaging 2.313 billion. The agency cites “larger exports and increased corn used to produce ethanol” for the downward shift in domestic supplies.

“Exports are raised 175 million bushels to 2.225 billion, reflecting U.S. price competitiveness, record-high outstanding sales, and reduced exports for Argentina,” according to the report.

USDA also lowered its world ending stocks for corn from February estimates of 203.1 million metric tons to 199.17 MMT. That number was more in line with an average trade guess of 198.9 MMT. Expected yield reductions in some areas such as Argentina were partially offset by higher production in areas such as the European Union, South Africa and India, according to USDA.

“USDA’s reduction of corn carryout was more than I expected, though the agency’s forecasts of exports and usage are in line with my own,” Knorr says. “I didn’t expect such a large reduction this quickly, because feed usage is still a question mark. Higher prices could trim corn usage in rations, especially with more sorghum likely available. But feed usage changes won’t be worked into the supply and demand table until April, following release of quarterly grain stocks March 30.”

Knorr says the reduction in corn could help May futures rally to the $4 level. December has a better shot at the $4.15 level in the short run – but, that will buy too many acres if the market moves too much too soon, he says.

“Plus, it’s important to remember we’re still talking about 2.127 billion bushels of corn still being around on August 31,” Knorr says. “The wildcard will be Brazil’s crop. USDA made only a token reduction there.”

Soybean and wheat ending stocks trended higher, meantime. For soybeans, USDA added 25 million bushels to its February U.S. ending stocks estimates, landing at 555 million bushels.

“An increase in food use is more than offset by lower biodiesel use, leaving domestic disappearance lower this month,” according to the report.

Global soybean stocks trended lower, meantime, from USDA estimates of 98.1 MMT in February to 94.4 MMT in March. Trade analysts also predicted lower world ending stocks, but had only projected an average reduction to 95.0 MMT.

“Soybeans face a more interesting test,” Knorr says. “For the third straight report beans are trying to generate a bullish reaction to bearish numbers. If the market is able to hold a reversal higher today it could generate more buying from investors betting on inflation and rising commodity prices.”

The market may also hinge on what China does next, Knorr adds. Chinese purchases of U.S. soybeans have picked up a little in recent weeks but are still down 20% from last year’s levels, he notes. If Brazil’s crop comes in larger, that will help to offset some of Argentina’s production woes.

For wheat, USDA added 25 million bushels to U.S. ending stocks, bumping up that total to 1.034 billion bushels. Trade analysts actually predicted a slight reduction in domestic stocks, with an average guess of 1.007 billion bushels. USDA points to lower exports due to price competitiveness issues with some international markets.

The agency also points to rising supplies and falling demand to support its latest global ending stocks estimate of 268.99 MMT, up from 266.1 MMT in February. As with domestic stocks, trade analysts had predicted a small reduction in global wheat stocks, with an average guess of 265.8 MMT.

“USDA cut its forecast of wheat exports a little more than I expected, but the story in that market is all about new crop now,” Knorr says. “A lower close today could start a consolidation as we wait for the winter wheat crop to come out of dormancy and begin focusing on what farmers are doing on the northern Plains, where it’s also dry.”

USDA also offers projections for South American grain crops, the fate of which can swing prices dramatically in either direction throughout the winter and early spring. For the most part, USDA foresees shrinking corn and soybean production in South America, with one notable exception.

Argentina’s continued struggles with drought has USDA pushing down production estimates for that country once more. Argentina’s corn crop is now projected at 36 MMT (down from 39 MMT in February), while its soybean production tumbles from 54 MMT in February to 47 MMT in March.

Brazil’s corn production is also trending slightly lower, with USDA pushing it from 95 MMT in February to 94.5 MMT in March. But USDA’s soybean production estimates for Brazil are drifting in the other direction – from 112 MMT to 113 MMT.

About the Author(s)

You May Also Like