Mid-February is normally a time when corn and soybean markets lick their wounds, searching for bottoms as traders focus on South American harvests and potential U.S. acreage shifts in the spring. But this winter saw a complete reversal of that trend.

Nearby corn futures traded near the highest level since June 2013, while soybeans basked in their best showing since June 2014, with both crops posting gains around 40% off fall lows. Such rallies from harvest to February are hardly a given. July soybean futures moved higher only a third of the time over the last 50 years, while corn had only a 50-50 chance of gains.

Strong demand and tighter supplies gave life to the rallies this year. And to keep going, both markets likely will need more bullish news, especially from big USDA reports, including monthly World Agricultural Supply and Demand Estimates, quarterly grain stocks and prospective plantings.

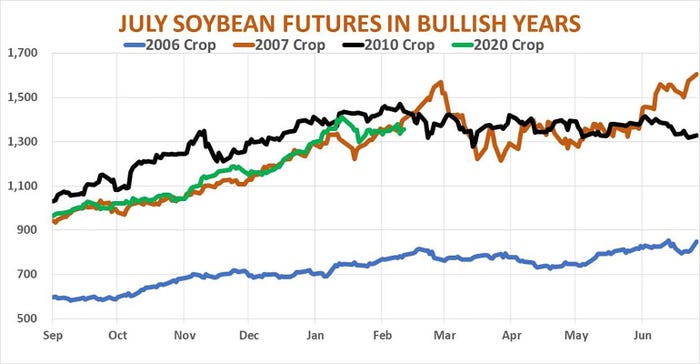

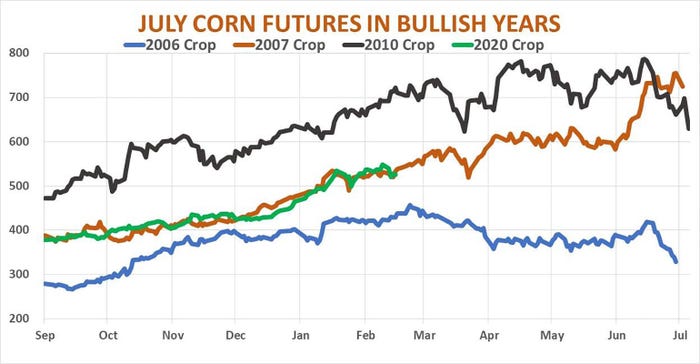

The size of the 2020 crop rallies was matched only three times in the past 15 years – in the 2006-2007, 2007-2008, and 2010-2011 marketing years. The history of those markets provides.an indication of both magnitude of the achievement and the hurdles bulls face in keeping the upward pattern intact.

Soybean volatility

July 2007 soybean futures extended their move higher into the end of February before backsliding into spring, because USDA estimates of 2006 crop ending stocks actually increased from September to February. The market eventually recovered with a late rally into delivery, with old crop prices supported by a big cut in new crop acreage that kept forecasts friendly.

Indeed, July 2008 futures went on a tear, gaining more than 50% as 2007 crop ending stocks estimates fell 26% from September 2007 to February 2008. Futures collapsed in March as traders anticipated a big increase in seedings that spring, but eventually recovered to make new highs, topping $16 for the first time.

July 2011 futures also posted big increases from September 2010 to Mid-February 2011. But after that the market ran out of momentum, with prices trending lower into delivery, losing more than $1 of their gains as ending stocks estimates eventually increased.

Corn pattern mixed

The same wide variation was seen in the corn trade too during the three years. July 2007 futures rallied 60% off fall lows as USDA cut its forecast of 2006 crop ending stocks 38% from September 2006 to February 2007. The market held on until early March 2007, when it began a slide into delivery thanks to increasing estimates of carryout.

The following year didn’t see large cuts in USDA’s carryout estimates from September 2007 to February 2008. But July 2008 futures rallied nearly 45% off fall lows after the government forecast very tight new crop supplies because the market anticipated a large cut in 2008 acreage. That tightened supplies and ultimately drove futures above $8 for the first time as the commodity boom reached a blow-off top before the great financial crisis.

The grain market was just beginning to recover from that debacle as the 2010 marketing year began. The rally kicked into overdrive after harvest as USDA cut its forecast of 2010 crop carryout 40% from September to February – a similar magnitude as the cuts to the 2020 crop so far. July 2011 futures rallied 47% into mid-February, then traded in a range of almost $1.85 cents, ending weak into delivery.

To be sure, three years isn’t a big sample. But farmers holding both crops will be rolling the dice. Even if more gains come, volatility could be extreme if the past is a guide.

The fact it’s been a decade since those winter markets were hot suggests longer rallies aren’t a given, so be sure your marketing plan can withstand the uncertainty.

Knorr writes from Chicago, Ill. Email him at [email protected]

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like