Multi-year highs in old crop corn and soybean futures are part of a larger commodity boom sweeping markets from crude oil to copper. But USDA helped turn traders’ attention at least a little to new crop prospects last week at its annual outlook conference.

The forum, held virtually this year, featured the government’s first estimates of new crop acreage, supply and demand. Though the acreage and production forecasts stem from statistical models, not actual data from farmers, the numbers help focus attention on what will happen in the coming year.

USDA’s Prospective Plantings report issued at the end of March is based mostly on farmer surveys conducted in the first two weeks of the month. Until those results are released, the outlook conference acreage estimates are the unofficial starting point for what farmers will do this spring.

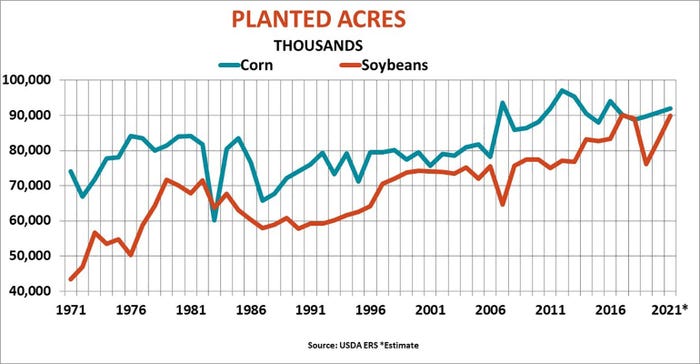

According to the government, farmers could plant 92 million acres of corn this spring, 1.3% more than 2020. Soybean seedings would soar to 90 million, 8.3% more than the 83 million put in a year ago.

What farmers actually wind up planting can vary widely from March intentions, due to weather, markets – and as we found out painfully recently – extraneous events like trade wars and pandemics. The March report could also depart from the outlook estimates depending on what happens to markets over the next couple of weeks.

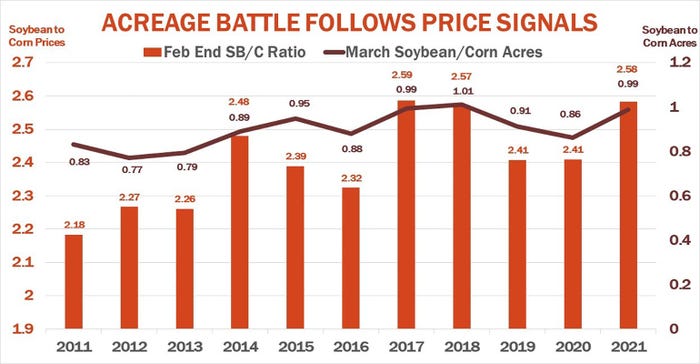

Much of the early debate on acreage focuses on the ratio of new crop soybean to corn futures. The long-term average for this ratio at the end of February is about 2.36 to 1 in favor of soybeans. The ratio settled last week at 2.60 to 1, a level that significantly favors soybeans. Based on this figure, farmers might plant almost as many acres to soybeans as corn.

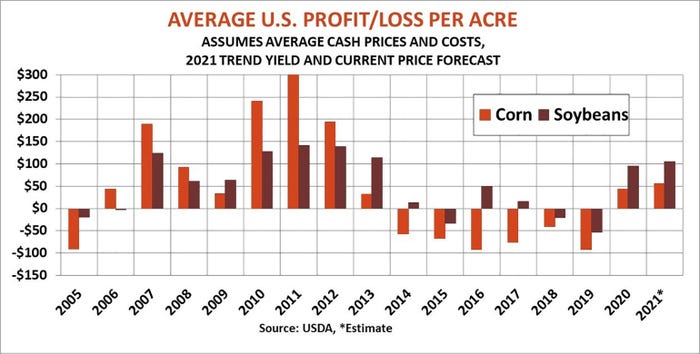

Another factor in soybeans’ favor is the crop’s potential profit advantage. At current futures prices less expected basis, corn returns nearly $50 an acre less than soybeans, based on average costs and yields. That’s about the same differential between the two crops as is expected for 2020 production, according to current USDA forecasts.

Indeed, soybeans are on a roll, out-earning corn from 2013-2019. Even during the depths of the trade war with China, corn underperformed, and that’s before any of the billions in government assistance is counted.

One factor does mitigate corn’s position. The feed grain is still expected to turn a profit when full results for the 2020 marketing year come in. Statistics prove the market’s assumption that farmers love to plant corn, especially if it’s profitable, and what happened the year before can influence’s cropping choices.

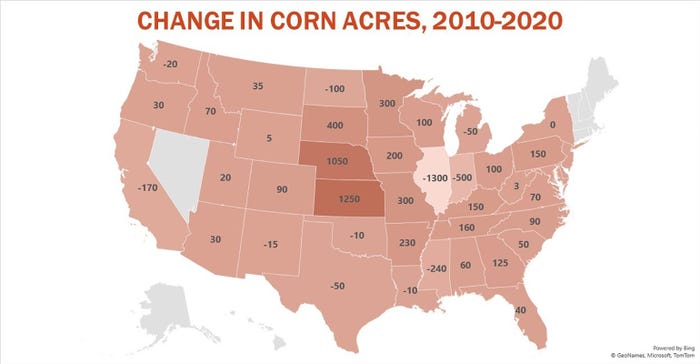

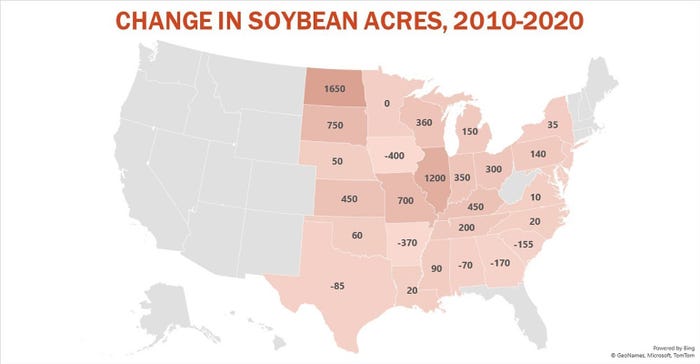

Weather might eventually get in the mix too. Parts of the western Corn Belt are dry and forecasts through summer call for above normal temperatures and below average precipitation there. While soybeans have added plenty of acres over the past decade, especially in the Dakotas, corn has gained ground in the West too, with big increases noted in Kansas and Nebraska. Soybeans added acres at the expense of corn in Illinois and Indiana, where normal conditions are expected to prevail.

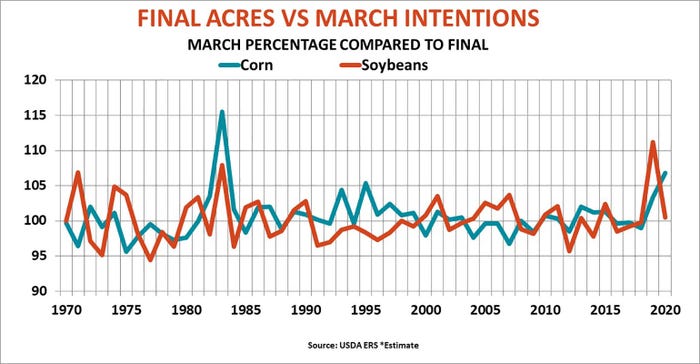

The history of changes in planting intentions offers mixed results. Over the past 56 years, March prospective Corn plantings were higher than the final numbers slightly more often than not. In years when final corn acres were lower, the actual number fell an average of 2.4%. In years when farmers planted more corn than March intentions, acreage averaged 1.4% higher.

Final soybean seedings were higher than March intentions more often, yearly 60% of the time, with weather usual key. In years when farmers wound up planting more, the average gained was around 2% of March intentions. When farmers planted fewer soybeans, the decrease was around 3%.

This uncertainty should make the 2021 “battle to buy acres” more interesting an affair than it’s been for a decade or more. Unlike the trade dispute, the prospects from this war aren’t brining red ink for either corn or soybean growers. Both crops offer a shot at good returns at current price levels.

Knorr writes from Chicago, Ill. Email him at [email protected]

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like