April 12, 2018

If you have corn or soybeans stored unpriced this spring, here’s a marketing opportunity to consider. It’s especially helpful for bushels stored in on-farm bins, especially if those bushels aren’t going to be dry enough to safely store into summer or fall.

Using this marketing strategy on at least a portion of those bushels, you can lock in the basis and still stay long in the futures market. You simply deliver the grain when basis is attractive. Then re-own those bushels you delivered by using these tools: a basis contract (re-owning via July futures) or a minimum price contract (re-owning via July call options).

Basis is the difference between the local cash price and the nearby futures price. With the selloff in futures prices due to the threats of Chinese tariffs, the processor and river basis bids narrowed (strengthened), as local demand remains strong for both corn and soybeans.

Spring offers best pricing

Some of the best basis opportunities of the year often occur during April and May. Farmers get busy with spring fieldwork and planting and are reluctant to deliver large quantities of bushels. Likewise, co-ops and other country elevators are busy in spring and have less time and manpower available to move stored grain to processors.

BUSY IN FIELD: Springtime is when farmers typically deliver the least amount of grain to the marketplace, which strengthens or narrows the basis.

Once we move past Memorial Day weekend, however, you can expect renewed interest in hauling grain by both farmers and co-ops. Farmers should not lose sight of the large U.S. ending stocks of corn and soybeans forecast for the end of the crop marketing year in August. A return to more normal planting conditions this spring could impact basis for both old- and new-crop bushels.

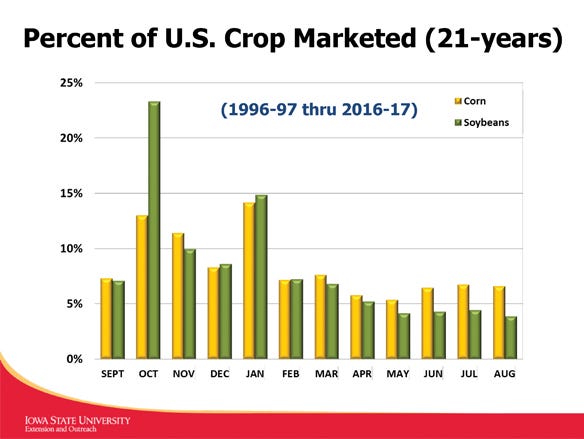

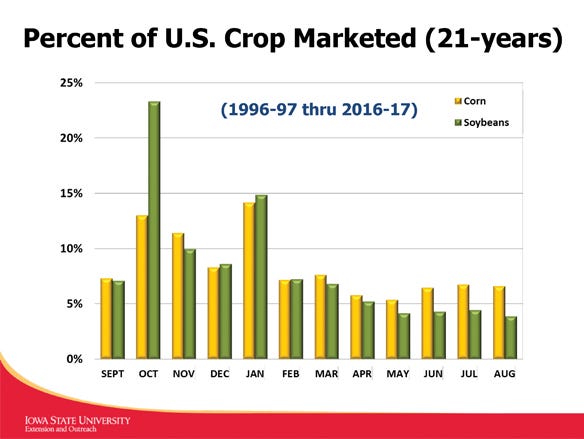

This chart reflects USDA National Agricultural Statistics Service data for percent of U.S. corn and soybeans marketed by month for the past 21 years. Note the November-December period when farmers typically lock their grain bin doors. An even better basis tends to occur in April through May, as farmers head to the fields and co-ops are busy delivering seed, fertilizer, etc. Check the basis offered by major processors in your area. Most have better cash bids for last half of April through May versus the June-July time frame.

These six weeks could prove to be a good time to move the grain to market, especially corn that you know won’t be dry or cool enough to be stored safely into July and August.

Executing the strategy

Tell your grain merchandisers you have corn you’d like to deliver as you notice the basis they are offering is attractive. Ask them if you could deliver your corn on a basis contract or perhaps a minimum-price contract. Upon delivery of your grain, the merchandiser will then buy a July futures contract or buy a July call option on your behalf.

Farmers will be very busy the next few weeks getting crops in the ground. Co-ops are also busy in spring and aren’t likely to be delivering as much grain to processors. Thus, this April-May time frame could provide some of the better basis opportunity of the year, especially on days when market prices move sharply downward.

Keep in mind processors, such as ethanol plants and soybean crushers, need grain every weekday; nickels and dimes are sitting there with the processor basis because they are always buying grain.

Once you put those delivered bushels on basis or minimum price contracts, you will still need to have a price objective and a time objective. Remember, minimum price using the call options for July will expire on July 22. So, by using this strategy, you can buy yourself a couple months’ time. For bushels placed on basis contracts, they will require a decision to sell those July futures positions by the first notice day of the July contract, or about June 29.

Avoiding risks

Staying long the July futures allows for participating in a July futures price rally, as well as the risk of lower futures prices. Since you have already delivered the cash bushels, you aren’t risking both basis and futures prices simultaneously.

This marketing strategy takes some of the price risk off the table. It can also prove useful for bushels in commercial storage. However, don’t expect as attractive of basis opportunities as are offered by processor bids.

In addition, you’ve already accumulated approximately six months of commercial storage costs. Consider moving these commercially stored bushels earlier in the marketing year to avoid accruing fixed costs of storage and possibly interest.

As you plan your marketing strategy, keep in mind that with ending stocks of 2.1 billion bushels for corn and 570 million bushels of beans projected, the U.S. will have a large quantity of bushels left over on Aug. 31. Many of these bushels will still be moving in September, as odds of an early harvest have been minimized with the later-than-normal corn planting.

Johnson is an Iowa State University Extension farm management specialist. Contact him at [email protected].

About the Author(s)

You May Also Like