Big speculators took bearish bets on agriculture into USDA’s Sept. 30 reports – and paid the price.

Here’s what funds were up to through Tuesday, October 1, when the CFTC collected data for its latest Commitment of Traders released Friday.

![]()

Wrong side of the boat

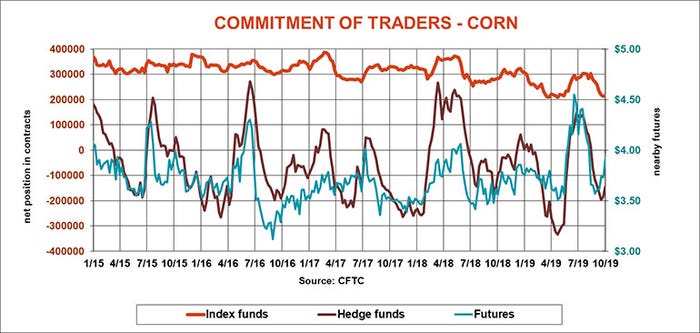

Big speculators started trimming bearish bets in crops and livestock in the wake of USDA’s Sept. 12 reports. Their effort intensified after bullish Sept. 1 stocks data came out at the end of the month. Hedge funds cut a net 109,385 contracts from bearish bets. Investors wanting to own commodities through index funds went in the other direction, trimming their net long positions to the lowest level since the financial crisis bottomed in 2009.

Stocks shock

Bearish speculators were unprepared for the big cut in Sept. 1 corn stocks, prompting them to buy back 39,995 contracts of their net short position this week. They’re still short 145,110 lots.

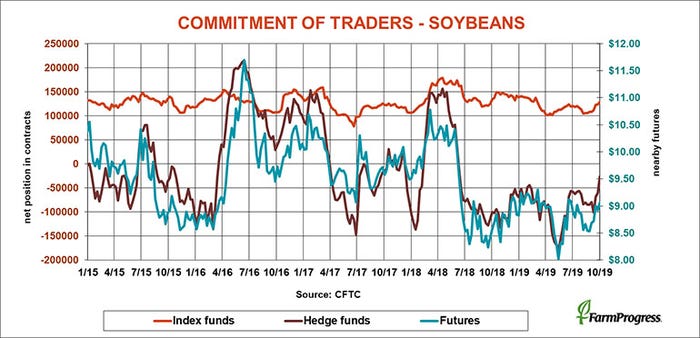

Sweet 16

Big speculators abandoned most of their bearish bet in soybeans this week, cutting it to the lowest level in 16 months on a friendly inventory report from USDA.

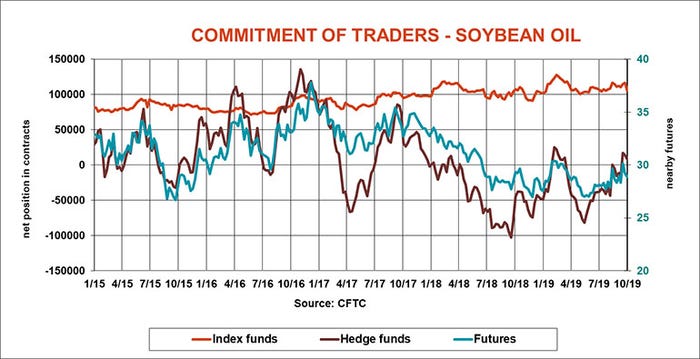

Wrong way

Big speculators trimmed their small bullish bet on soybean oil this week, cutting 5,787 lots of the net long position – just in time for prices to rally after the CFTC data was collected Tuesday.

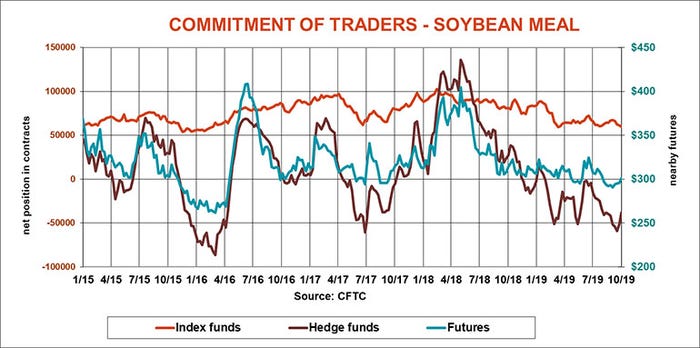

Dried up

Big speculators cut bearish bets in soybean meal by a third earlier this week, only to see prices falter when that short covering evaporated.

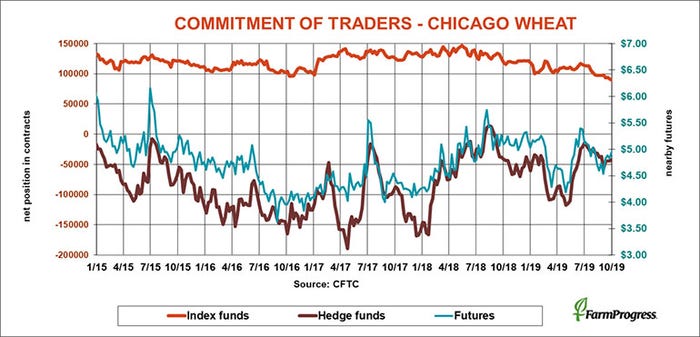

Waiting for news

After modest short covering at the beginning of September, big speculators didn’t change their net positions much in soft red winter wheat. Hedge funds cut a mere 1,730 contracts of their bearish bets this week.

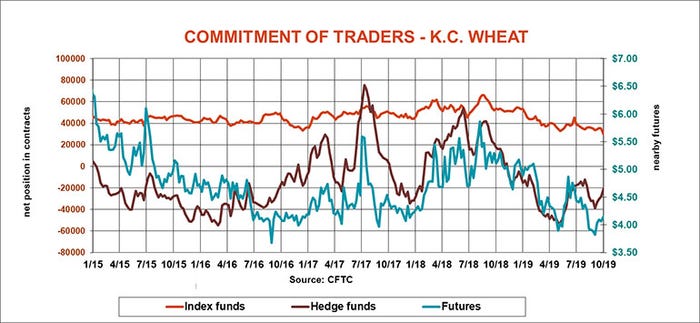

Slow gains

Big speculators bought back short position in hard red winter wheat for the fourth straight week, trimming bearish bets by 6,815 contracts.

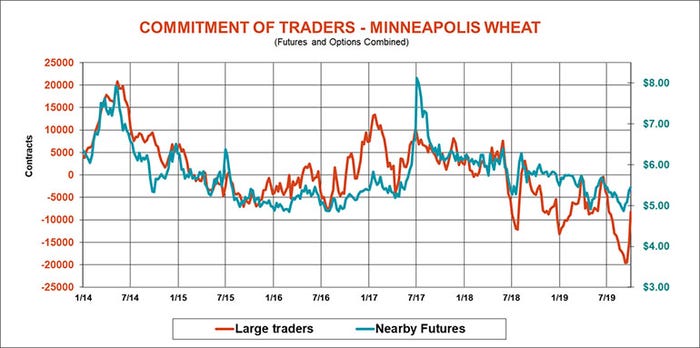

All over?

Minneapolis futures ran into trouble from the USDA reports, which raised the estimate of wheat production. Large traders trimmed bearish bets by 7,049 this week before selling intensified.

Price war

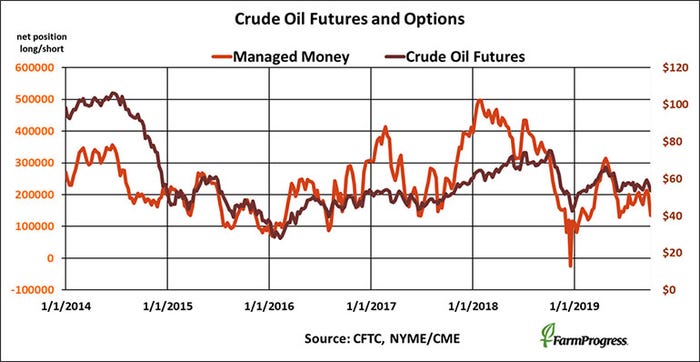

Crude oil futures fell off a cliff this week on fears of a slowing world economy. Money managers gave the market a push, selling nearly $3.4 billion worth of crude oil futures and options.

About the Author(s)

You May Also Like