Big speculators don’t make money by being timid. So, they were placing bets this week ahead of Friday’s USDA reports.

Here’s what funds were up to through Tuesday, Nov. 5, when the CFTC collected data for its latest Commitment of Traders released Friday.

![]()

Money flows both ways

Big speculators sold into the USDA reports, adding 57,194 net short positions back to their bearish bets against crops and livestock. But investors gaining exposure to commodities through funds that track indexes were buyers, adding 71,121 contracts to their net long position, which reached its second highest level of the year.

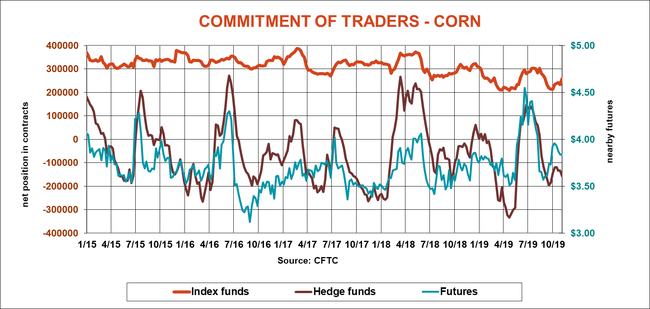

Shooting for bear

Big speculators added another 22,8358 contracts to bearish bets against corn this week, only to see the market receive a little bullish news from USDA. Index traders were buyers, adding 24,426 contracts.

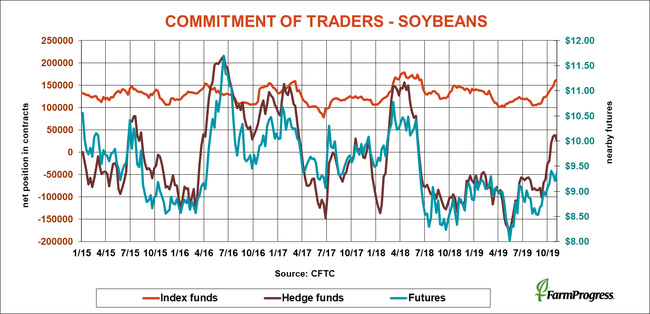

To the exits

Big speculators squared more of their modest bullish bets on soybeans into the reports, which looked like a wise decision after the government raised its forecast of carryout. Hedge funds trimmed 12,480 contracts from their net long position in all.

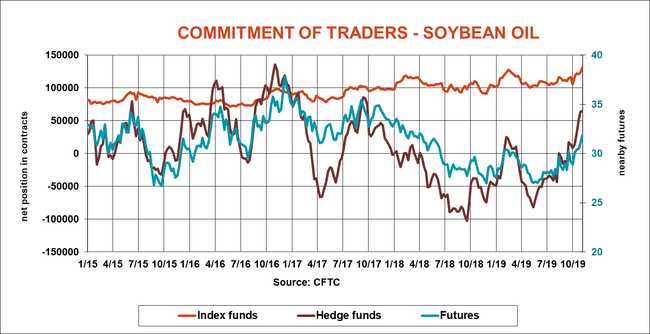

Chosen one

Vegetable oil markets again were in play this week, with palm oil hitting new highs for the year. Big speculators jumped on board the bandwagon, extending their net long position in soybean oil, while index traders increased their net long position to an all-time record.

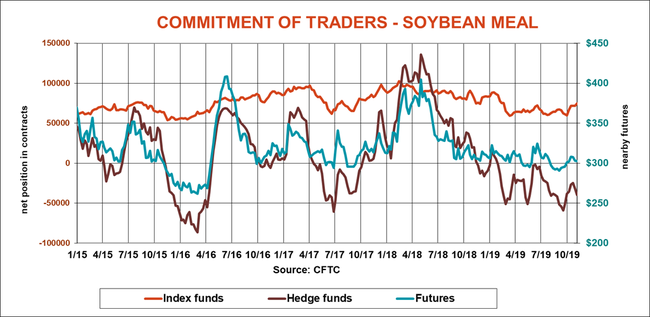

No love

Big speculators sold soybean meal again last week, adding 7,590 contracts to their modest bearish bet.

Right or wrong?

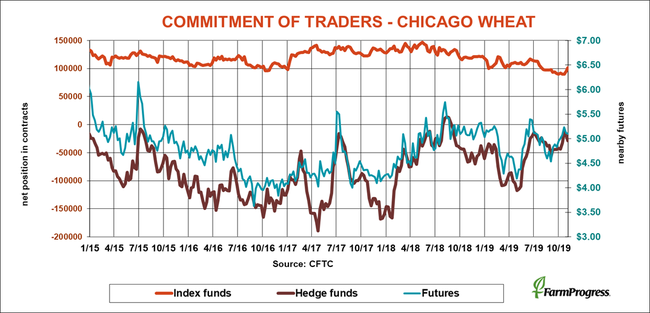

Big speculators added to bearish bets in soft red winter wheat this week, extending their small net short position by another 9,001 contracts.

Discount store

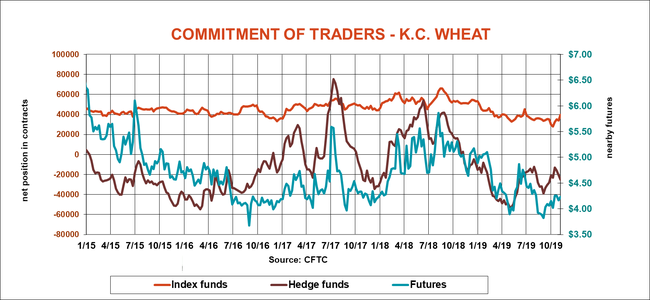

Hard red winter wheat continues to sell at a discount to other markets, and big speculators kept up the pressure last week, adding 4,374 contracts to their bearish bets.

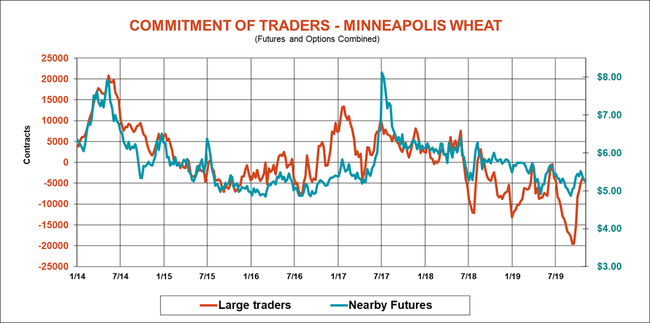

Waiting for the news

Large traders treaded water this week, waiting for USDA’s updated spring wheat estimate. The big guns cut just 17 contracts off their net short position.

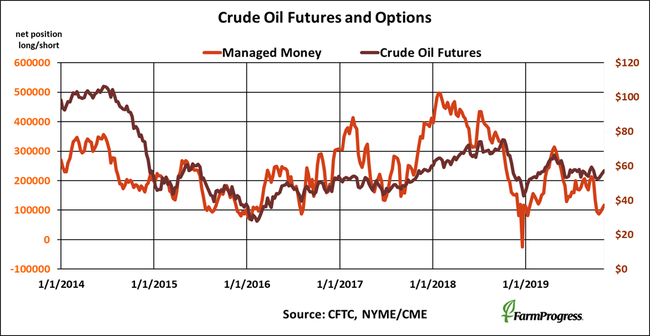

On the right side

Crude oil gyrated this week on news about the trade war. Money managers were small buyers again, adding $675 million in futures and options to their net long position.

About the Author(s)

You May Also Like