USDA’s Oct. 11 reports created plenty of waves in the market. But funds mostly tried to avoid rocking the boat ahead of the data dump, though they did show some clear preferences.

Here’s what funds were up to through Tuesday, Oct. 9, when the CFTC collected data for its latest Commitment of Traders.

![]()

Juggling act

Big speculators cut bearish bets overall in agriculture for the third straight week. But after two weeks of aggressive short covering, the squaring slowed. Hedge funds bought only a net 23,499 contracts. Investors wanting to own commodities through index funds were even smaller in their preferences, buying just a net 4,896 lots.

Hit parade

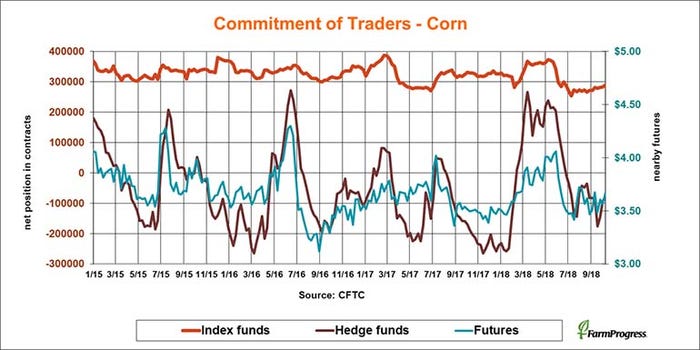

Corn garnered the most interest from funds, confirming it may have the best outlook of the three big crops. Large speculators trimmed another 14,606 contracts off their net short position while index traders added 5,387 lots.

Tread water

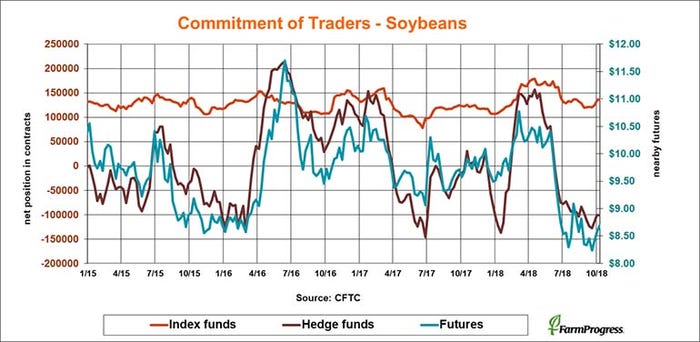

Big speculators didn’t do much in soybeans last week, extending their bearish bet by another 1,461 contracts. Index traders were modest buyers, adding 3,539 contracts to their net long position.

Slick clover

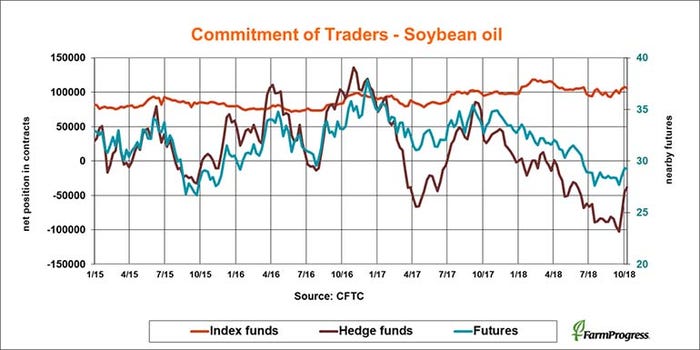

Big speculators covered another 6,590 contracts of their bearish bet in soybean oil, though they’re still short 38,054 lots.

Meal time

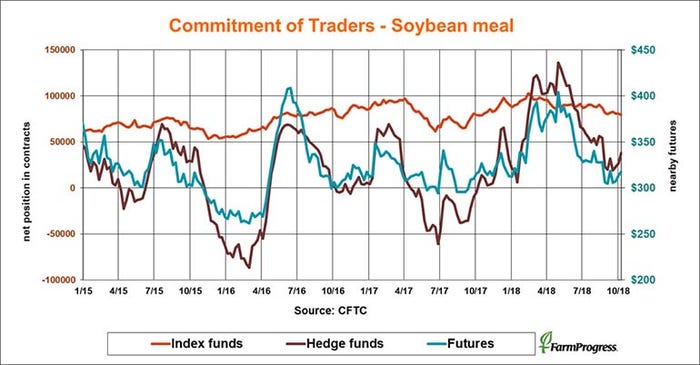

Big speculators bought soybean meal for the third straight week, building back their net long position by another 11,533 contracts.

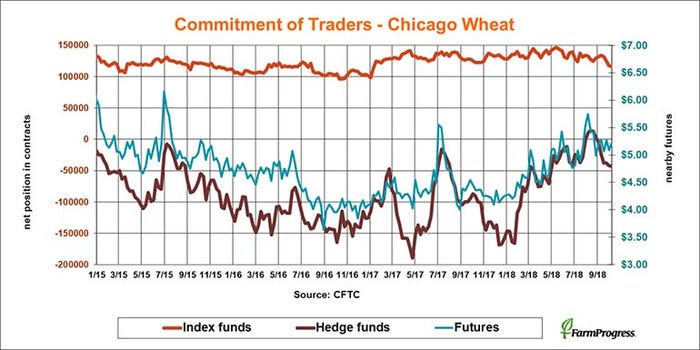

No cover

Big speculators sold soft red winter wheat for the eighth straight week, though again by only a small amount. They added 1,517 contracts to their modest net short position while index traders sold again too.

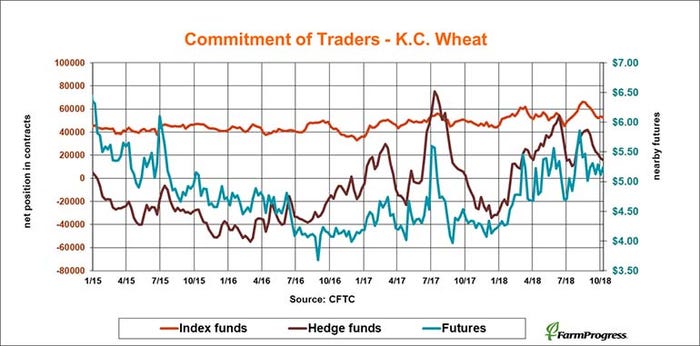

Smaller stuff

Big speculators kept selling hard red winter wheat last week, knocking another 1,354 lots off their small net long position.

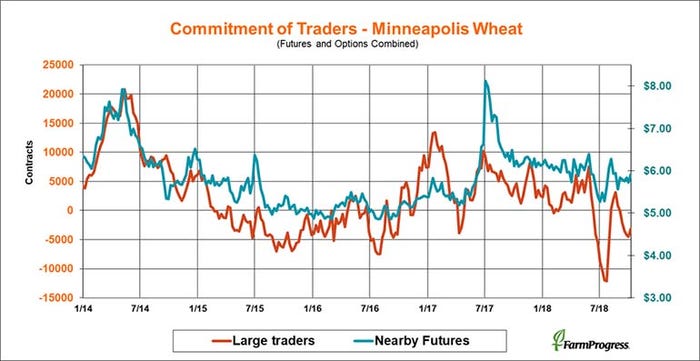

Lucky seven

After selling for six weeks in a row, large spring wheat traders covered some of those bearish bets this week, buying a net 1,272 contracts.

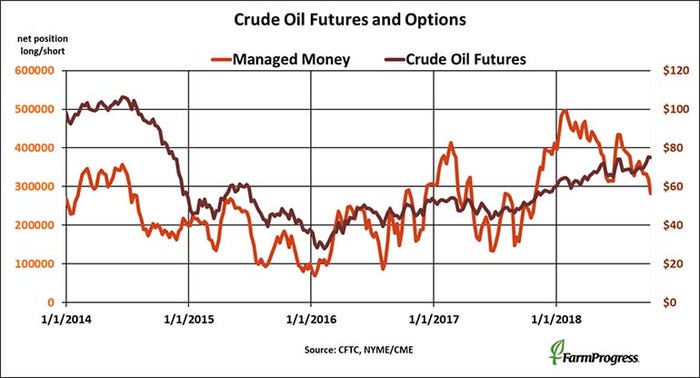

Off the table

Money managers sold crude oil for the fifth straight week and didn’t do it in a small way, liquidating more than $2.8 billion in futures and options.

About the Author(s)

You May Also Like