This is my 40th year of trading. I started down on the floor and worked my way up through the industry. I honestly have never seen fundamentals change this quickly. Usually, it takes two years minimum to drop carryover the way USDA has dropped it this year.

About a month ago, I wrote a blog about the rare opportunity that the market is presenting. In my article, I compared this year's market with 1972-74 and 2001-07. The similarities were almost eerie, and statistics suggested a significant valuation in corn was yet to come. But, just as the comparisons were similar to corn, the soybeans nearly mirror one of the biggest price moves in history.

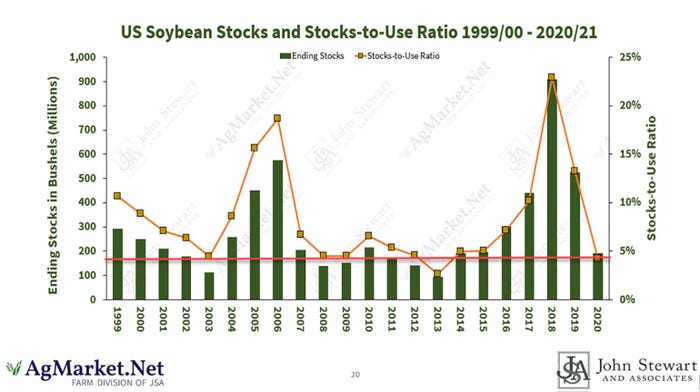

During the 2005 to 2008 era, nearby soybean prices moved from $5.50 a bushel to more than $16.00. This was a result of ending stocks declining due to a surge in demand followed by a cut in supply due to adverse conditions. In 2005 and 2006, stocks-to-use ratios were between 15.8% to 19%. Earlier this year, USDA was projecting old crop stocks between 14% and 22%, which is pretty similar. By the time 2007 and 2008 came along, stocks-to-use ratios fell to 4.5%. This year, within three months, USDA lowered stocks-to-use ratios from about 14% to 4.5%. In other words, our industry went from the normal 50-day supply of soybeans to only a 14-day supply on hand, leaving very little inventory for people to fight over if there were to be another surge in demand or a supply disruption in the coming 12 months.

In my article, I also wrote about fiscal policy and the pressure on the dollar that should continue into the first or second quarter. This, of course, is making our commodities 12% cheaper for international buyers relative to our domestic users. We have the cheapest corn and soybean price in the world. Oddly, again in 2006-2008, the dollar fell below 92.00 and dropped all the way to 73.00. Currently, the U.S. dollar just fell below 92.00 and based on history, we suspect a move into the mid to low 80s is possible. That is over a 20% potential sell off from the high. Obviously, this is export commodity friendly, especially when other exporters like Argentina and Russia are limiting their exports and forcing non-traditional buyers to the only store in town . . . good ‘ol USA.

Fund position is huge. Historically, whenever you see inflation take out 2%, funds will accumulate massive positions of food and fuel as an inflation hedge. This has already started, but they could get a lot more positions on with current CFTC and exchange trading rules. Inflation and the weaker dollar are both outside influences that cause that new truck to get “revalued” and what was $65k now becomes $75k --- for no reason--- people aren’t buying any more and there is no new shortage --- it is just that you are willing to pay more in order to get it so now your neighbor has to do the same. Also true for corn, beans and cattle.

Key to success

My wise mom always said to listen to the old timers and use other people's mistakes to avoid them yourself. So here are a few “sayin’s” I grew up hearing:

“Never sell a dull market short.” - our market has been sideways for the last six years. Historically anything beyond four years is a market that has found its value no matter how negative the news and eventually the news will change. This creates a 'powderkeg' market.

“He who sells what isn't his’n, pays the price and goes to pris’n.” - Small speculative traders have been short this market for the last three years. Now the market is in a tight supply and they only have two choices -- pay the cash price in the country, certify that inventory for delivery to meet their obligations or pay up and buy back their shorts. To buy cash corn or beans for delivery you'd be losing $.40 to $0.70 a bushel versus just buying back the short position and getting out. Oftentimes this is the final leg of a bull market or what they call emotional exuberance. This tells me as a consultant that we need to remain long while the market is building valuation, but we should be getting less bullish with every move higher. You can manage the downside risk by selling to lock in your farming profits and protect a major upside swing with an option.

“Bulls and bears make money ‘n hogs get slaughtered.” - I don't even need to expound on this one.

“Droughts don't happen overnight, but sometimes they end that way.” - As long as there is a threatening weather pattern against the drawdown in stocks, this market will have fuel to move higher. But remember to always protect your gains as the market moves up because whether we're monitoring the South American or North American droughts, the drought could end on any Monday morning we wake up.

If you want to sign up for AgMarket.Net emails, demonstration of our App, or listen to our weekly research video, please call us at 844-4Ag-Mrkt.

Reach Bill Biedermann at 815-404-1917 or [email protected]

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. AgMarket.Net is the Farm Division of John Stewart and Associates (JSA) based out of St Joe, MO and all futures and options trades are cleared through ADMIS in Chicago IL. This material has been prepared by an agent of JSA or a third party and is, or is in the nature of, a solicitation. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading infromation and advice is based on information taken from 3rd party sources that are believed to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. The services provided by JSA may not be available in all jurisdictions. It is possible that the country in which you are a resident prohibits us from opening and maintaining an account for you.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like