Big speculators remain bearish overall against commodities. But new selling by hedge funds eased a little in the latest week as the tone of financial markets improved.

Here’s what funds were up to through Tuesday, September 3, when the CFTC collected data for its latest Commitment of Traders released Friday.

![]()

Saints and sinners

Big speculators added another 50,373 contracts to their net short position in crops and livestock this week, a little less than the two previous periods. But investors gaining exposure to commodities through funds that follow indexes continue to liquidate their holdings, which slipped to the lowest level in four years.

Leaning short

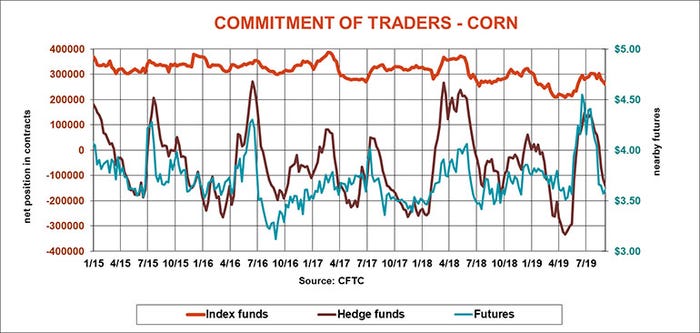

Big speculators continue to flock to the same side of the boat, increasing bearish bets on corn by another 24,685 contracts this week as prices hit new contract lows.

Heeding risks

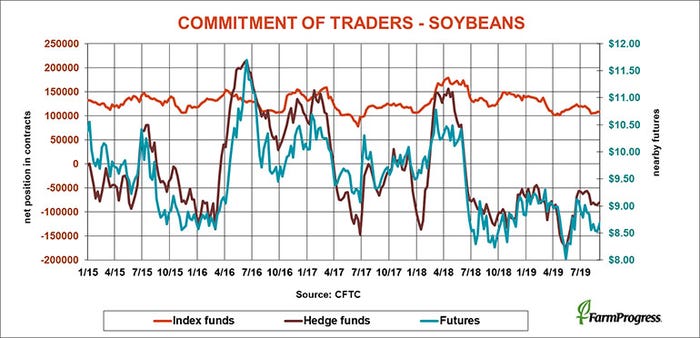

Big speculators bought back a few bearish bets on soybeans this week as traders mull upcoming USDA reports. Hedge funds covered 5,656 contracts but remain with a modest net short position.

Fallowing Asia

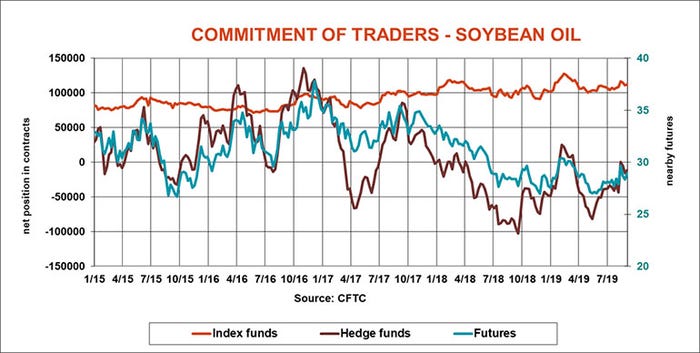

Funds covered some of their small bearish bet in beanoil this week, anticipating bulling news on palm oil. Big speculators covered 1,051 contracts of their net short position.

On the sidelines

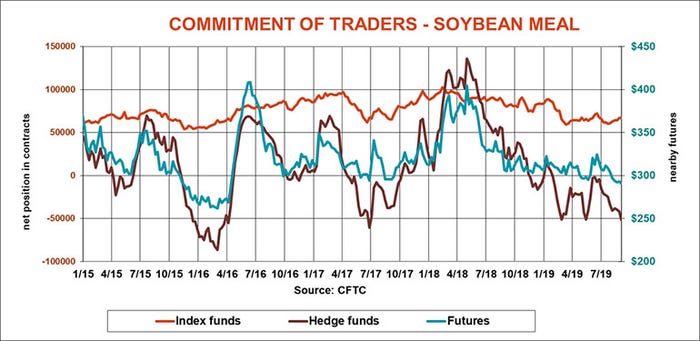

Soybean meal remains the old man out in the soy complex, with big speculators adding 10,001 net short positions to their bearish bet in the product, which hit its widest level in more than two years.

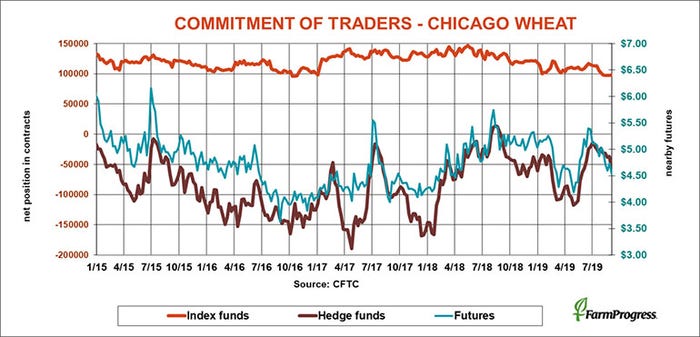

Pressing down

Big speculators sold soft red winter wheat again this week, adding a net 19,749 short positions to help futures make new summer lows.

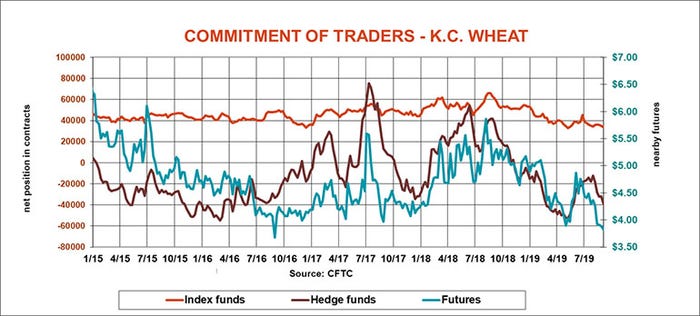

Still lower

Hard red winter wheat hit new contract lows this week, getting a push by hedge funds that added 7,425 lots to their bearish bets.

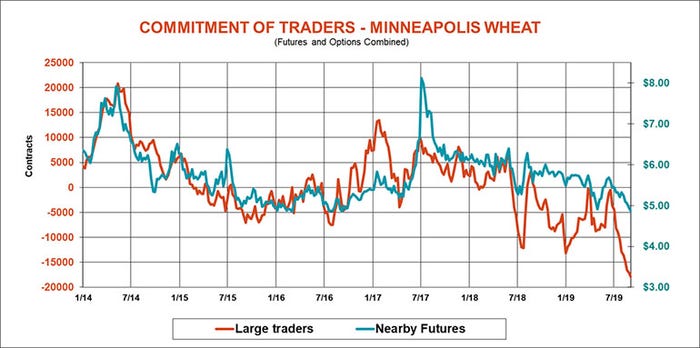

Off the chart

Large traders extended their record bearish bets in Minneapolis by another 769 lots this week despite more rain and harvest delays.

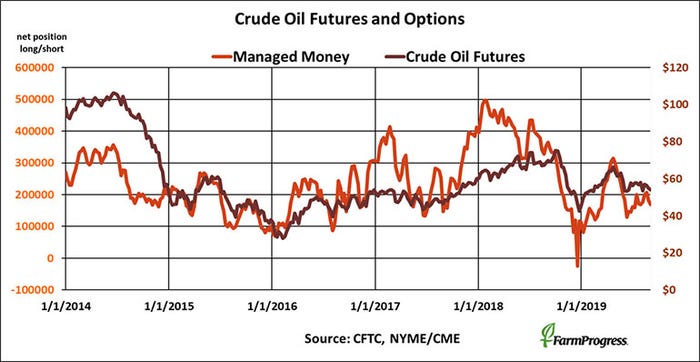

Holding pattern

Crude oil continues to churn along with many other markets, searching for direction. Money managers shed risk into Labor Day, selling $765 million worth of crude oil futures and options according to the CFTC report.

About the Author(s)

You May Also Like