Big speculators in the commodity market are often accused of having a herd mentality. That certainly was the case this week. These hedge funds sold just about everything during a very nervous week of trading.

Here’s what funds were up to through Tuesday, November 13, when the CFTC collected data for its latest Commitment of Traders.

![]()

Bearish twist

After buying crop contracts in the first week of November, big speculators returned to their selling ways, shorting livestock again and also selling most crop futures and options. These hedge funds added 67,361 contracts to their net short position. Investors wanting to own exposure to commodities through index funds were small buyers, adding 8,035 contracts.

No cigar

After moving closer to net even in corn during the first week of November, big speculators reverted to selling this week, increasing their bearish bet by 14,396 contracts.

Trade winds

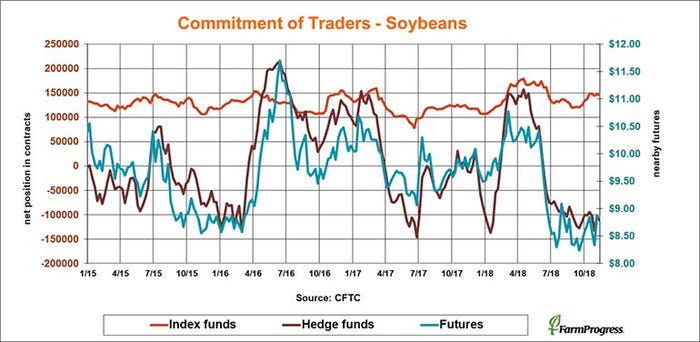

Big speculators are following shifting winds in the tariff dispute between the U.S. and China. That meant they sold soybeans early this week, adding 9,140 contracts on to their net short positions.

Oil slick

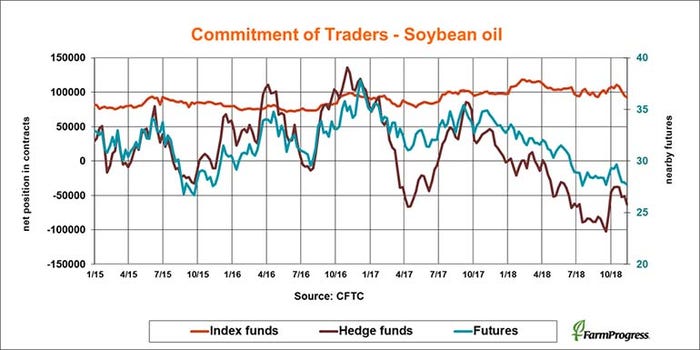

Big speculators remain bearish on vegetable oils, selling soybean oil this week by adding 12,643 contracts by on to their net short position.

Nearly finished

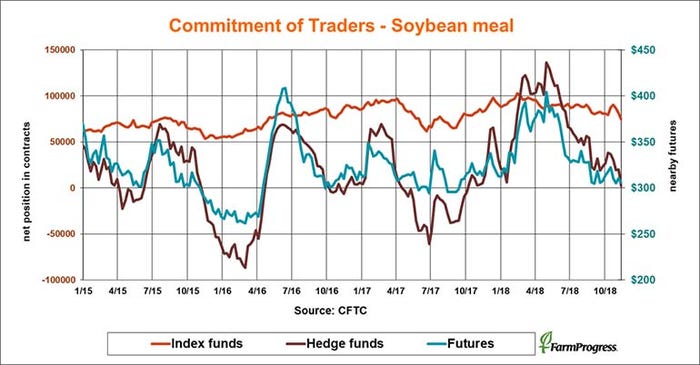

Big speculators continued winding down their bullish bets in soybean meal, slashing another 17,869 lots off their bullish bets. That liquidation took the net long position down to just 2,113 lots by Tuesday.

Odd man out

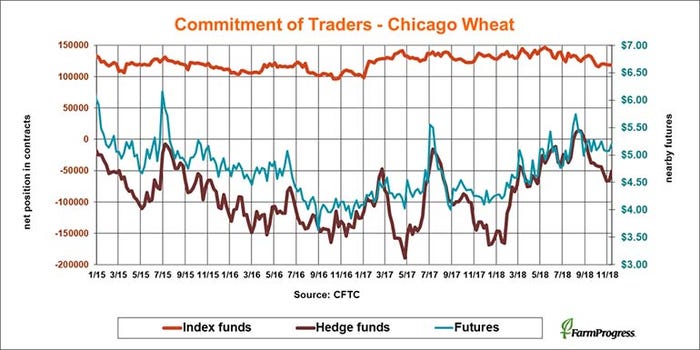

Funds sold soft red winter wheat for the better part of the fall before finally covering some of that short position last week. That pattern continued this week as the big specs bought back another 14,896 lots of their bearish bet.

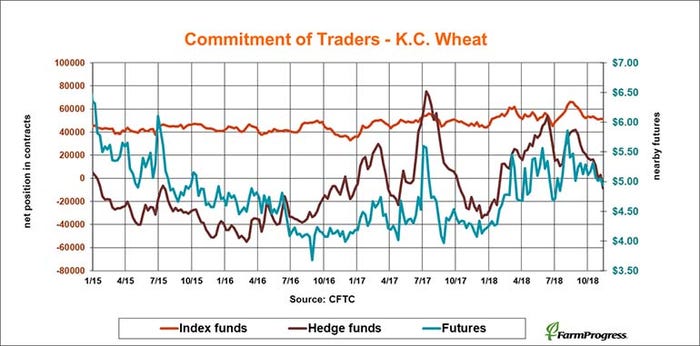

Flipping the switch.

Big speculators finally turned bearish in hard red winter wheat last week, selling a net 11,477 contracts to turn net short for the first time since January.

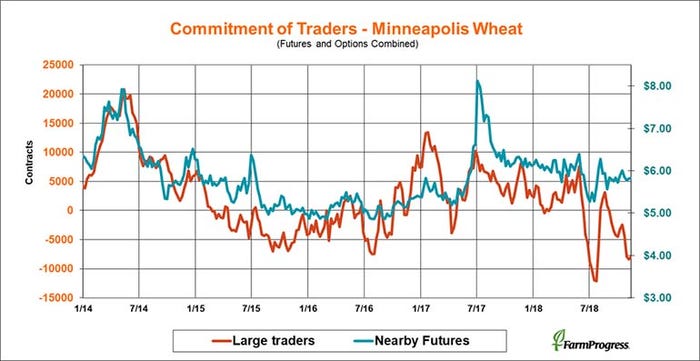

Sideline in wheat

Large traders in spring wheat bought back a little of their net short position this week, but only a little, cutting 319 contracts off their bearish gets.

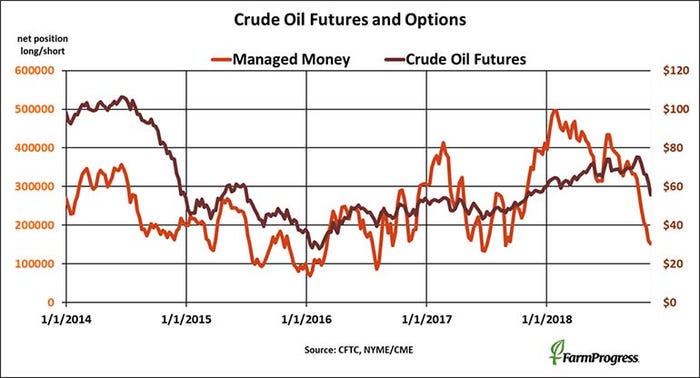

Hitting bottom

Crude oil appeared to reach a least a short-term bottom this week after futures held above $55 barrel. Money managers rode that wave down, adding $463 million on to their bearish bets.

About the Author(s)

You May Also Like