For those who choose to forward price grain, particularly for grain that will eventually be stored in on-farm storage and delivered at a date later beyond harvest within, say, an 18-month crop year, the three elements of that contract being sold need to be managed independently for the full potential of said contract to be maximized.

Why is this important?

All three components of your net cash price are rarely determined on the same day, as futures, carry, and basis all move independently from one another. They often reach their peak values on different days in terms of timelines throughout the course of a marketing season.

The three elements of your net cash price are as follows:

Setting (selling) the futures price on the new crop contract once you see it fit for it to be sold;

Later, “rolling” the sold contract out to the deferred futures month to add to or pick up the carry being offered by the marketplace on bushels that will be stored past harvest;

Setting the basis on that contract before delivery with your local buyer.

These elements must be managed independently in order to attain the most value per grain contract sold within a given crop year.

I will attempt to show this utilizing the Dec19 Corn Futures, relative to the July2020 Corn carry in the charts below.

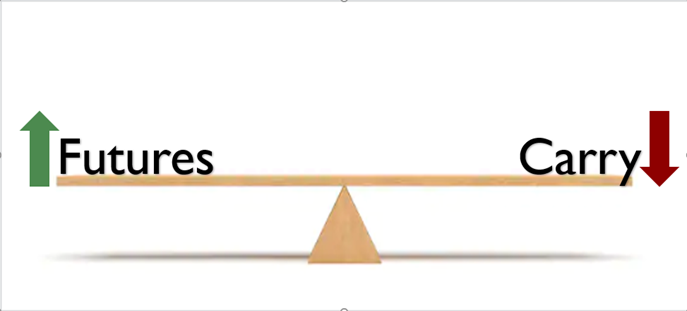

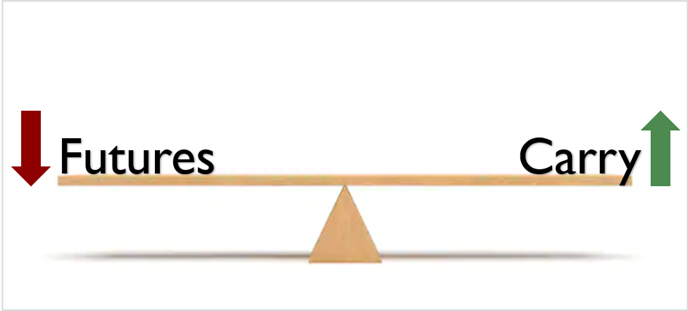

Imagine new crop futures on one side, and the deferred futures or carry spread on the other side, for corn in this example given. (Slide A1&A2)

Think of futures and carry as a teeter totter, when one side is increasing or going higher, the other is usually decreasing (narrowing) or going lower, and vice versa, except in years of extremely short supply of the old crop and problematic issues pertaining to new crop. This uncommonness can happen, called an “inversion”, but that is another discussion for another day.

Dec19/July20 corn carry example

As the Dec19 corn futures climbed, the July20 carry narrowed or declined. Once the Dec19 futures had peaked, and later declined into pre-harvest to harvest lows, then the deferred (Dec19/July20) carry had already increased or widened to its peak in said deferred month which was, at that point, 30.75 Cents.

This type of movement is not unusual.

When the new crop Dec19 futures ran higher due to a perceived production problem, the Dec19 value shot up from lows of $3.6375 on 5-13-2019 to highs of $4.73 on 6-17-2019.

How do you actually capture the deferred carry? The contract must be sold ahead -- first on the new crop month (Dec19 Corn), to then later be rolled out in the deferred carry market (July20), for the carry to be added to the initiated contract later.

Dec19 Corn Futures: Two Charts

From the 5-13-2019 lows of $3.6375 to the 6-17-2019 highs of $4.73, the market rallied $1.0925. That was the peak of the rally, before then taking itself back down to new lows of $3.5225 found right around pre-harvest to harvest time on Sept. 9th, 2019.

Dec2019 to July2020 Carry Spread: Two Charts

During the peak of the Dec19 Futures, the carry spread to the deferred July20 market continued to narrow, or lose value vs. the Dec19 Futures Month. In fact, on the 6-17-2019 peak high of the nearby Dec19 futures price of $4.73, the July20 carry spread on that day was only paying between 2.5 cents to 7.0 cents more than the Dec19 market.

That is not enough to justify selling the deferred market of July20 corn at that juncture!

The largest amount of Dec19/July2020 carry available as nearby Dec19 futures declined into harvest (Sept.12th) after the May through June futures rally was 30.75 cents.

What should you do?

A grain producer could simply utilize a contract type (such as a Hedge-to-Arrive or a futures contract) to sell the Dec19 futures when ready, then wait; wait until the carry spread to the deferred July20 started to grow, improve and become worthy of a roll out to capture said carry spread to pay for those personal storage costs on corn that was going to be stored to June or July anyway.

So, the theoretical highest net futures price offered the Corn producer for July2020 delivery after the Dec19 rally was Dec19 $4.73 + July2020 Carry of 30.75 Cents = $5.0375 July 2020 net futures.

Yes, that’s a Five Dollar number in front of Net July20 corn futures price, and although not easy to achieve, was available by the market place this last year.

Obviously, the last element to contribute to this number is the local basis against that said net July20 futures price of $5.0375, from the day the roll took place until setting said basis before delivery for June/July in 2020.

The difference between profit and loss

Learning the general nuances of markets and understanding how futures, carry spreads, and basis all impact one’s net cash price can mean the difference between profit and loss. Understanding these components is essential for every operation. They are clearly more important than predicting market movements.

Advance Trading

Contact ATI at

800-664-2321

www.advance-trading.com/disclaimer

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like