The best grain markets in a half-dozen years or more don’t guarantee profits for farmers headed to the field this spring. A supply chain notorious for problems is just one factor increasing the cost of growing – and financing – crops in 2021.

Blockage of the Suez Canal for a week is the latest challenge for a world still dealing with the coronavirus pandemic. A topsy-turvy global economy combined with whiffs of inflation could squeeze profit margins even if grain prices hold on to gains.

There is light at the end of the tunnel on fertilizer prices, though pullbacks won’t be in time for 2021 crops.

Already volatile energy markets could have the most at risk in the agriculture space from the woes of the container ship Ever Given, which was stuck in the waterway connecting the Mediterranean and Red Seas that accounts for more than 10% of world trade. Shipments of grain and fertilizer could also be impacted by delays and back-ups that could take months to clear.

The mishap came on the heels of a winter that created its own logistical woes from the Texas deep freeze to a frigid winter in parts of Europe and Asia that triggered a surge in natural gas prices. And springtime in the U.S. means risk of flooding on the inland waterway system. Flood conditions exist on the Mississippi south of Cairo, while some locks on the upper Mississippi River are in overdraft conditions that can slow traffic too. So far problems aren’t extreme, though a wet week ahead in the South could add to delays.

A dry Corn Belt forecast could be a also mixed blessing if farmers head to the field at once, straining suppliers’ ability to deliver.

High-cost nitrogen

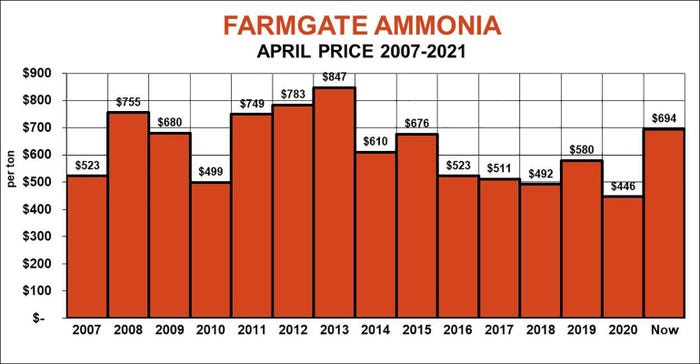

Retail fertilizer costs for growing an acre of corn reached their highest level since 2015 last week, though wholesale markets finally showed signs of catching their breath. Average ammonia costs for growers near $700 a ton would be the highest April level since 2013, and likely won’t cool off until planters are put back in the shed. April contracts at the Gulf settled at $494 a ton – they dipped below $200 last summer during the peak of the pandemic – and dealers were quoting $650 to $750 around the Midwest.

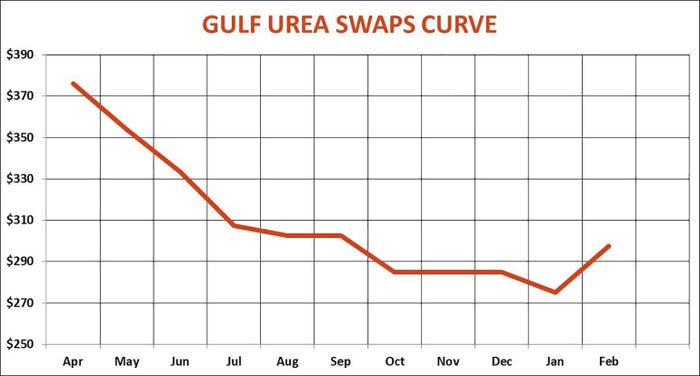

International urea trade took its first pause in six months last week, amid speculation about Suez disruptions. Another big tender from India – usually a bullish event – took a bearish spin when Chinese companies committed to fulfilling most of the deal. After surging last fall, Chinese urea exports plummeted into February, helping extend the global rally. India is expected back in the market later this spring, when U.S. buyers could be affected by Suez delays. Some problems were reported loading barges at the Gulf thanks to weather problems could persist, helping Gulf urea firm to $388 a ton last week. However, forwards for May were put at $354, with October down to $285 and January at $275. Average retail costs looked to be around $500, though many Midwest suppliers were above that benchmark.

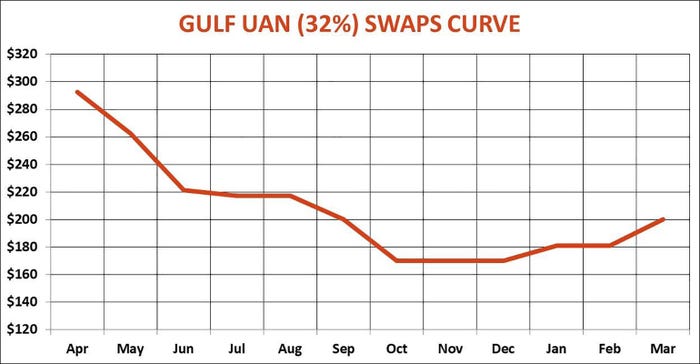

UAN was the laggard in the nitrogen complex over the winter, but caught fire in March as growers and suppliers got serious about needs for application later this spring. Gulf swaps for 32% at the Gulf settled last week at $278, up more than $150 since the end of 2020. April swaps were quoted at $292.50 but June was down to $219. Retail costs rose as more dealers put up offers, with 28% quoted above $300, with some up to $350 to $355.

P and K stay expensive

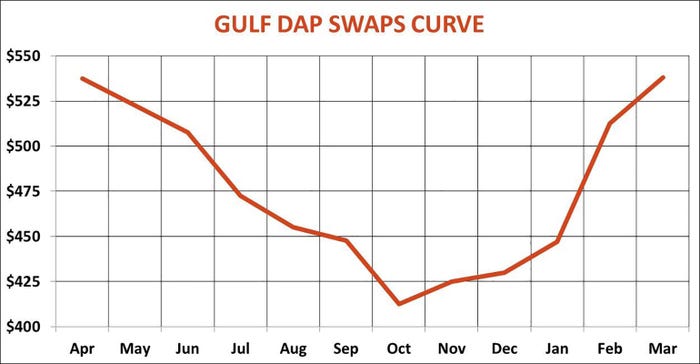

Higher nitrogen values compounded a phosphate market still dealing with fallout from U.S. tariffs on imports from Russia and Morocco. Declining exports out of China over the fall and winter only added to that tightness, though manufacturers there boosted sales a little in February. Like other markets, DAP quotes at the Gulf showed signs of topping finally last week after a $250 rally, but still gained $1 to $540. October contracts were down to $412.50, though March 2022 was right back at today’s current values. Average retail costs for DAP currently are above $650, with some dealers in the $650 to $700 range.

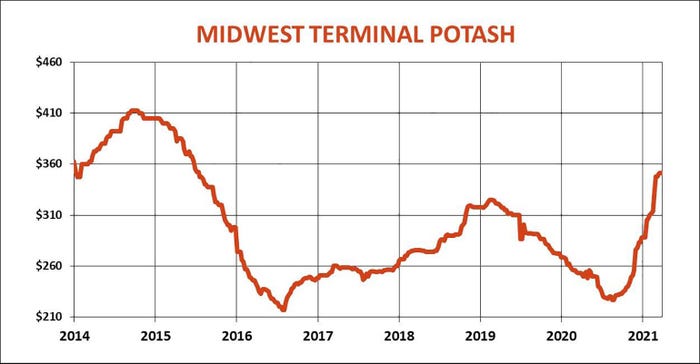

The potash market was slow to rally from pandemic lows but finally found footing over the winter thanks to strong demand from growers spurred by rising higher grain prices. Corn Belt terminals stayed around $350 last week, with more retailers around $400 to $450. China held off on new purchases for most of the winter until booking some cheap deals from Belarus that only seemed to embolden other suppliers.

Fuel depends on OPEC+

Any bargains are scarce in the energy complex these days. Optimism over a recovering economy boosted crude oil futures to pre-pandemic levels, getting another leg higher after weather disruptions in Texas. The fate of costs into summer likely depends on what OPEC and its allies – mostly Saudi Arabia – decide to do about production cuts due to expire in May. Crude futures above $60 started to lure more rigs back into production in the U.S., though production has basically been flat since November.

Fundamentals of supply and demand point to average crude futures around $56 a barrel, though uncertainty remains very high. The best evidence of that is the cost of options. Implied crude oil volatility closed last week above 45% -- levels usually reserved for drought market grain rallies. That suggests futures could easily retest March highs at $67.98 over the next three months if U.S. drivers head to the highways.

Current crude values translate into ULSD futures around $1.81, right where they closed Friday after pulling back from a test of $2 early in March. Those contracts are delivered in New York Harbor, but back in the Midwest the cash market is seasonally on fire, with basis levels running above average. Production at refineries in the region plunged on the Texas weather disruption to crude feedstocks, sending supplies to the lowest level ahead of planting since 2010. Chicago and Group 3 ULSD swaps don’t show much of a dip into summer, typically the best time to book fall fuel needs.

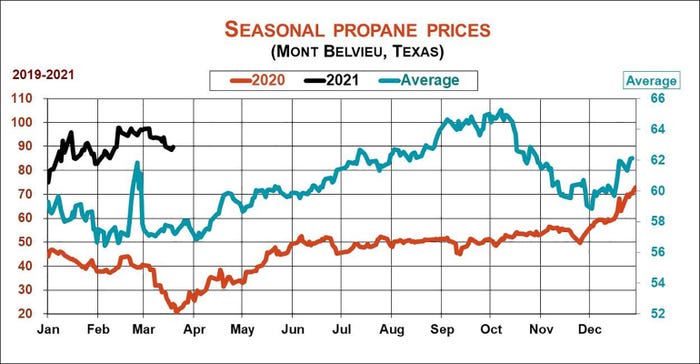

The end of winter normally is a good time to look at buying fall propane to refill on-farm tanks. Gulf propane retreated a bit in March after rallying close to $1 a gallon when the Texas mess shuttered production at refineries and natural gas plants. U.S. inventories are down 30% from year-ago levels, and how fast stocks rebuild depends in part upon strengthening gasoline demand from a reopening U.S. economy. Still, propane values tend to follow crude, so the upcoming OPEC+ decision looms large.

Inflation a risk

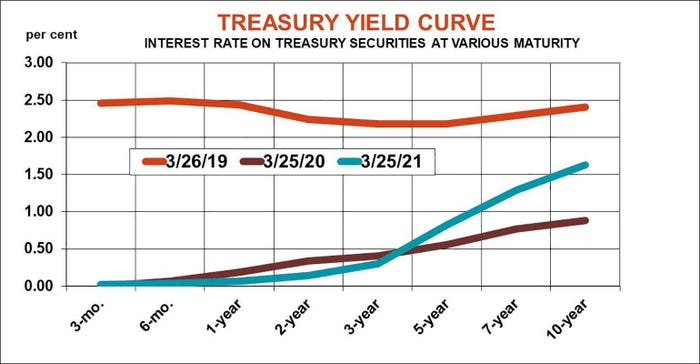

Higher commodity values are one reason for Wall Street’s new obsession with inflation. While the Federal Reserve continues to downplay the risk of runaway prices, saying a move higher this year is only temporary, investors aren’t quite so relaxed. Yields on benchmark 10-Year Treasury Notes traded up to 1.75% -- still cheap by historical standards but up more than a full point from pandemic lows.

The Fed exerts influence over longer term interests rates by buying securities off a market flooded with government debt, but its main lever is short-term rates. At its mid-March meeting central bank forecasts from participants indicated those short rates will stay near zero through 2023, despite U.S. GDP growth of 6.5% in 2021.

The data muddles forecasting for everything from the dollar to interest rates to stock prices. The huge deficit coupled with strong economic growth project 10-Year rates that should be sharply higher. That would be bullish for the dollar, because higher risk-free returns typically lure investors to a currency, though they can depress stocks and other asset values, include farmland prices.

The S&P 500 Index Friday surged back near March highs just under 4,000, ending the week close to my projected high based on 2022 fundamentals as the economy recovers. Despite that federal deficit and a U.S. money supply that quadrupled in the last two years, optimism over U.S. prospects boosted the dollar off the bottom of its range over the past six years. Friday’s 92.76 close on the dollar index was near my forecast based on fundamentals, with upside perhaps to 96.

Knorr writes from Chicago, Ill. Email him at [email protected]

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like