A new report out from Rabobank Food and Agribusiness Research and Advisory group states that farmers must shift from being volume driven to efficiency driven.

The report, “Farming the Efficient Frontier: Crop Efficiency, Not Volume, Will Drive Future Financial Performance,” states that the shift will keep operations profitable even with low prices, and high seed and agrochemical prices.

Basically, farmers must get away from the thought that crop yield is what matters when it comes to making a profit. That’s not all that matters. Instead, farmers must find ways to get a profit which means they have to be as efficient as possible in their operation.

This may mean adopting new procedures in the operation and it may mean new technology.

Crop use increases

One of the issues causing the low commodity prices in the United States is that there has been no increase in row crop utilization. For example, the use of corn began increase in 2006 by 20 percent. However, there is no political momentum to drive significant increases in the near future.

However, Rabobank expects to see an increase in export demand for soybeans. Overall, the report shows a 3-8 percent increase in corn exports and a 12-14 percent increase in soybean exports.

Another bright spot in the report is that the growth of animal protein consumption of feed grains and feed protein should be an opportunity for crop usage in the United States over the next few years. This is likely to impact both corn and soybeans, as feed demand is expected for both beef and poultry. In totally, the increase in feed demand is expected to be 3 percent by 2020 for corn and 8 percent for soymeal.

Breakeven or below prices in 2016 and 2017

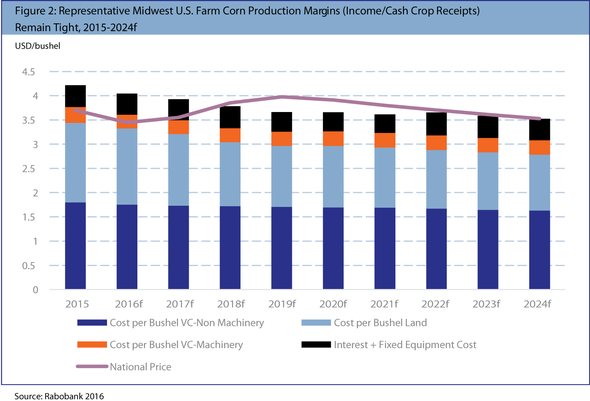

The combination of low crop prices and high input costs will mean that row crop farming income is likely to be negative again in 2016 and 2017, marking the third and fourth year consecutive year of losses.

The report by Rabobank makes it pretty clear that if farm business models want to remain viable, production costs will have to decline and crop prices will have to recover some.

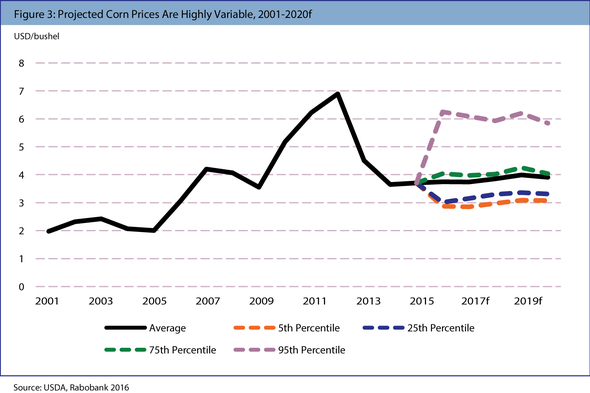

The volatility in commodity prices will be what drives a farm’s profitability. The model indicates a high probability (75 percent) that the farm-received price for corn will remain at $4 a bushel or lower, each year as the potential for drought conditions that would push the value of harvested crops higher.

2017 and 2018 will be critical for farm survival because the operating capital on many farms has disappeared and credit is becoming harder to come by because of two or three years of negative income.

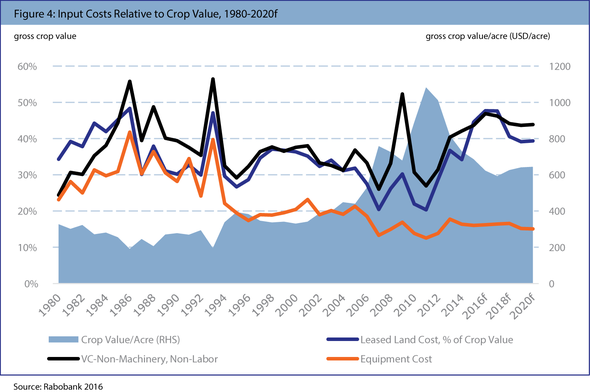

Farmland costs

Rabobank concluded in the report that farmland is the next input cost to become a major concern for producers. According to the report, the cost of land is currently estimated at $1.60 a bushel of corn produced. This doesn’t seem like a problem until farmers figure in the cost of non-machinery costs of $1.75 a bushel and fixed costs and machinery at 70 cents per bushel for a total cost of $4.05 a bushel.

Then when farmers figure in that the corn price range expected to payout after harvest is between $3.10 and $3.75 a bushel then it becomes a reality that producers could see a negative income in 2016. The Rabobank report declared that the 2016 breakeven level of $4.05 a bushel and made it clear that some costs need to decline in order for farmers to remain afloat.

In 2016, the report estimates that land for the Midwestern farm business represents over 47 percent of the crop value. This means that the cost of inputs has a high probability of exceeding the value of the crop, without even covering labor or non-machinery expenses.

Farmers are urged to renegotiate for lower rents or combine forces and work with others to spread input costs over a larger amount of acreage.

Shrink to Grow

The data in the report reveals that some farms may have to let go of some acreage in order to gain a profit. This may mean some farmers renegotiating leases on land or letting go of the acreage in order to gain a profit across the entire acreage. This is partly because the leased land has to be charged entirely to the crop produced and the tight profit margins may make it impossible. Farmers will have to realize that if the land is owned, they can spread out the costs a little more.

Computer software

The report from Rabobank goes on to say that producers using the proper data management can also help with the profit margins. By using precision farming, producers can cut input costs and improve the business management of the farm. Farming using accounting software can also see where money is being spent easier and know where they can make cuts in order to pay the bills and make a profit.

About the Author(s)

You May Also Like