August 21, 2015

At the end of February, RMA established Projected Prices for crop insurance contract for corn of $4.15 and for soybeans of $9.73 for insured production in 2015. The Projected Prices serve as the minimum indemnification prices for most of the insurance contracts sold, but for many insurance contracts, can be supplanted by a Harvest Price if prices during the month of October average higher levels than the PP.

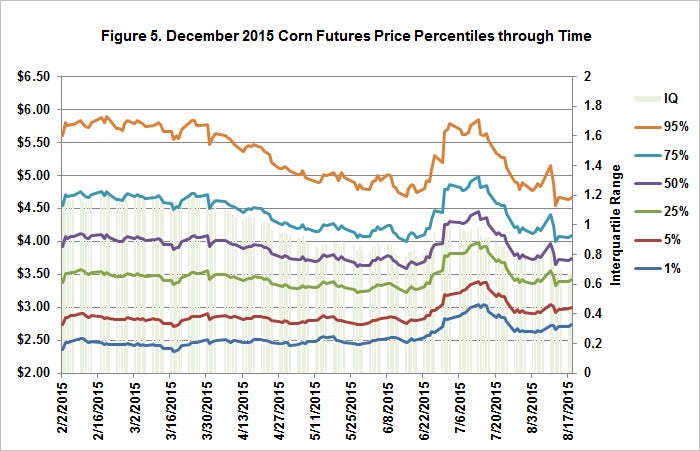

During 2015 to date, generally favorable early-season growing conditions resulted in increasing expectations about the levels of production which in turn have led to declining prices. During July, a period of greater uncertainty about production potential and some signals on the demand side support prices and both corn and soybeans moved above projected prices, but then fell below again as market understanding of supply potential and demand dampened price expectations. The USDA's first release of aggregate yield estimates in early August further confirmed information in the market and further impacted estimates of prices possible for harvest.

Much of the market's aggregate price expectations are summarized in futures prices and the prices of options on futures. The eventual realizations of futures prices through harvest have important risk management implications, and directly affect crop insurance indemnification as well. The establishment of the Projected Prices (PP) used in establishing initial crop insurance guarantees in February prior to planting is meant to reflect the market's best "guesses" about levels of prices, but thereafter, growing season conditions, and the accumulation of other information affecting supply and demand affect market participant's beliefs about future possible prices.

It is generally regarded that futures markets provide the best aggregated beliefs about future prices by market participants, given all currently available information; and that changes in information or resolution of uncertainty are reflected in changing prices of both futures and of options on those contracts. As time goes on, information generally becomes better understood and the possible range of prices shrinks toward the final futures prices. In turn, the prices of options on futures reflect the degree of uncertainty about the futures prices and provide a means to recover additional probabilistic information about price uncertainty, or the probability of prices moving to various other levels, either higher or lower than the current futures price prior to expiration.

As farmdoc daily has provided in past articles, these figures provide a set of related views of price distributions and the confidence around the market expectations of futures prices, taking advantage of the information that is provided through market prices of options. To recover probabilistic information from options markets, a technique is used that identifies a best fitting distribution given observed prices of both puts and calls across the set of actively traded strike prices. The specific approach used is somewhat akin to using a variant of the Black-Scholes option pricing model, but solving it "backwards" across all options simultaneously.

As the growing season continues and as uncertainty is resolved about final production and demand, the prices will continue to shift and evolve and collapse on final values. It is increasingly unlikely that harvest prices will be greater than projected prices, and thus the effective price for much of the crop insurance coverage is likely to be at the original Projected Prices. The probability ranges have also tightened substantially as was the case in 2014 as production prospects became more certain through the growing season and as the risk of substantial interruptions in production at this point appear to the market to be relatively low.

You May Also Like