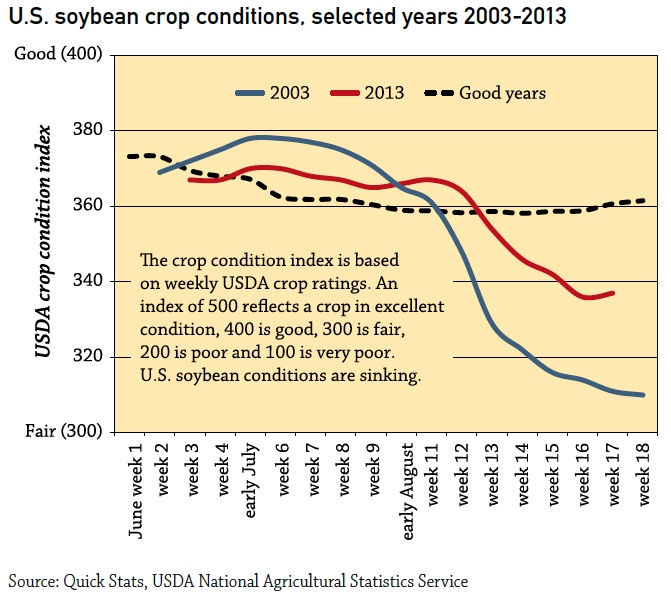

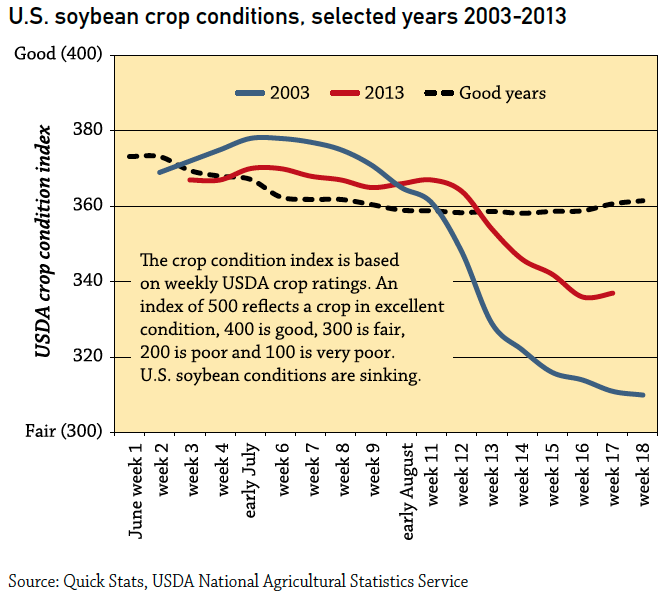

Baseball great Yogi Berra once said, “It’s like Déjà Vu all over again.” Yogi had a funny way of saying nonsensical things that made perfect sense, and I have a Yogi sense for the 2013 soybean crop - it’s 2003 all over again.

In early August 2003, the Corn Belt was in very good condition. July weather had been tame, and the corn and soybean crops looked great. As I walked a farm show in Minnesota, a light rain fell and I remember being concerned about mud on my shoes. Little did I know it would be the last significant rain to fall in August and September.

July makes the corn crop. In 2003, despite a dry August and September, a corn crop with great potential still ended up good. August makes the soybean crop and, in the same year, a soybean crop with equally great potential at the end of July produced the worst yield in 10 years.

Like what you're reading? Subscribe to CSD Extra and get the latest news right to your inbox!

Does this sound familiar? While I don’t believe the dryness in 2013 has been as extreme, in terms of the timing and trend in crop conditions, it’s 2003 all over again.

Late season dryness has put life into the soybean market, but only the soybean market. During the month of August, while Nov’13 soybean futures gained $2 per bushel, Dec’13 corn futures managed to rise 15 cents. At least the market rose - Dec’13 wheat futures actually declined by 15 cents per bushel. So far, this is a “soybeans only” party.

The sharp rise in soybean prices creates a noteworthy price spread between soybeans and corn. Nearby soybean prices are nearly 300% of corn prices, high by any historical standard. If this ratio endures, it could have a big impact on 2014 plantings, leading a shift away from corn and towards soybeans. The soybean/wheat price spread is also high, promising to boost the trend away from planting wheat and towards soybeans in traditional wheat states like North Dakota and Kansas. Pricing anomalies create incentives, and current prices are an incentive for more soybean acres in 2014.

While 2013 looks a lot like 2003, some things have changed in the past decade. In early 2014, South America will harvest a soybean crop 60% larger than the 2003 crop. Brazil is now the largest exporter of soybeans in the world market. The stiff competition we faced in 2003 is even greater today. Four months from now, a big South American crop might be the cold shower that tempers soybean prices.

While your mind is focused on harvesting the current crop, I can’t help but look ahead to possibilities in 2014. Is the “short crop, long tail” phenomenon creating another early pricing opportunity in soybeans? While no actions have been taken to date, my eyes are on the soybean market and 2014 opportunities.

About the Author(s)

You May Also Like