Harvest is back and it’s time to make some marketing decisions. Should I sell now or store grain to sell later in the crop year? Maybe I should sell the carry in the market. Our alternatives are limited and, with prices at four-year lows, the choice will not be easy. Let’s look at the cards we’ve been dealt.

Carrying charges. Carrying charges are the price differences between futures delivery months (e.g., Dec’14 to Jul’15). Carries in the corn market are fat and positive. For example, the Jul’15 corn contract has been trading at a 28¢ premium to the nearby Dec’14 contract. Even carries in the soybean market – November/July at 25-30¢/bu. – are large enough to draw some interest. By storing grain and selling the July contract with a futures sale (or HTA), you can put the carry in your pocket by spring, plus any gain in your local basis. Which raises a question: Will basis improve next year?

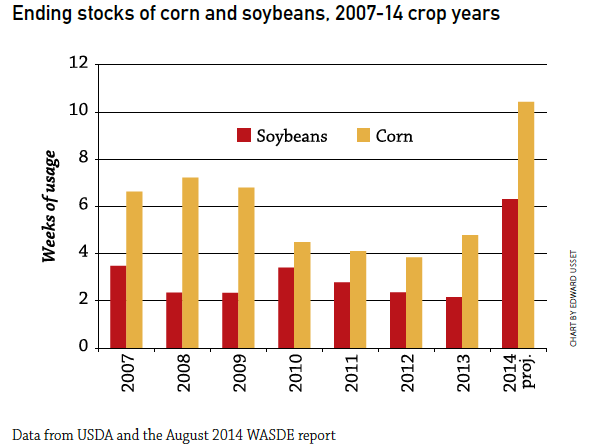

Rising stocks decrease the odds of a significant post harvest rally in prices.

Basis. With big crops coming and grain stocks building, this is not a strong basis environment. And talk about rubbing salt in a wound – when will the railroads get their act together? Last spring, basis levels of $1-1.50/bu. under the nearby contract were common in many parts of northern Minnesota and the Dakotas. Basis prospects are troubling. For the moment, I’ll be hopeful that railroad performance will improve in 2015 and your nearby basis could be 20¢ better than harvest levels by spring.

I like big carries and an improving basis, and the opportunity they present to sell the carry. But here’s the rub. If I passed on opportunities to price grain before harvest, the prospect of turning $3 corn and $10 soybeans at harvest into $3.50 corn and $10.50 soybeans by next spring is not very inspiring, especially when my costs might be $1/bu. higher. I need more than the 50¢/bu. that could result from selling the carry. I need a home run!

I see only two ways to hit a home run. One way is to put your grain in storage and hope for a very big rally in prices after harvest. If storage is not available, the other way is to buy call options and, again, hope for a big rally in prices.

Cash prices. Is a big price rally in the cards? It can happen. Since 1990, there have been six years when cash corn and soybean prices, as measured by the national average price, increased 20% or more from October to May. These years included 1995/96, 1996/97 (soybeans only), 1999/00 (corn only), 2003/04, 06/07, 07/08 and 2010/11. These years also shared an important fundamental factor: they were characterized by decreasing grain stocks from the previous year. As noted before, stocks of corn and soybeans are increasing (see chart), not decreasing, in the current crop year. The current year is fundamentally different from these extraordinary years. Your odds of profiting from the purchase of calls are likewise diminished.

Limited and difficult choices - my instinct is to grab the 40-50¢ offered by selling the carry and hope for better opportunities to price the 2015 crop.

About the Author(s)

You May Also Like