June 3, 2020

Congress and the President Donald Trump have approved multiple phases of COVID-19 assistance, including three separate bills in March, culminating in the $2.3 trillion dollar Coronavirus Aid, Relief, and Economic Security Act on March 27.

For agriculture, the CARES Act included funding for two Small Business Administration programs, the Paycheck Protection Program (PPP) and Economic Injury Disaster Loans (EIDLs) that included agricultural producers and agribusinesses among eligible participants.

USDA direct assistance for agriculture was implemented through a $9.5 billion allocation to the secretary of agriculture for famer and rancher relief for price losses, and $14 billion in funding to replenish Commodity Credit Corporation (CCC) accounts, of which $6.5 billion is being used by the secretary to provide relief against ongoing market disruptions.

The Small Business Administration programs were quickly rolled out and were quickly exhausted of available funding. A fourth relief bill was passed in April to provide additional funding for emergency efforts, including replenishing the PPP to provide additional support. The USDA assistance for farmers and ranchers was rolled out in May after rulemaking and administrative review as the Coronavirus Food Assistance Program (CFAP), with sign-up underway with the Farm Service Agency as of late May.

CFAP provides direct payments to producers of a range of crops and livestock based on market disruptions from January to April and projected continuing losses in the wake of the COVID-19 pandemic. CFAP utilizes both CARES Act funding and CCC funding.

Crop assistance

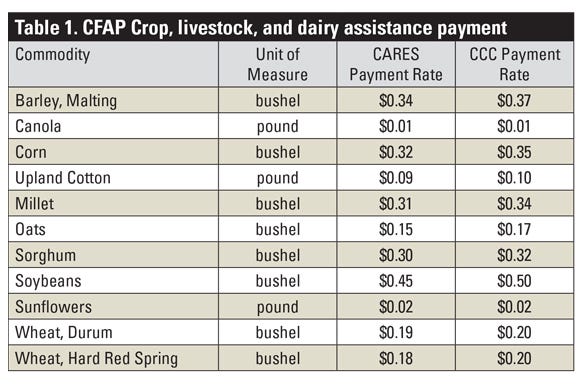

For a range of non-specialty crops (grains, oilseeds, cotton), the CFAP payment covers “eligible inventory” equal to the lesser of a producer’s unpriced inventory as of Jan. 15, 2020, or 50% of 2019 production. The CARES Act payment rate is based on 50% of the price decline for the commodity from mid-January to mid-April and is payable on 50% of eligible inventory.

The payment rate from CCC funds is based on 55% of the mid-January to mid-April price decline and is also paid on 50% of eligible inventory. With corn for example, the CARES Act and CCC payment rates are $0.32 and $0.35 cents per bushel, respectively. Averaging the two payment rates shows that a producer will effectively receive an average of $0.335 per bushel on 100% of eligible inventory, subject to payment eligibility, limit and compliance rules.

The eligible inventory definition effectively excludes crops that were sold prior to Jan. 15 as well as crops priced for future delivery, as these crops didn’t experience the impacts of the price decline. The producer is responsible for certifying unpriced inventory eligible for assistance, subject to future spot checks.

Numerous specialty crops (fruits, vegetables, nuts) are also covered by CFAP. While these commodities historically may not have been direct recipients of farm program support through FSA, the agency will also work with these crops on the application process. Assistance for specialty crops is split into three separate payment rates depending on whether the crop:

was sold between Jan. 15 and April 15 at a qualifying price loss

was shipped from the farm but not sold due to a lack of a market by April 15

was not or will not be sold, and remained on the farm due to a lack buyers by April 15

Documentation will be critical to determine the amount of production potentially eligible for each category.

Livestock assistance

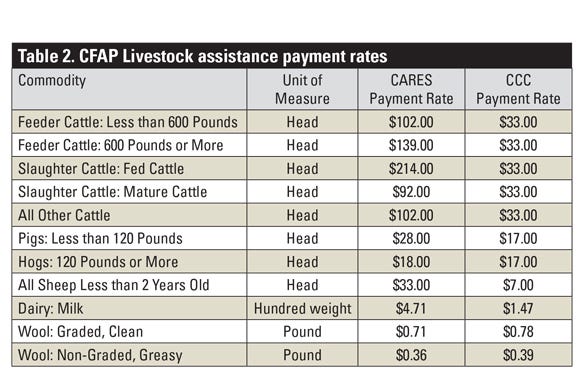

The CFAP assistance is expected to primarily go to livestock producers to cover economic losses from price declines on sales during the period of Jan. 15 to April 15, as well as the decline in market value of inventory. CFAP provides assistance to cattle, hog, sheep, dairy, and wool producers.

For cattle, hog, and sheep producers, the assistance is split into multiple parts and payment rates. The first part from CARES Act funding is based on head sold between Jan. 15 and April 15.

The second part from CCC funds is based on the producer’s highest level of unpriced inventory between April 16 and May 14. The payment rates are also divided between class and size by species. Producers with cattle sold during the three-month period are eligible for a payment of $92 to $214 per head based on class and size, while cattle held unpriced in inventory are all covered by a payment rate of $33 per head.

Hog producers are eligible for payments of $28 per pig (less than 120 pounds) sold, $18 per hog (120 pounds or more) sold, or $17 per head in inventory. Sheep producers can qualify for payments on all sheep less than 2 years old equal to $33 per head sold or $7 per head in inventory.

The assistance provides payments to dairy producers for January-March milk production (including dumped milk) at $4.71 per cwt and estimated April-June milk production at $1.47 per cwt.

Finally, for wool producers, the assistance is split with the first part of the payment equal to $0.71 per pound paid on 50% of eligible inventory and the second part equal to $0.78 per pound also paid on 50% of eligible inventory for an average payment rate of $0.745 per pound on 100% of eligible inventory, all for clean, graded wool. For greasy, non-graded wool, the payment rates are $0.36 and $0.39, respectively, for an average of $0.375 per pound.

General perspectives

While sign-up for CFAP is ongoing through Aug. 28, there may still be some questions to be answered along the way. USDA addressed one of initial questions with additional guidance on marketing contracts that do and don’t qualify in terms of inventory that was unpriced as of Jan. 15. Inventory is not eligible if it was covered by marketing contracts that lock in a cash or futures price or a minimum cash or futures price. This would rule out most hedging tools other than basis contracts, or delayed or deferred pricing contracts. The ineligible contracts generally eliminate price risk, or at least the risk of futures market declines from which market losses were calculated in the first place to determine assistance.

The mechanics and math can be complicated, but FSA has produced a spreadsheet tool that can be used to calculate potential payments and apply for assistance. Details are available on USDA’s CFAP website at farmers.gov/cfap. The downloadable Excel spreadsheet payment calculator is available through a link on this page or directly at the following UNL shortcut: go.unl.edu/fsacfaptool.

The payment calculator will allow producers to plug in appropriate numbers for production, sales, and inventory to automate the calculations and estimate total payments across all commodities.

Based on some general estimates of crops and livestock in Nebraska, total CFAP payments could exceed $1 billion, before considering potential reductions due to payment eligibility, payment limits and conservation compliance requirements. The payment will also be split into two parts — with 80% due to be paid upon approval and the remaining 20% paid later subject to potential prorating of payments if available funds are limited.

CFAP assistance will definitely help producers hurt by market price declines and market disruptions in the wake of the COVID-19 pandemic. The estimated $1 billion of potential assistance will increase cash flow on the farm and ranch, and will represent a major part of the farm income bottom line this year.

However, it will certainly not make up for the full extent of market losses to date, nor cover continued losses and challenges for the remainder of the 2020 production and marketing year. Watching for further legislative development and potential additional assistance will be a key part of the financial picture going forward.

Lubben is an Extension policy specialist at the University of Nebraska-Lincoln.

About the Author(s)

You May Also Like