The December USDA’s Supply & Demand report last week started off with considerable upside momentum in corn and soybeans, but by the day’s end, March corn closed 2 ½ cents weaker at $4.21 ¼ and January soybeans shed 5 ¾ cents, slipping to $11.52 ¾.

From a U.S. perspective, the corn report was a non-event as the USDA’s 20-21 ending stocks forecast was sharply unchanged at 1.702 billion bu. Pre-report estimates had penciled in an average reduction of about 11 million with a fairly wide range of 1.55 to 1.82 billion.

The soybean carry-out, while already tight, saw less of a change than had been expected by the trade: stocks declined 15 million from last month to 175; the trade was expecting a 169 million bu. figure to be printed with estimates ranging from a low of 120 mbu to a high of 221.

Focus on foreign fundamentals

The bulk of the attention ahead of this month’s report was focused first, on the potential impact of South American weather on the Argentine and Brazilian corn and soybean crops. And secondly, on possible changes the USDA might make to particularly the Chinese corn balance sheet. Trade ideas on South American corn production ranged from 105-112 million metric tonnes (MMT) for Brazil and 48.0-50.0 for Argentina. USDA did take Argentina down 1 to 49.0 with the thinking that area planted will be less than initially thought while the Brazil forecast was unchanged at 110.0 MMT.

Brazil’s equivalent to the USDA, CONAB, came out that same morning with an estimate of 102.6 million, down 2.3 MMT from its November forecast. Soybeans saw similar results from USDA: The Argentine estimate was trimmed by 1 to 50.0 (trade range: 48.5-51.0) with Brazil continuing at 133.0 (range: 129.0-134.0).

La Niña impacts

Conab remains a bit more optimistic at 134.5 although this was down ½ MMT from last month.

In the months ahead, the market will be literally watching the daily weather forecasts for South America as we are indeed, in a La Niña pattern and this phenomenon seems to have a more dramatic effect on crops in Argentina than in Brazil.

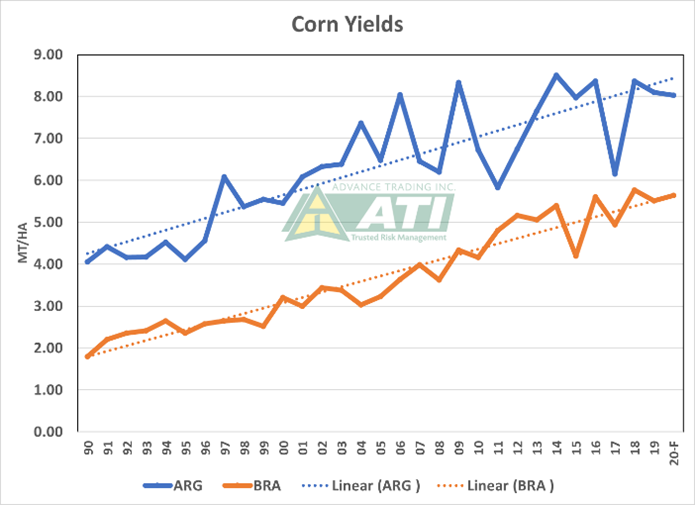

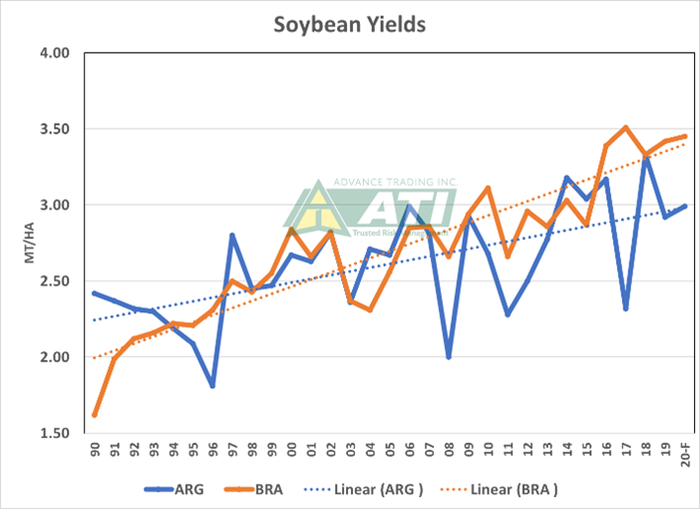

The two graphs below show recent yield results for corn and soybeans in each country as well as the latest USDA forecast (20-F) along with the “trend-line” results. The years with sharp declines in yields particularly are associated with La Niña events of varying degrees and as the charts suggests, the impact on both corn and soybeans in Argentina can be rather dramatic.

Certainly, the latest USDA forecasts for yields in Argentina are well above recent La Niña years and the uncertainty for this producer’s output is likely to keep a firm under pinning in the market. That being said, keep in mind the Mid-September to Mid-December period for Brazil’s top four producing soybean states has been the driest in more than 41 years.

China’s big appetite

USDA made no changes to China’s soybean balance sheet with imports still expected to rise 1.5 MMT from 19-20 to 100 MMT and crush at 99.0, a 7 ½ million increase. China’s buying from the U.S. has so far been unprecedented, with known sales on the books as of December 3rd at 1.09 billion bushels, surpassing the previous early December high of 946 in the 16-17 year by over 140 million.

China’s appetite has been voracious with the U.S. shipping a record large 725 million in that time period, 45-50 million ahead of the 16-17 pace. With China needing about 300 mbu in imports each month to support its domestic crushing requirements, the 365 million in unshipped sales currently on the books to China will cover about five weeks’ worth of needs. And there is another 324 million in sales to Unknown which from 50-70% are likely to be eventually switched to China. So, 324 X 60% = 194/ 70 mbu per week = 2.8 weeks’ worth of coverage.

All in all, we estimate China has just enough U.S. soybeans on the books to meet its needs through mid-February. That brings up a big variable in all this: The timing of the Brazil harvest which will likely be short of the February 1st 10% average of the past few years. A delay in that could bring China back to the U.S. market for another 1-2 MMT (70+ mbu) to bridge the harvest delay.

Beyond that, additional Chinese purchases from the U.S. will likely be for late summer loading and on the order of 1-3 MMT, depending on the final size of the Brazil soybean crop.

As for China and corn, the USDA did increase its import forecast by 3 ½ MMT to 16.5 million for the 20-21 campaign. We note that through December 3rd, U.S. sales to China stand at 11.3 MMT in “known” sales and there is perhaps another 4.4 million in the Unknown category for a total of 15.7 MMT (608 mbu). Trade ideas have China importing 20-25 MMT from all origins and with Ukraine believed to have commitments of 4-5 MMT, subsequent buying from the U.S. could be questionable.

What’s the take-away

The December supply and demand report, not unexpectedly, provided little new information regarding the global corn and soybean balance sheet, but here’s what we know:

China remains a critical unknown regarding its 20-21 demand for corn while South American weather will be the key driver in soybeans over the next few weeks.

The U.S. soybean balance sheet is at a historically tight 3.9% stocks-to-use ratio and could be very volatile to the upside in the short-term should problems develop in South America.

The U.S. corn balance sheet with a 11.5% stocks-to-use ratio is “comfortable” but could see higher prices, pending South America and in the event China corn buying accelerates. Some do see U.S. exports to all destinations as much as 250-300 mbu ABOVE the USDA’s 2.650 bbu forecast.

One final note: the 7.4 MMT difference between the U.S. and Conab for Brazil’s corn crop seems a little worrisome. Conab DOES have boots on the ground and this may be a more accurate indicator.

Contact Advance Trading at (800) 664-2321 or go to www.advance-trading.com

Information provided may include opinions of the author and is subject to the following disclosures:

The risk of trading futures and options can be substantial. All information, publications, and material used and distributed by Advance Trading Inc. shall be construed as a solicitation. ATI does not maintain an independent research department as defined in CFTC Regulation 1.71. Information obtained from third-party sources is believed to be reliable, but its accuracy is not guaranteed by Advance Trading Inc. Past performance is not necessarily indicative of future results.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like