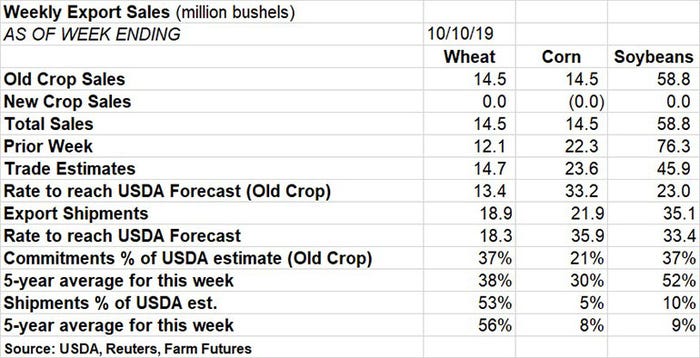

Export sales data released today by USDA doesn’t include purchases made after U.S. and Chinese negotiators reached a tentative deal a week ago on their long-standing trade war. But Chinese buyers were already purchasing U.S. soybeans, helping boost total business completed.

Net new booking of soybeans came in at 58.8 million bushels, including 31.3 million done by Chinese buyers. The total was down from the huge numbers the previous week, but better than trade expectations and appeared to include around 10 million bushels to China not previously reported by USDA under its daily wire for announcing large purchases.

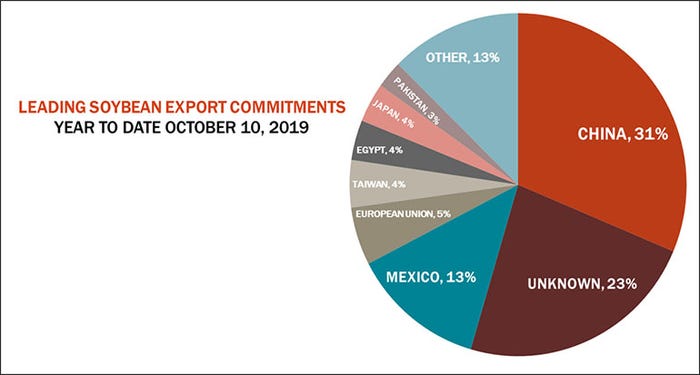

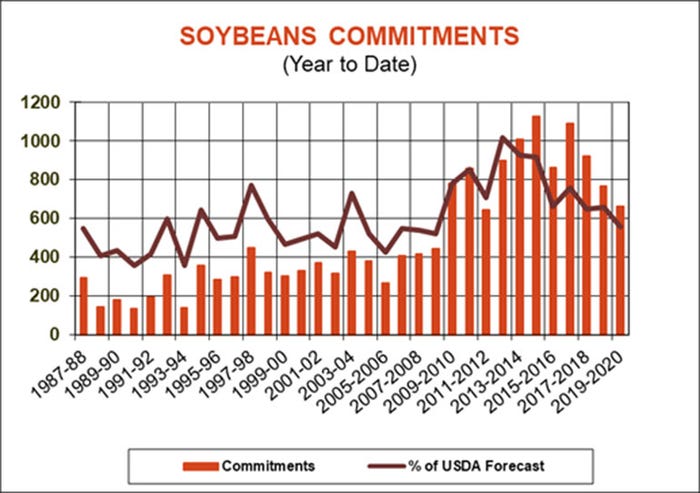

Lack of new soybean sales to China on the daily wire since the trade deal was reached raised a few eyebrows, though the agency has reported around 19 million bushels done to “unknown destinations.” Six weeks into the new marketing year those unknown destinations are the second leading category, accounting for 23% of total soybean commitments. China remains the top dog, accounting for 31% of U.S. sales and shipments to date; before the trade war China typically took around 60% of U.S. soybeans.

While numbers the last few weeks have been good, slow bookings of 2019 soybeans this summer has the total well below levels seen previously, suggesting strong purchases will be needed this fall to meet USDA’s forecast for the crop.

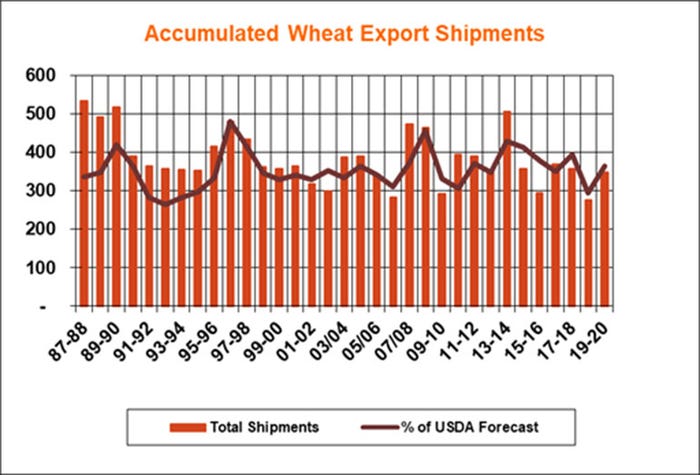

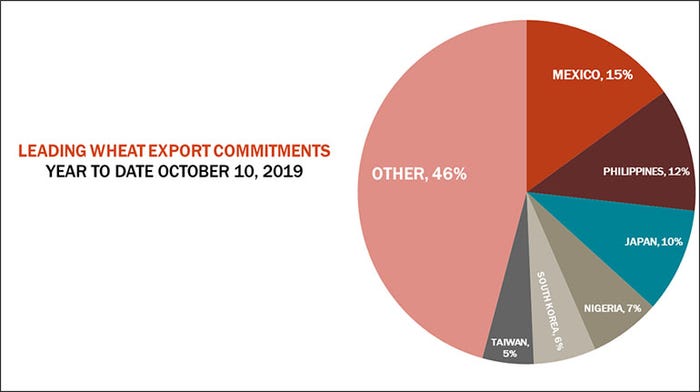

Wheat exports included new sales of 14.5 million bushels, close to trade estimates and a little above the weekly rate forecast by USDA for the 2019 marketing year that began June 1. U.S. exporters again worked hard to reach that total, because buyers continue to take single cargoes or less in a very fragmented market. The U.S. remains mostly shut of big import markets like Egypt, which bought French and Black Sea wheat again this week.

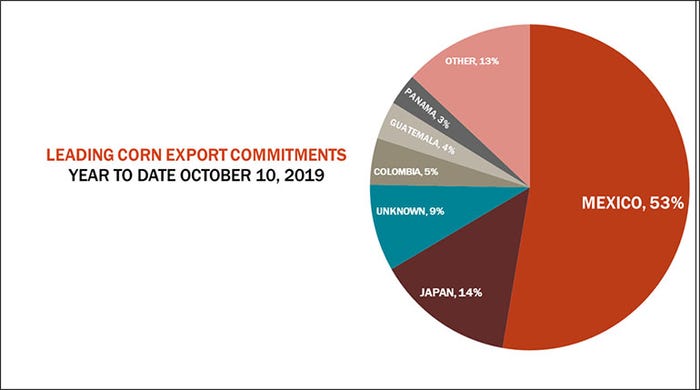

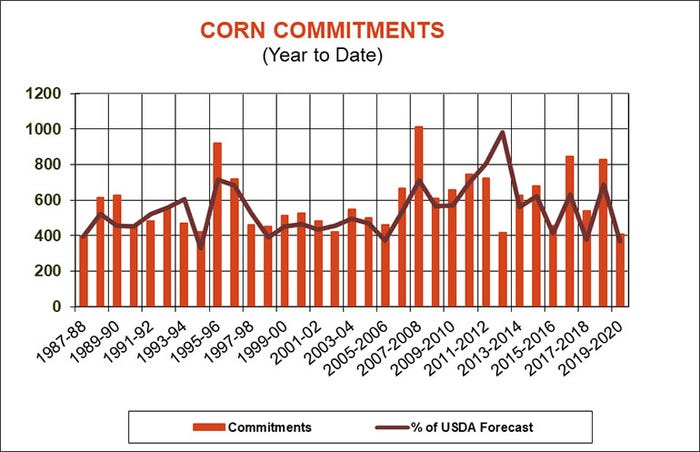

Fragmentation also describes a corn market where exports are off to a very slow start. Total new sales of 14.5 million bushels are less than half the rate USDA forecasts for the 2019 marketing year. Buyers from 17 different countries purchased corn but there were some noticeable no-shows. South Korea continues to buy corn from South America, where Argentine farmers reported are pushing deals ahead of elections later this month. A huge Brazilian crop has dominated global business this summer and fall.

About the Author(s)

You May Also Like