Green shoots are starting to appear – and not just in U.S. farm fields. Signs of reawakening economies, especially in China, are emerging after the world’s pandemic slumber. The result could mean higher input prices for growers, so it’s time to take a serious look at buying plans.

Fertilizer in particular needs attention. Now, that’s not unusual; the first half of summer typically is a good time to book needs for fall and the following spring, as inventories rebuild after planting demand subsides. But this year a combination of events could give that seasonal rebound in nutrient prices some added momentum. China could play a major role in whatever happens.

The coronavirus pandemic disrupted fertilizer and other supply chains around the world. China, the epicenter of the disease, was hit first. Chinese imports and exports are often crucial for influencing market moves and this year was no exception.

China’s urea exports dropped 23% year-to-year from December through March, and data out over the weekend showed total fertilizer sales down again in May. The downturn in exports came just as demand in the U.S. for nitrogen picked up after a poor application season in 2019, getting additional impetus from a surge in corn acreage. With demand elsewhere down, led by lackluster purchases by India, imports flooded the U.S. in April.

The price of urea at the Gulf dropped $80 a ton to $182 by the end of May, but ticked higher last week as international demand appears to be returning. India is expected to tender again soon and buyers in Brazil took advantage of a slightly weaker dollar to boost their purchases. Some of the excess U.S. inventory is also being exported elsewhere.

Spring demand held up farmgate prices but some recent offers suggest that support is cracking. Retail prices in some areas dropped $60 or more recently, down to the $300 to $335 level.

China exports – and imports

A late winter pickup in exports out of China also helped take the wind out of the sales of phosphate market in May, when Gulf prices fell $30 off spring highs. But DAP is up more than $10 at the port despite production cuts by North African exporters. Retail prices are lower as dealers begin to reset, falling to the $390 to $400 level on updated offer sheets.

China could play a role in other fertilizer markets as well. June contracts for ammonia at the Gulf settled $15 lower, falling below $200 for the first time since Labor Day. China imports anhydrous and its purchases are up 45% recently, which could signal some support. Recent U.S. retail offer sheets saw updates in the $380 to $460 level.

China is a massive importer of potash and its moves typically set the tone for that market. Prices have ratcheted lower for more than a year in the U.S. as global demand fell, led by a 30% drop in Chinese buying since last fall. China last month scooped supply at bargain basement prices around $20 less than the $241 Gulf price. That could make $320 to $330 a target for U.S. farmers looking for supplies.

China could also influence prices growers pay for fuel to harvest and dry crops. Preliminary trade data for May showed China’s crude oil imports soared as the economy there got going again, reaching an all-time record. After trading in negative territory for the first time ever briefly in April into futures delivery, West Texas crude rallied back to $40 a barrel last week as global demand recovers and OPEC and its allies agreed to extend production cuts.

Diesel and propane follow swings in the crude market and prices for those petroleum products also rebounded. Propane hit 50 cents a gallon at the Texas Gulf last week, a level not seen since crude prices began eroding in December. The uptick in ULSD wasn’t as significant, but prices still moved back to pre-pandemic levels last week, sending cash wholesale benchmarks in the Midwest above $1.10 a gallon.

Where prices go from here in coming weeks depends partly on seasonal factors and partly on crude’s direction. Fundamentals of supply and demand suggest crude is fairly valued around $37 in range from $31.50 to $42.50 unless volatility increases again.

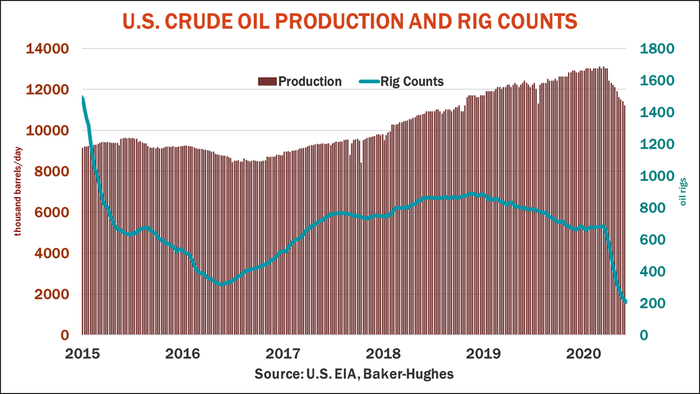

Crude oil production in the U.S. continues to fall from the record levels achieved before the pandemic lock-down, down nearly 2 million barrels a day, some 14.5%. The number of rigs drillers have in service is down 70%, reaching its lowest reading since the financial crisis a decade ago.

Gasoline use shows life

Still, the gradual reopening of the U.S. economy has already pulled gasoline usage off the mat. Apparent demand for the fuel is already 50% above its lows though still down 20% from year-ago levels.

Diesel deals

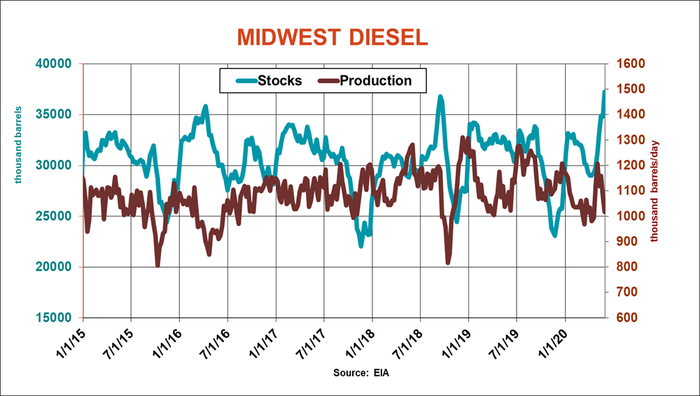

Diesel demand, by contrast, is headed in the other direction as buying from farmers dropped after planting. Even though Midwest refineries operated at only 75% of capacity last week, they still produced too much. ULSD (ultra-low sulfur diesel) inventories in the region jumped to 37.2 million barrels, a record. Nonetheless, the Chicago cash wholesale benchmark ended last week at $1.10, with futures a nickel higher. Basis appears to be trying to firm seasonally, another sign to be on the lookout for deals. Swaps for delivery near harvesttime only show a nickel of upside currently, but prices could average another 15 to 20 cents higher on the year.

Crude’s direction is key. If the deal between OPEC and its allies falls apart – of if the economy gets another ugly surprise – crude could be headed back towards $30.

Such a downturn could make propane cheaper too. The fuel used for drying corn is a byproduct of crude oil refining and natural gas processing, both of which were pummeled by the pandemic. Hurricanes in the Gulf could also come into play to upset the balance, but summer is normally when supplies rebuild ahead of the winter heating season. The market anticipates that demand and begins firming prices during the summer as a result.

Knorr writes from Chicago, Ill. Email him at [email protected]

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like