Export data released from the U.S. Census Bureau this morning reported $14.5 billion of food, feed, and beverage exports out of the U.S. in December 2020 – a new record high. In fact, calendar year 2020 food feed, and beverage exports were the highest on record at $154.4 billion.

So that should be good news for the Phase 1 trade targets for agricultural products, right?

Remember, the Phase 1 trade deal was negotiated on the basis of currency, not volume. The agreement stipulates that Chinese purchases of U.S. ag goods would be $12.5 billion over the 2017 baseline in 2020 and $19.5 billion over the same benchmark in 2021. China purchased $24 billion of U.S. ag products in 2017, placing the 2020 target at $36.5 billion and 2021 goal at $43.5 billion.

But even with rapid end-of-year shipping paces, China only purchased $28.75 billion of U.S. agricultural goods in the 2020 calendar year, falling over 21% short of the $36.5 billion commitment. The initial targets – though vaguely calculated at best – suffered amid the COVID-19 pandemic, despite China’s economy recording a 2.3% increase in gross domestic product (GDP) growth in 2020.

The news hardly comes as a surprise. Market watchers were initially skeptical of the 2020 goal of $36.5 billion. The previous high for Chinese purchases of U.S. ag goods recorded in 2013 was 25% lower than the 2020 target, totaling $29 billion.

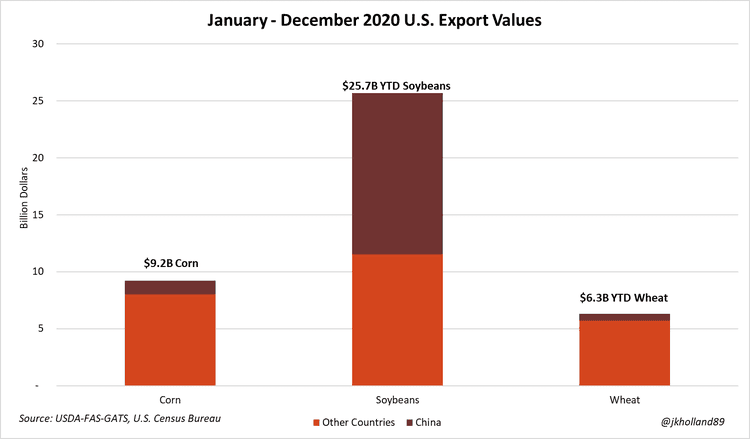

China bought $14.16 billion worth of U.S. soybeans in 2020, boosting exports nearly 77% higher than the previous year. But while it was a staggering amount, the final value was lower than top U.S. soy exports to China in 2012 ($14.88B), 2014 ($14.48B), and 2016 ($14.20B).

Looking to 2021

A recovering hog herd in China and high global grain prices will continue to make U.S. grains a lucrative option on the international market, especially with recent Russian efforts to limit exportable supplies amid rising domestic food prices.

But will China commit to $43.5 billion in purchases in 2021?

Corn exports to China in 2020 rose to $1.2 billion – following 2012’s peak of $1.3 billion as the second highest on record. But previous E-corn-omics analyses have shown that soybean exports are the crown jewel of grain purchases in the Phase 1 trade agreement, contributing exponentially more value to the trade agreement than any other grain.

Rising meat demand in China also contributed to U.S. ag purchases in 2020. China’s increase in purchases of other U.S. agricultural products are certainly welcome, but higher-valued soybeans remain the key to Phase 1 success.

The Biden Administration may use the shortfall as a negotiating chip to reexamine Phase 1 trade goals. However, immediate action on the trade deal likely remains tabled as the new White House focuses on combatting the pandemic.

A glimmer of hope for ethanol

U.S. ethanol and forest products comprised $2.32 billion of 2020 ag purchases made by China, or 8% of total U.S. ag exports to China last year. U.S. ethanol exports in 2020 totaled 1.33 billion gallons. The volume is the fourth highest in the books, even amid a 9% decrease from the 2019 calendar year. The Renewable Fuels Association estimates that nearly one of every ten gallons of U.S. ethanol produced in 2020 was exported.

Chinese ethanol demand is a bright spot for the U.S. ethanol industry, after news broke late in January of 200 million gallons of ethanol scheduled for delivery in the first half of 2021 are currently under order from China. In December 2020 alone, U.S. ethanol exports to China totaled 13 million gallons.

Despite high corn prices and currency issues limiting its U.S. corn purchases in 2020/21, Mexico increased December 2020 purchases of U.S. dried distillers’ grains (DDGS) by 11%. Mexico is the largest buyer of U.S. DDGS used for livestock feed. The recent slowdown in U.S. corn exports to Mexico suggests that our neighbor to the South may be increasing corn acreage amid rising grain prices to reduce reliance on higher priced U.S. grain.

About the Author(s)

You May Also Like