Today was another historic day for the corn producers of America. Our NEW number one buyer stepped in again today and bought 2.1 million metric tons (mmt) of U.S. corn , the second largest daily purchase in history.

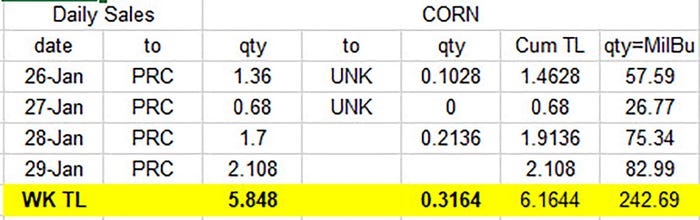

China’s purchase was in addition to the purchases made earlier this week , putting weekly totals at 5.848 mmt to China and 0.316 mmt to the unknown category. That brings total weekly corn sales (that we know of) to 6.1644 mmt, or 242 million bu. Other sales may show up in the weekly report if they were below the 100,000 tonne, the standard for reporting to USDA.

Demand keeps growing

Obviously the selloff in corn and soybean futures has resulted in bigger demand, which creates a math problem for the Jan. 9th WASDE Supply/Demand report.

There is no gentle way to resolve the supply and demand numbers that USDA put out. In the January report they pretty much cut demand 100 million bu. here and there in order to keep carryover at a reasonable level. But the reality of our industry is that demand has not dropped 100 million bu. here and there. Exports are running nearly 300 million bu. above USDA's projections, ethanol is on course to exceed USDA's numbers and be closer to the previous months. To top it off we all know there are a lot of livestock to feed.

We understand USDA is trying to forecast how we will end up the year’s carryover. But in order to get there we have to cut demand. We will not cut demand at these prices.

If we use current rate of demand and project out the balance of the year, carryover might be down to 1.1 billion bu. and stocks-to-use could be in line with the lowest number on record ($8 corn?)

Soybean numbers are even more of a challenge. If we were to cut off export demand right now, there probably would not be any carryover. Thus we either need to import a lot of beans or cut demand. Probably a combination of both.

Economically, the down and dirty of the story is our markets require a higher value in order to achieve economic redistribution of old crop supplies and the proper incentive to produce new crop supplies.

Today’s profit margins

Although all economic studies suggest higher prices, we as managers need to look at profit margins based on what the market offers today as there is no guarantee to what tomorrow will bring. We use the AgMarket.Net app to calculate these margins as well as using one of our tools to optimize strategy for your operation.

We are using strategies that protect your farm income no matter what happens to the market on the downside, while leaving the upside open.

Some of our analysis shows farms will make nearly as much money on the upside as they would if they did not sell one bushel. However, having the position in place provides solid returns that cannot be given up.

This is a market where everyone should evaluate the current return they can generate and balance that with how much risk your operation is in a position to take. Call us anytime and we would be happy to show you what your farm could be doing.

Reach Bill Biedermann at 815-404-1917 or [email protected]

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. AgMarket.Net is the Farm Division of John Stewart and Associates (JSA) based out of St Joe, MO and all futures and options trades are cleared through ADMIS in Chicago IL. This material has been prepared by an agent of JSA or a third party and is, or is in the nature of, a solicitation. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading infromation and advice is based on information taken from 3rd party sources that are believed to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. The services provided by JSA may not be available in all jurisdictions. It is possible that the country in which you are a resident prohibits us from opening and maintaining an account for you.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like