China put its money where it’s mouth apparently is, at least with soybeans. USDA filled in some of the data gaps created by the government shutdown by releasing total export sales for the last six weeks, and the news showed large purchases by the world’s largest soy importer.

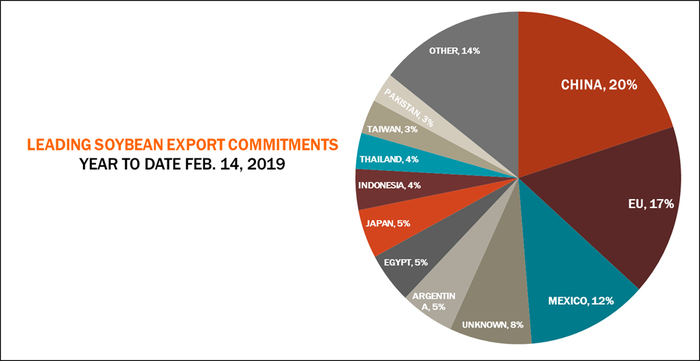

In all, China bought 144 million bushels of soybeans from the U.S. during the last month and a half, 60% of the 240 million in old crop business done during the period. That took China’s total commitments of 2018 crop soybeans to 20% of the 1.356 billion bushels done so far. While that’s far below the usual level of 60%, it represents a sizeable advancement after bookings to China stalled in the wake of the trade dispute with the U.S.

Still, total old and new crop business done since Jan. 4 fell below the level of trade guesses, though those estimates varied widely. USDA had previously announced 117 million bushels in new business with China under its daily reporting system. And in a footnote to today’s report the agency said another 26 million of large Chinese deals had been done but not reported during the shutdown.

Just what today’s numbers mean for what China could do going forward – and how that could affect total exports for the 2018 marketing year -- remains unclear. The slow start to sales during the trade war mean commitments must be stronger than normal in the second half of the marketing year, a time when soybeans from Brazil and Argentina typically dominate China’s imports.

USDA Feb. 8 lowered its forecast of 2018 crop sales to 1.875 billion bushels, suggesting 519 million bushels of new deals must be sold and shipped by Aug. 31. That’s a rate of 18.5 million a week, twice the average for the period during the last five marketing years.

Chinese negotiators meeting in Washington this week reportedly offered to step up purchases of U.S. farm products by more than $30 billion a year, though no breakdown has been specified.

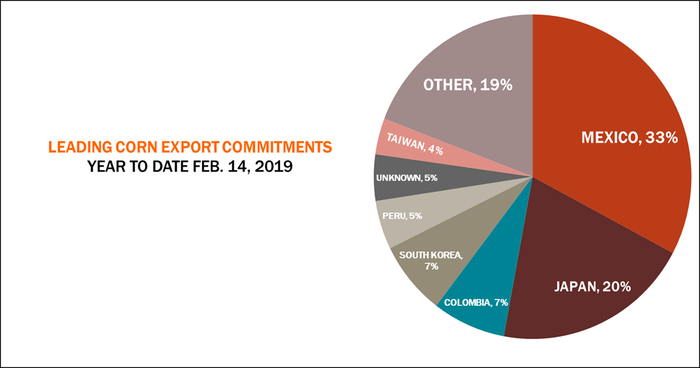

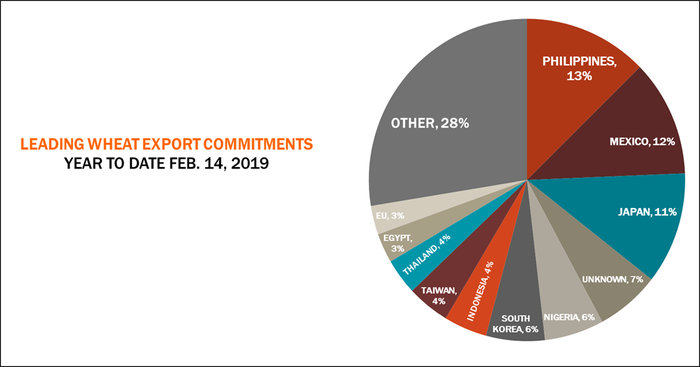

While China loaded up on soybeans, its purchases of other crops was modest at best. No sales of sorghum were made and just a container of corn, along with 1.5 million bushels of wheat.

Total old crop corn sales of 238.5 million bushels were a little better than trade guesses and also beat the rate needed to reach USDA’s forecast for the 2018 crop. Shipments, however, will need to pick up noticeably to reach that total, averaging more than 50 million bushels a week in the second half of the marketing year. With traffic on the river system slowed by slow water this winter, that could help firm basis once northern stretches reopen in March and April.

Today’s wheat numbers provided at least a little backing for USDA forecast that sales and shipments would pick up this winter. Total old crop sales of 131.4 million bushels, or an average of 21.9 million bushels a week, were much better than recent reports. Still, total commitments remain behind the percentage of USDA’s forecast normally seen this time of year.

And unlike the corn and soybean market, which have a couple of big buyers, wheat remains highly fragmented due to intense competition for business among leading exporters.

About the Author(s)

You May Also Like