USDA reported March 1st soybean stocks at 1.564 billion bushels, higher than the average trade guess of 1.528 billion bushels (bb), but down dramatically from last year's 2.255bb tally.

The most shocking part of this report is where the stocks are sitting. The on-farm stocks are down a massive 41.3% from last year at 594 mb bushels. Off-farm stocks were projected at 970 mb. If you are in the position of having to procure soybeans this summer, it is looking like it could be nearly impossible to find enough supply unless you are positioned to import soybeans from South America.

With old crop stocks literally at the bottom of the barrel, we expect old crop futures contracts to find support on breaks and work higher as they ration demand and encourage imports to bridge the supply gap until new crop supplies are available. The new crop balance sheet looks to be even tighter if U.S. producers plants the number that USDA projects in its March acreage survey.

More acres needed

USDA’s producer survey estimated 2021 soybean intentions at 87.6 million vs. 90.0 expected, and 83.1 last year. To put it simply, if we don't find more acres to plant, we will not produce enough soybeans in the upcoming year to meet demand.

Our calculations show that even with a trend yield of 50.8 b/a, we will need to cut at least 200 mb of demand to keep ending stocks at the pipeline level of 100 mb. If we would end up with a 2-3 bushels drop in trend yield, ending stocks would theoretically go negative. To keep this from happening, the market will have to rally to potentially all-time highs to ration out demand and encourage imports from South America if they have supply available to export to us.

Corn also shocks

The corn portion of this week's reports was a bullish shocker as well. March 1st, corn stocks were pegged at 7.701 billion bushels (bb). This was below the average trade estimate of 7.770 and lower than last year's 7.952bb stocks. On-farm stocks were 9.4% lower than last year, coming in at 4.03 bb while off-farm stocks were estimated at 6.66 bb.

With on-farm stocks down from year-ago levels, we anticipate it will become increasingly challenging for end-users to get their hands on the physical product. AgMarket.Net anticipates demand for old crop corn will continue to rise due to ramped-up ethanol production and shipping out the already sold product to China and other importers. This should keep basis stronger than the historical norm.

Corn acres came in at 91.144 million acres vs. 93.1 million expected and 90.8 million last year. Like soybeans, these acres may not be enough to meet anticipated demand if a trend yield of 179.9 b/a is achieved.

Using an old crop carry-in of 1,200 mb and a production of 15,040 mb, it would put domestic supply at 16,240 mb. We estimate demand for the upcoming season at 15,100 billion bushels which means the carry out would fall even lower than this year, with trend yields.

Odds of trend yields

But is trend yield even in the cards this year? When we dive into the acreage number, it looks like trend yield might be a stretch, even with perfect weather this summer. The survey reported that the "I" states corn acreage will fall over a million acres this year. Offsetting these lost "I" state acres is a 13% jump in South Dakota acres to 5.6 million and a massive 69.2% jump in North Dakota acreage to 3.2 million acres.

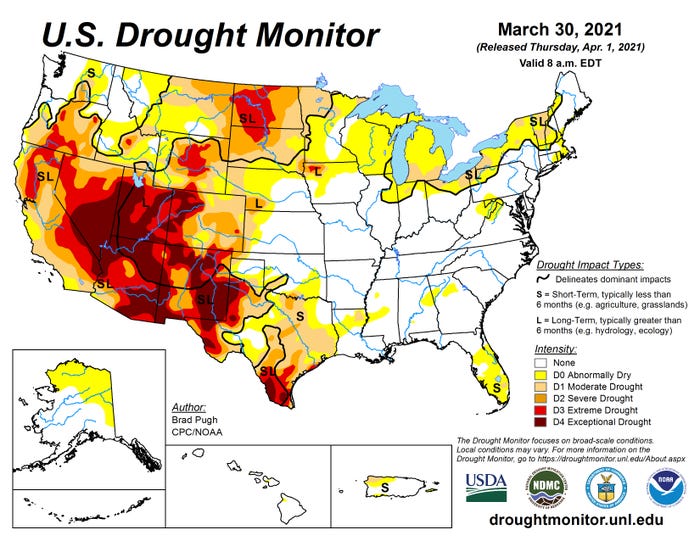

The reality is the Northern Plains corn yields are not as high as the "I" states, even in good years. With the current drought raging, the odds of below-trend yields in that portion of the country are high. A 5-bushel drop-off trend yield will drop ending stocks to record low levels unless we ration demand.

More beans, less corn?

Between now and the end of planting, the job of new crop corn and soybean futures will be to steal acres back as they attempt to produce enough bushels to meet this year's anticipated demand. If soybeans manage to take more acres from corn, they will fill the market's demand needs at the expense of corn. This is true in the opposite direction if corn manages to take acres from soybeans. Every commodity that ends up getting short-changed on the acreage front will have to move to plan B, which is ration demand. The million-dollar question is how high is high enough to accomplish this feat? Throw in below trend yields, and the rationing of supply becomes even more necessary, which will drive prices higher and maybe to all-time highs.

Reach Jim at 815-665-0461 or [email protected] @jpmccormick3

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. AgMarket.Net is the Farm Division of John Stewart and Associates (JSA) based out of St Joe, MO and all futures and options trades are cleared through ADMIS in Chicago IL. This material has been prepared by an agent of JSA or a third party and is, or is in the nature of, a solicitation. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading infromation and advice is based on information taken from 3rd party sources that are believed to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. The services provided by JSA may not be available in all jurisdictions. It is possible that the country in which you are a resident prohibits us from opening and maintaining an account for you.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like