Last month I discussed “Limited and Difficult Choices” (CSD September 2014) facing grain producers at harvest this year. Despite my concerns, I continue to read marketing strategists who are urging producers to store grain at harvest and wait for better prices. Be stubborn! I disagree because I think the odds of a large price rise in the first-half of 2015 are small. The burden is on me to explain my outlook.

Supply and demand fundamentals drive market prices. When looking for clues to price direction in a particular year, commodity analysts will often look back in time to examine years that shared important fundamental characteristics. For example, how do corn and soybean prices behave in the year following a widespread drought, a la 2012? Answer: short crops have long tails (CSD September 2012). Some people will refer to this as “similar years” analysis, while others might call it a “conditioned” analysis. Either way, the purpose is to find years that share similar fundamentals to provide clues to price direction in the current year.

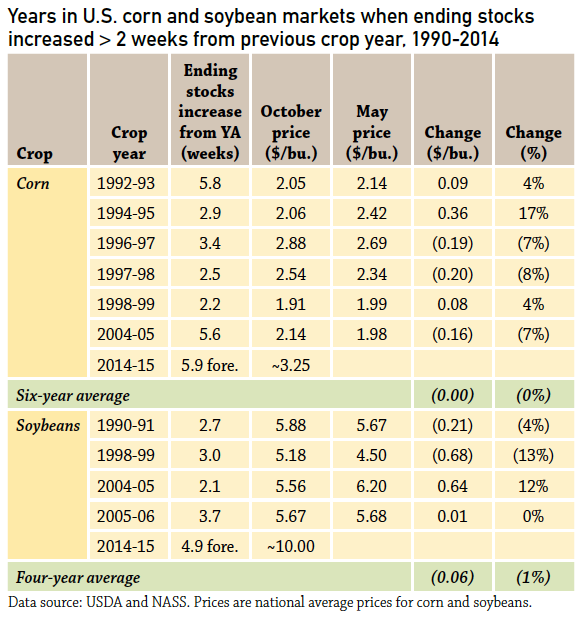

Ending stocks of grain are one such important fundamental factor. Data from the September WASDE report indicates that ending stocks of corn will rise from 4.5 weeks of usage at the end of the 2013/14 crop year to 10.2 weeks of usage at the end of the current crop year. Ending stocks of soybean are forecast to increase from 2.0 to 6.9 weeks. These are big increases – for both crops the largest since 1990 – and a result of record yields for corn and soybeans.

The accompanying table shows years since 1990 when ending stocks of corn and soybeans increased by more than 2 weeks usage from the previous year. Six years met this criteria in the corn market; four years in soybeans. In half of these years, prices were lower in May than they were in October. Bear in mind that there is a strong seasonal tendency for cash prices to rise (not fall) from October to May - in the “typical” year, there are 75% odds of a cash price increase from harvest to spring. Even more concerning is scarcity of “large” cash price gains (>10%). Large imports of corn by China put a spark in the 1994/95 corn market, as did strong exports of soybeans in the 2004/05 crop year. If you put grain in storage, you must hope for a similar spark this year.

A note for wheat producers - ending stocks are forecast to rise from 12.6 to 17.4 weeks and the same grim analysis applies to wheat prices.

The battle cry this fall is “Store grain and wait for higher prices!” This can work in the typical year, but stocks are rising sharply and this is not a typical year. In similar years, odds of a cash price increase after harvest are 50%, with just two of ten years showing the robust gains that producers want. If you must store grain, sell the carry and hope for better pricing opportunities for the 2015 crop.

About the Author(s)

You May Also Like