A year ago in my September 2014 CSD column, I argued that supply and demand fundamentals made me a skeptic about the chances for a large rise in corn and soybean prices in the first half of 2015. I was, unfortunately, correct. Despite a sharp post harvest rally, corn prices had returned to harvest levels by May. Soybeans prices were actually lower than harvest by spring.

If I apply the same analytical approach to 2015, my outlook for corn prices after harvest is more optimistic. For soybeans, not so optimistic. Let me explain.

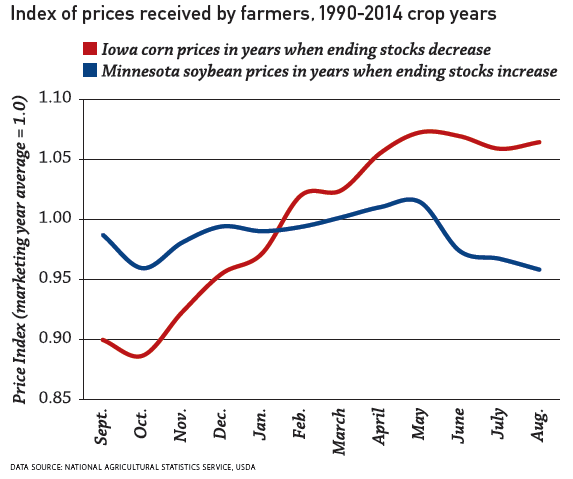

Despite a surprisingly large yield jump in the August WASDE report, corn stocks are still expected to shrink modestly in the year ahead. Since 1990, there have been 12 other years when corn stocks declined and in each of these years, prices the following spring were higher than harvest (based on NASS figures for Iowa prices received by farmers). On average, prices by spring were about 20% higher than harvest (see chart).

The story for soybeans is different. Ending stocks of soybeans are expected to increase in a big way – again – by the end of the 2015/16 crop year. Since 1990, there have been 10 years when soybean stocks increased in a big way and in half of these years, prices in the following spring were lower than harvest. The average price increase may be modestly positive, but 50/50 odds are not comforting.

Is it possible for corn prices to rise if soybean prices do not? Absolutely.

Now that you have absorbed the good news about the possibility of higher corn prices in the year ahead, let’s get real about our price expectations in the year ahead.

If you have unpriced corn in storage, think of a realistic price objective. A year ago, many farmers in the Corn Belt harvested $3 corn. By mid-December, prices were 70-80 cents higher. Corn price increases of 25% or more in a three month period are not common, but far too much corn stayed in storage as the market gave back the bulk of the gains. Do I think you might get $4 corn by next spring? Yes – $4 corn is a possibility. But I would start pricing sooner than that. Are you waiting for $4.50 cash corn? That type of price rise remains a stretch without an unforeseen supply and/or demand shock.

The game has changed. In the seven years prior to 2014, the best marketing plan was “wait three months and prices will get better.” It actually worked last fall too, but few producers could wrap their mind around $3.90 corn as a “better” corn price.

Demand is good, but supply is even better. We are scanning the horizon for the supply shock that will upset the balance and send prices higher. We are not there yet. Until we get there, you might do better with more realistic price expectations and a commitment to selling rallies.

About the Author(s)

You May Also Like