Weather forecasts and USDA used to be the big movers in commodity markets. But President Trump created a storm with his tweets about trade late this week. Before that, however, funds were bearish.

Here’s what funds were up to through Tuesday, Oct. 30, when the CFTC collected data for its latest Commitment of Traders.

![]()

Everything but the squeal

Funds were selling just about every in agriculture, at least until Tuesday. The only exception came in hogs, where buying was noted. Otherwise, big speculators added 83,597 contracts to their bearish bets in crops and livestock. Investors gaining exposure to commodities by buying index funds also trimmed some of their longs ahead of the next week’s start to the Goldman Roll, when positions roll out of the nearby December.

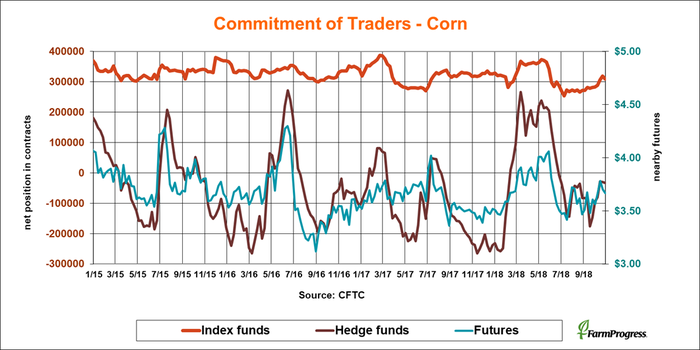

Leaning short

Big speculators sold a little corn this week, adding 3,675 lots to their small net short position before buying Thursday and Friday.

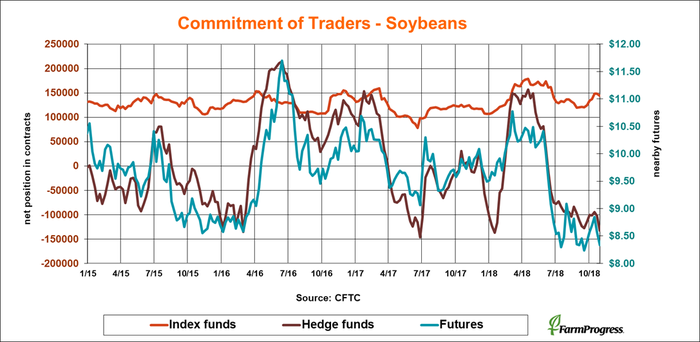

Treading lightly

Big speculators ran for cover Thursday and Friday, and for good reason. As of Tuesday, their bearish bet in soybeans was up another 29,910 contracts, reaching its widest level since January.

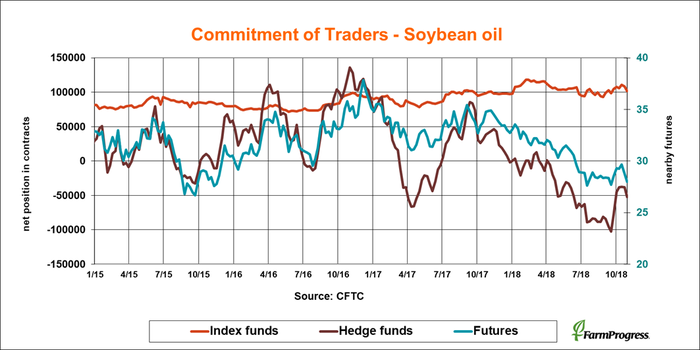

Crushed again

With crush margins weakening even before the soybean trade rally, soybean oil traders added to bearish bets this week. Big specs boosted their net short position by 13,837 contracts.

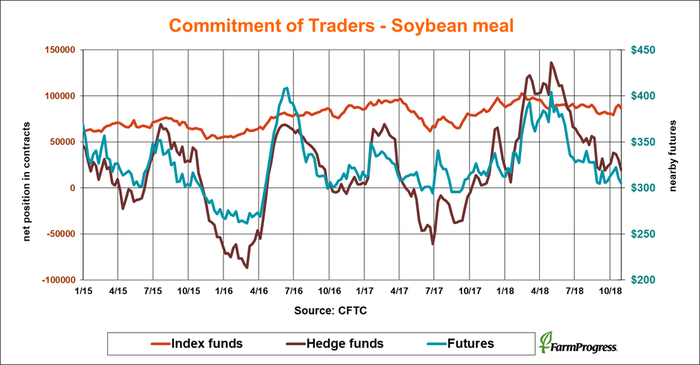

Not much

Big speculators are still long soybean meal but their net long position is shrinking. Hedge funds cut 11,104 lots to take their holdings down to 16,678 contracts.

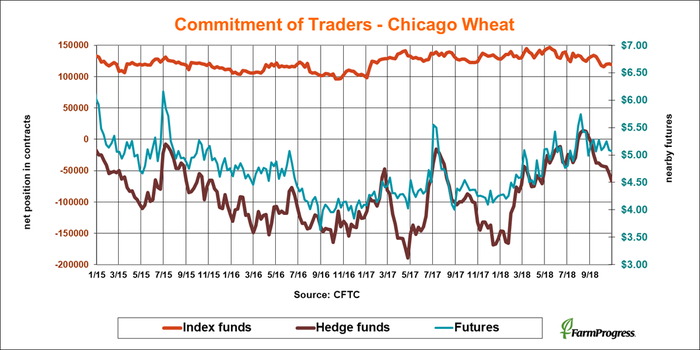

Take the elevator down

Big speculators sold soft red winter wheat for the 11th straight week, adding 12,594 contracts to their bearish bets.

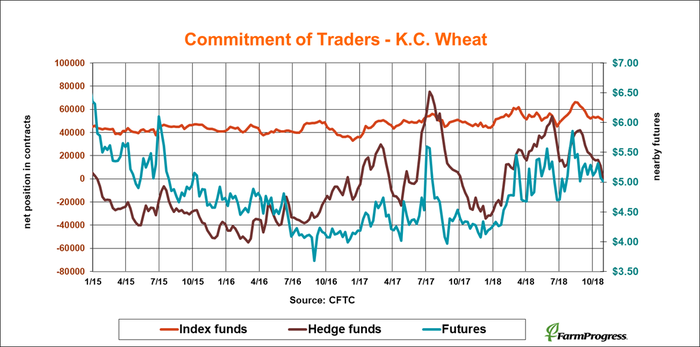

Scratch play

Big speculators have been long hard red winter wheat since January but that string came close to breaking this week. Hedge funds cut 11,110 contracts off their position to be net long only 164 lots as of Tuesday.

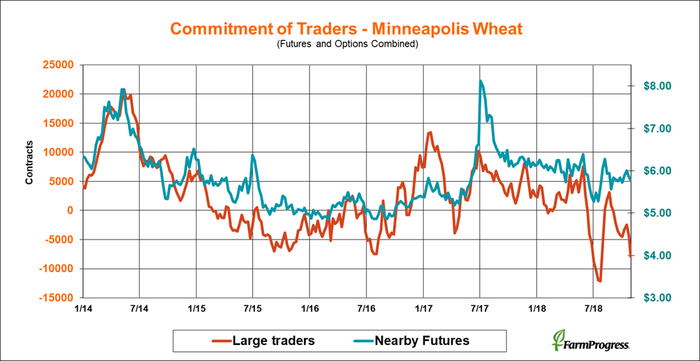

Twin Cities bears

Large traders in spring wheat sold more aggressively into early this week, extending their bearish bet by 3,565 lots.

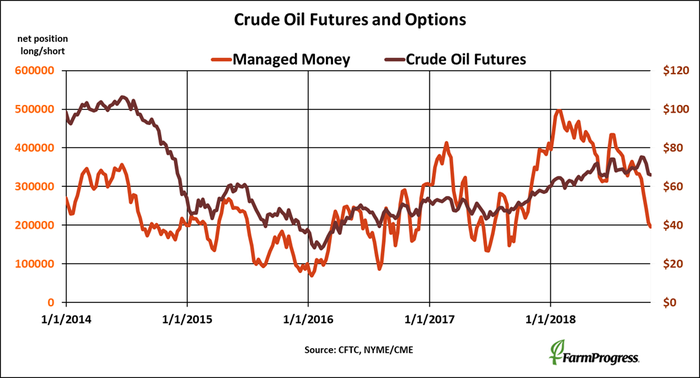

Slowing down

Money managers have been dumping holdings in crude oil all through the fall. The string continued this week, albeit not as aggressively. These funds sold around $670 million in crude oil futures and options as of Tuesday, before prices tanked again into the end of the week.

About the Author(s)

You May Also Like