Bearish March 29 reports triggered heavy funding selling before prices recovered a bit. But big speculators were still net sellers overall earlier this week.

Here’s what funds were up to through Tuesday, April 2, when the CFTC collected data for its latest Commitment of Traders.

![]()

Mixed reviews

Big speculators added to bearish bets in the wake of the USDA reports, but selling wasn’t uniform. Contracts with a positive news flows, including cotton and hogs, saw buying, offsetting some of the selling in grains. For the week hedge funds added 84,499 contracts to their net short position in crops and livestock.

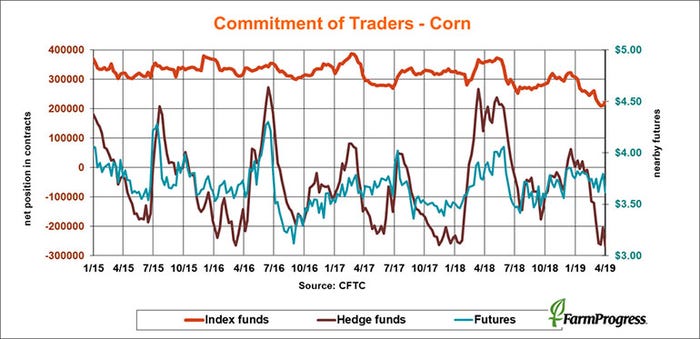

Bottoming out

Big speculators took corn to new contract lows March 29 and extended their net short position by 65,150 lots to an all-time bearish level of 269,827. That leaves plenty of room for short-covering rallies like the one that lifted prices a little this week.

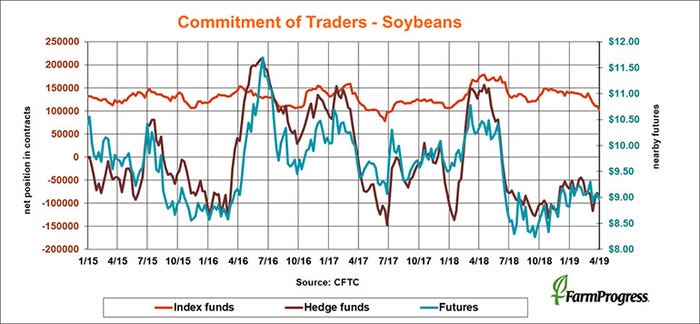

Selling again

Big speculators haven’t aggressively sold the soybean market recently, but they were selling nonetheless, adding 14,088 contracts to their net short position as of Tuesday.

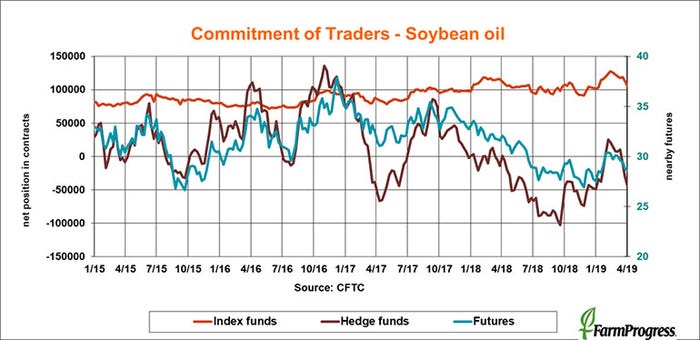

Foreign affairs

Vegetable oil prices rallied in Asia this week but big speculators headed in the other direction with U.S. soybean oil futures. They added 13,444 contracts to their modest bearish bets.

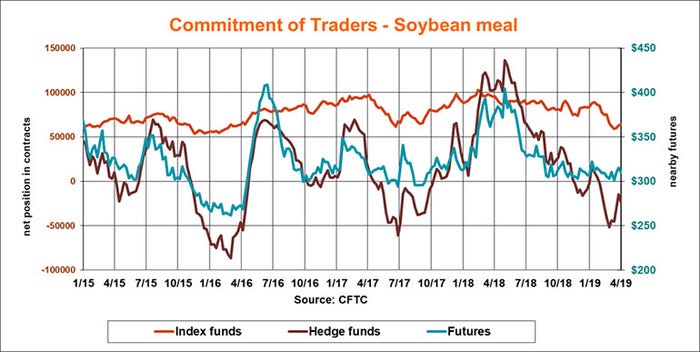

Forget almost

Big speculators were moving closer to even in meal, at least until the latest week, when they sold more aggressively again, adding 10,163 contracts to their net short positions.

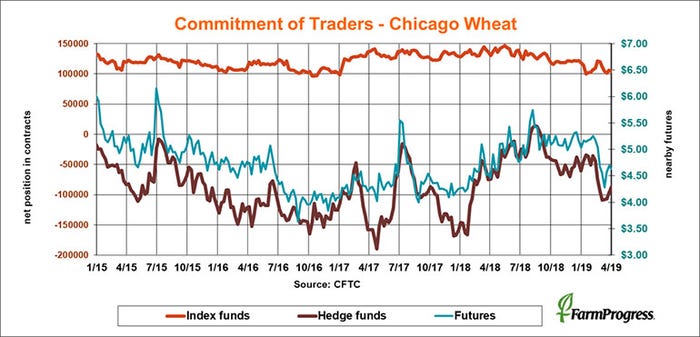

A little low

Big speculators covered more of their bearish bet in soft red winter wheat this week, buying back 10,278 net contracts from their net short position, which now stands at 86,672.

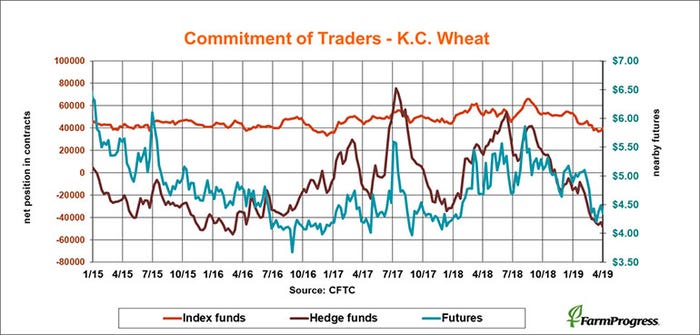

Down and dirty

Big speculators pushed their bearish bets in HRW to the widest level in more than three years this week, selling another 4,421 contracts.

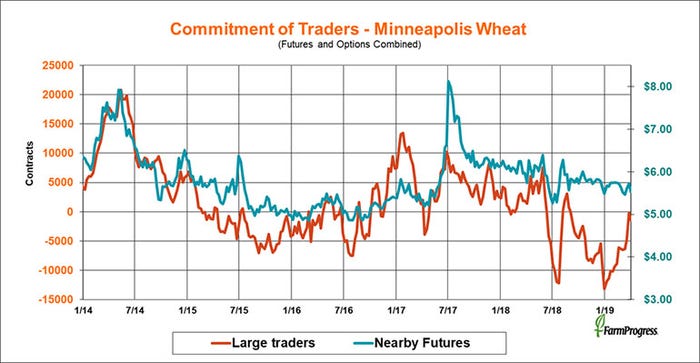

Where there’s smoke

Large traders were close to even towards the end of March but started selling again in the latest week. That selling accelerated after the CFTC data was collected Tuesday, pressing Minneapolis to new contract lows.

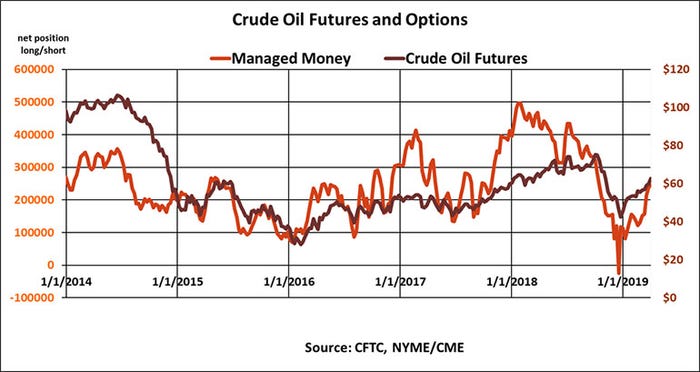

Pain at the pump

Money managers bought crude oil for the sixth straight week, adding more than $400 million in futures and options as prices confirmed their move above $62 a barrel.

About the Author(s)

You May Also Like