October 11, 2013

Projected budgets for 2014 corn and soybean production are out – and they’re pretty scary. But Dave Hommel has faced tight years in the past. And a balanced offense with staggered small sales helps keep profits at levels he can live with.

Hommel runs a corn and soybean farm in north-central Iowa at Eldora. About 60% of the land is rented. His family also runs a farrow-to-finish hog operation. “Livestock is part of our risk-management plan,” he says. “We need diversity to spread out our cash flow. We raise enough corn to feed our hogs. And we use liquid manure from hogs as corn fertilizer.”

Corn yields average about 200 bushels per acre on the region’s prime ground. Soybeans yield 60-70 bushels. Beans are marketed through local and regional elevators. About 40% of the corn is run through the hog program. Hommel makes commercial corn sales on the remaining corn.

He handles his own marketing, a philosophy which works more times than not. “I like to make my own decisions,” he says, based on various newsletters and other media. “I don’t hit home runs, but I usually hit singles and doubles when I do it myself.”

Hommel takes a businesslike approach to risk management. He determines costs, then works to make sales to cover inputs and generate a reasonable profit. He’s not one to wait on the next higher futures price tick.

“We do a lot of budgeting,” he says. “I look at sample budgets from Iowa State, then tweak them with our own input costs. We break down our costs, sometimes on a per-field basis. Then we work backwards from there and try to fit all our sales over certain months of the year. That helps improve your cash flow and overall profits in most years.”

His hog manure saves about $100 per acre over commercial fertilizer cost, Hommel says. “And with corn prices expected to be lower next year, I don’t think it’s time to lock in 2014 additional nitrogen needs too early.”

Marketing for 2013, 2014, 2015

Projected prices for 2014 are nothing like those seen in 2012 and earlier this year. “What a run we’ve been on the past five years,” says Steve Johnson, Iowa State University Extension farm management specialist. “But Dave is not setting on his laurels. He is looking to build on working capital as well as risk management. If you don’t have both of those in play, you’re in trouble.”

Hommel adds, “The advice I’m seeing is that grain marketing could be worse further out. So when corn rallied back a little in late August, I started looking at 2014 sales in the $4.80 range and beans at $11.50 to $12. I’m considering selling a sizable portion of 2014 and even a little bit of 2015.”

Those marketing moves were made while he still had 2013 corn to market. About 40% of this year’s commercial corn was sold via hedge-to-arrives (HTAs) in the $5.50-5.75 range. “Those were over the March 2014 futures contract,” he says. “I chose not to set the basis because it typically improves about January following harvest pressure on prices.”

His marketing philosophy of making orderly sales hasn’t been easy. “With $7-8 corn and $15-17 beans post-harvest the past two years, it makes it hard to feel like you’re a good grain marketer when you have made early $6 corn and $14 bean sales,” he says.

“Prices are that much more volatile now, all over the place. It adds to the emotion. “But I’m not for making crazy, rash decisions to where I’m not making any sales early. You have to have something for a rainy day. And that rainy day is coming, with lower prices projected.”

Along with revenue-protection crop insurance, options are also part of Hommel’s marketing. “In the past, I have used options for unpriced grain with the elevator,” he says. “I like put options more than calls, so I can set a floor on corn or beans not covered by HTAs or cash sales.”

He notes that price volatility increases the importance of on-farm storage. “We store most of our production,” he says. “Again, if it doesn’t go to the hog operation, it is protected by HTAs with basis to be set later, or will be sold later during a price rally.”

There is talk that many growers were still unsold on 2013 corn when September arrived. “It’s a lot about ego,” Johnson says. “They don’t want to be seen as selling too low. Seeing $8 corn and $17 beans did more damage than about anything.”

Hommel’s not waiting for a drought rally. “What kind of crazy marketing plan is it to take a do-nothing approach, then it pays off the best like it did last year,” he says. “That’s what happened for many. But if you try to bank on that more than one year – you lose.”

How does your budget stack up?

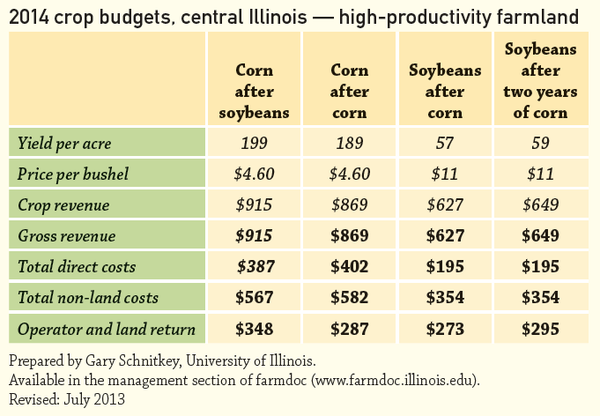

2014 operator and land returns are projected below levels realized in recent years, says Gary Schnitkey, University of Illinois Extension economist.

Schnitkey says, in discussing sample budgets for Illinois, budget which should also fit other Corn Belt regions.

For example, his sample budget for northern Illinois (see http://bit.ly/ILCropBudgets14), he uses a $4.60 average corn price and an $11 average soybean price. It includes all revenue and all financial non-land costs.

Corn-after-soybeans is projected to have an operator and land return of $284/acre. Schnitkey says this is the amount available to provide returns to the farmer and the land. If farmland is cash rented at $250/acre, the farmer would generate $34 of return for corn-after-soybeans ($35 = $284 operator and land return - $250 cash rent).

Schnitkey encourages growers to examine their own input costs and projections to determine their potential breakeven or profit. Marketing plans can then be tailored to provide a return when possible.

About the Author(s)

You May Also Like