Grain traders spend a lot of time agonizing over where prices are going. Sometimes, however, it’s useful to look back at how the market got where it is.

One year ago May 2020 corn futures struggled to stay above $3 a bushel headed into delivery. Nearby soybeans likewise battled to hold $8. Trade wars and the pandemic exacerbated fears about rising surpluses.

Despite lower acreage and below normal yields in 2019 – the first after six good crops in a row – USDA’s first monthly supply and demand forecast for the 2020 marketing year put out in May 2020 called for burdensome stocks to continue.

Initial outlook: bearish

The initial outlook for corn was especially bearish. Using its March planting intentions survey, the government said growers would push corn seedings to a near-record 97 million acres. With normal weather and yields of 178.5 bushels per acre, production would reach nearly 16 billion bushels, easily an all-time high.

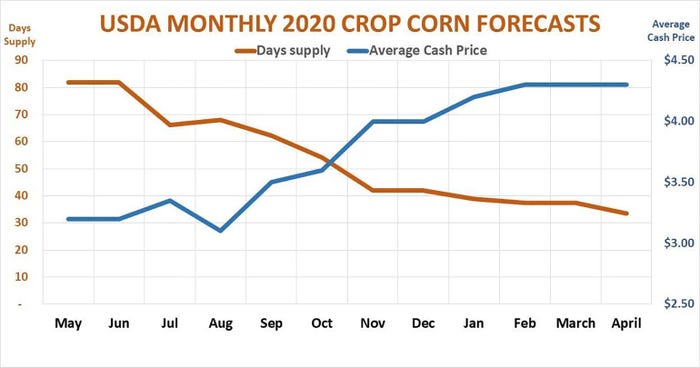

Demand of 14.8 billion bushels – tying a record -- wouldn’t be nearly enough to keep the corn surplus from rising to a staggering 3.3 billion bushels, an 82-day supply. USDA projected average cash prices received by farmers would fall to $3.20, the lowest since 2006 at the start of the ethanol boom.

With the global pandemic weighing on markets of all stripes, bears smelled blood. Big speculators pushed their net short position to a near-record, selling nearly 1.7 billion bushels of corn futures and options contracts.

The cure?

Seemingly proving the market maxim “the cure for low prices is low prices,” the outlook slowly began to change. Despite good planting progress farmers cut those large initial intentions significantly. USDA’s June 30 update reduced acreage by 5 million, knocking a billion bushels off the potential crop, and the final tally would be another 1.8 million acres lower. Futures rose to $3.63 in early July, but the rally didn’t take. Conditions remained favorable as traders braced for the results of the government’s first survey of growers’ production estimates. USDA’s August supply and demand report pegged the national yield at a record 181.8 bpa, dropping the average cash price forecast to $3.10.

Still, nearby futures held multiple tests of $3.20 as the stocks situation continued to slowly tighten. Despite the record August yield, lower acreage meant leftover supplies at the end of the 2020 marketing year would amount to a 68-day supply, 17% less than the original forecast.

USDA cut its yield estimates four times, reducing its acreage projection too, as supplies fell.

Then came China

There were also hints of revival on the demand side of the balance sheet. While forecasts for ethanol and feed usage declined as the pandemic dragged on, the export outlook for 2020 crop corn brightened. China began buying huge volumes of U.S. corn, swelling the new crop book to 621 million bushels at the start of the marketing year, the most since 1995.

With China accounting for an unprecedented 35% of U.S. commitments, total exports are now expected to reach a record 2.675 billion bushels by the end of August.

As a result, the government’s forecast of ending stocks continued to drop. In its last monthly report, carryout was put at 1.352 billion bushels, almost 2 billion less than the original estimate and just a 33-day supply, raising the average cash price forecast to $4.30. And those big speculators? They ultimately amassed a record bullish bet on corn, at one point owning a net long position equivalent to 2.2 billion bushels.

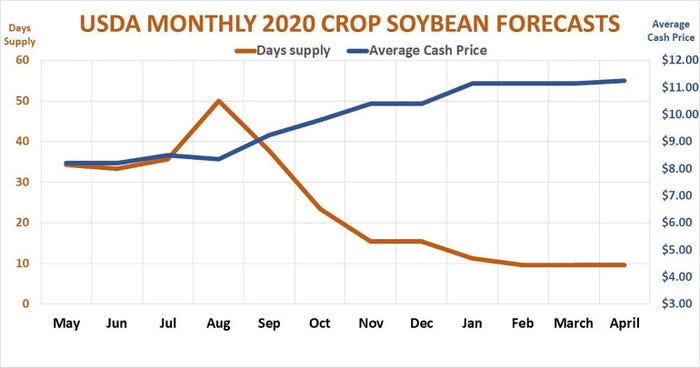

The genesis for the soybean rally followed a mostly similar path. Nearby futures stood their ground after USDA rocked the market with its forecast for yields of 53.3 bpa in August, a record that threatened to swell carryout back above 600 million bushels. The agency walked back its yields in September, November and January, while boosting estimates of both exports and crush.

In addition to renewed buying by China, prospects for processors also improved, getting a lift from drought in Argentina, the world’s largest exporter of soy products. A surge in crude oil helped trigger a big rally in soybean oil as prospects for biofuels gained steam.

USDA cut its forecast for carryout to 120 million bushels in February, helping the average cash price for the crop jump to $11.25 in April.

Comeback story

After consolidating over the winter, May 2021 corn traded above $6 last week, while nearby soybeans tried to mount a test of the March contract high at $14.60.

USDA will keep estimating old crop inventories into the fall, but the market’s focus is turning to new crop as farmers watch snow blanket some field in the Midwest. That could curtail planted acreage. The government’s first monthly forecast of 2021 crop supply and demand May 12 will set the stage for the next act, of what has already been a remarkable comeback story.

Knorr writes from Chicago, Ill. Email him at [email protected]

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like