January 1, 2012

Since Sept. 1, many producers have watched and some ignored the fact that corn prices have dropped by over $2/bu. and soybeans approximately $3.50/bu. While some may think this is a short-term correction in a long-term bull market, I am not in that camp.

Six months from now it may well be that everyone will look back on what’s transpired in recent months as an “event” changing market. What I am inferring is something that has occurred in the fundamentals and the structure of a market that has resulted in a substantial change in price direction. For example, let me give you an example of other event markets:

The Russian grain heist in 1973 that catapulted grain prices higher.

The collapse of Enron and WorldCom that resulted in a lack of confidence for investors, and hundreds of millions of dollars were pulled out of the stock market in 2002.

The collapse of many banks as well as General Motors and Chrysler in 2008, which resulted in the largest exodus in history from the stock market and the biggest loss in personal net worth of the average American.

These were “events.” They sometimes and frequently come as a surprise and not easily recognizable in the beginning. What are the events that are impacting the grain markets? Quite simply: the European collapse and the collapse of MF Global.

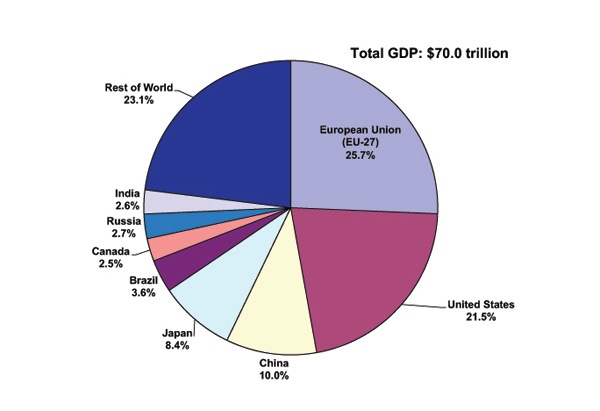

Europe accounts for 27% of the world’s GDP, the U.S. 25% and China 10%. What happens there is important. This collapse became intertwined with the collapse of MF Global. In a nutshell, in order to enhance returns and segregated funds, MF Global invested money in European bonds because they paid higher rates than government securities. As Europe came down the price of those bonds also collapsed, which brought MF Global into bankruptcy. And that impacted thousands of U.S. farmers and grain elevators who cleared trades through MF Global.

The ultimate impact of this entire situation is a lack of confidence in the commodity markets and individual farmers and investors not wanting to be involved in the futures and options market. While some may say “it’s about time,” let’s keep in mind that whether or not you directly use futures and options somewhere along the line, whoever buys your grain does. If the ability is no longer there to offset risk, then prices retreat to a much lower level where there is little risk.

In this type of a market you may have a neighbor who is what I would call a “line-item” economist who concentrates on only one fundamental such as subsoil moisture level, despite the fact that it may never rain again or that China may bail us out. But those line-item fundamentals are only a very small part in the big picture. And the big picture right now is Europe bringing the rest of the world down.

What It All Means

I started writing in early September that the grain markets were ready to enter the biggest bear market in history. It wasn’t very popular and very few people wanted to believe it. It has now unfolded and the last chapter has not yet been written. There will be rallies in this market – but from where? As I stated before, this was not a year to store grain (a short crop) and that passing up $6.50 corn and $13 soybeans at harvesttime could prove to be very costly. It now appears it’s going to be more costly than even I thought.

About the Author(s)

You May Also Like