There are two types of bull markets: demand-driven and supply driven. What’s the difference?

Plenty.

Supply scare rallies tend to come on fast and top out quickly as the world ramps up production to meet the short-term shortfall. And sometimes the market realizes that not as much production was lost as initially thought or priced in.

Demand-driven bull runs take time to build, but they tend to last much longer. With each passing week, it looks like we are moving into a long-term demand-driven market.

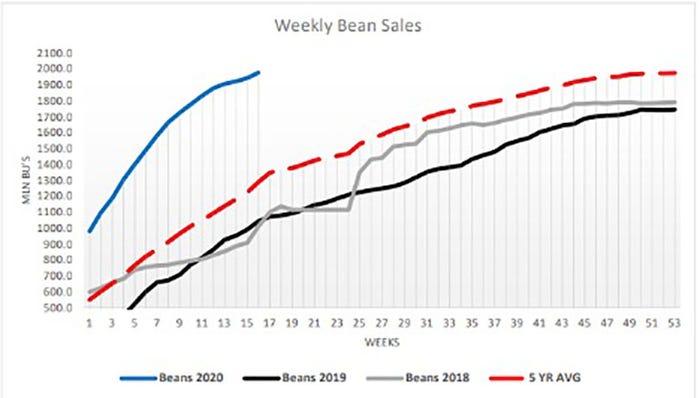

On Thursday, the weekly export report showed that we sold 33.9 million bushels of soybeans, putting the year-to-date sales at 1,977.8 million bushels. We have now sold 89.9% of the USDA anticipated export totals; the 5-year average pace of sales is 66.6%. Coming into this week, we needed to sell an average of 6 million bushels per week to hit the USDA target. This week alone we sold a little more than 5 ½ times what we need to sell to hit USDA targets.

The current sales pace strongly suggests that USDA need to revise the balance sheet's export portion higher, sooner than later. The AgMarket team believes this adjustment will show up on the January USDA report.

On the domestic front, this week's NOPA (National Oilseeds Processors Association) crush number suggests domestic demand is just as strong. In the month of November, NOPA crushed 181.018 million bushels of beans, topping the previous record set in 2018 by 8%. It was the 3rd highest monthly crush ever reported by NOPA. It was also the 10th record crush month seen during 2020.

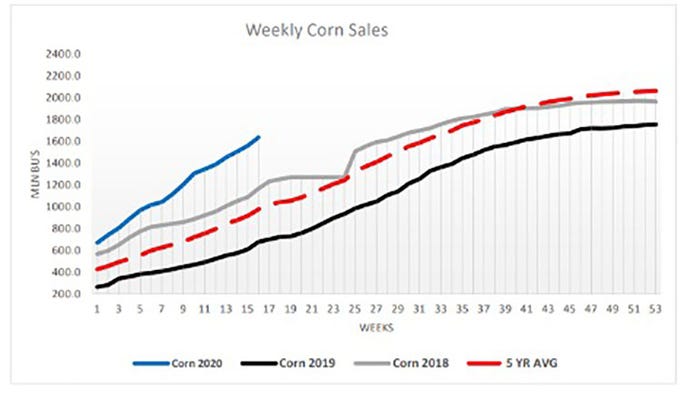

Corn exports surge

Corn export demand continues to run well above its traditional pace. The weekly export sales reported corn sales at 75.8 million bushels putting the year-to-date total at 1,636.9 million bushels. We have now sold 61.8% of the USDA anticipated sales figure of 2,650 million bushels; the five-year average sales pace is 46.2%. This week's sales were a little less than three times the 27.4 million bushels weekly sales pace we need to hit to reach the USDA goal.

Adding to the positive outlook for exports is the U.S. dollar index, as it is making new monthly lows as we wrap up the 2020 calendar year. This will be the first monthly close below the 100-month moving average since June of 2014. The weaker the U.S. dollar, the more competitive U.S. exports are on the international market.

We anticipate both the soybean market as well as the corn market to find continued support due to the strong export program we are seeing until the world is comfortable that there is another source of beans or corn to supply their import needs.

If you have questions, feel free to contact me directly at 815-665-0461 or anyone on the AgMarket.Net team at 844-4AGMRKT

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. AgMarket.Net is the Farm Division of John Stewart and Associates (JSA) based out of St Joe, MO and all futures and options trades are cleared through ADMIS in Chicago IL. This material has been prepared by an agent of JSA or a third party and is, or is in the nature of, a solicitation. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading infromation and advice is based on information taken from 3rd party sources that are believed to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. The services provided by JSA may not be available in all jurisdictions. It is possible that the country in which you are a resident prohibits us from opening and maintaining an account for you.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like