Bullish chart patterns attracted a lot of interest from fund traders as heavy rains stalled harvest. But while big speculators came close, they never quite turned bullish before selling accelerated again.

Here’s what funds were up to through Tuesday, Oct. 16, when the CFTC collected data for its latest Commitment of Traders.

![]()

Concentrated effort

Big speculators trimmed 42,716 contracts off bearish bets in agriculture early in the week, but that short covering focused only on a few commodities. These hedge funds sold cotton and livestock, and some grain crops too. But investors wanting exposure to commodities through index funds bought across the board, adding 46,510 contracts to their net long positions.

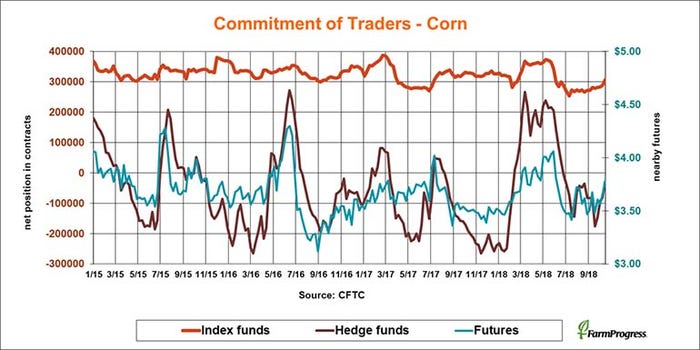

Close but no cigar

Big speculators slashed 52,149 contracts off their net short position in corn in the past week, trimming it down to 28,531 lots. But even before the cutoff for the CFTC data these hedge funds were selling aggressively again.

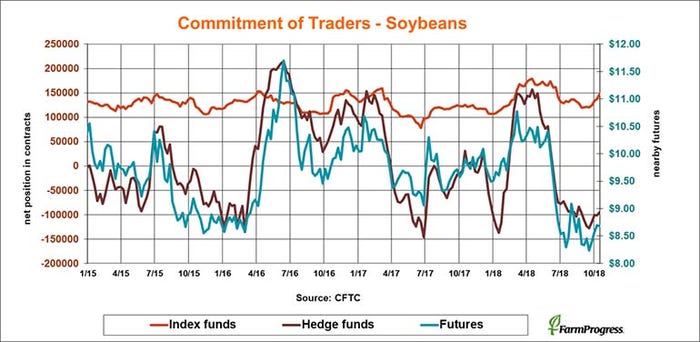

Treading lightly

Big speculators covered a little of their bearish bet in soybeans last week, but only lightly. The covered 7,392 lots of their net short position, but were still short 94,350 lots before they began selling again later in the week.

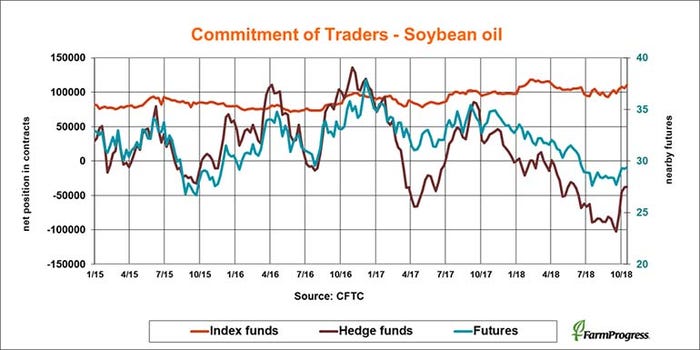

Not much

Big speculators trimmed some of their bearish bets in soybean oil over the past month, but that short covering eased last week. Hedge funds bought back only 382 lots off their net short position.

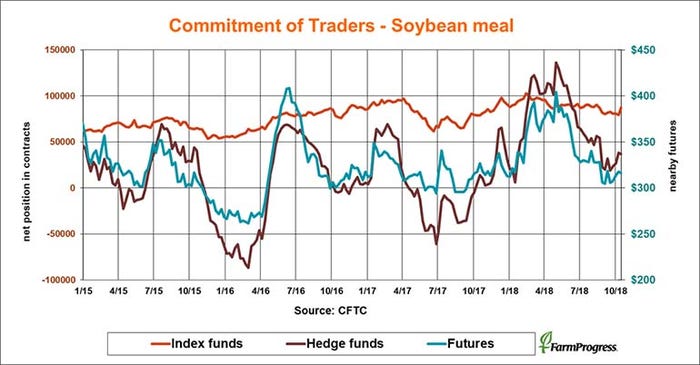

Backing off

Big speculators are still long soybean meal but cut some of that bullish bet over the past week, selling a net 1,616 lots.

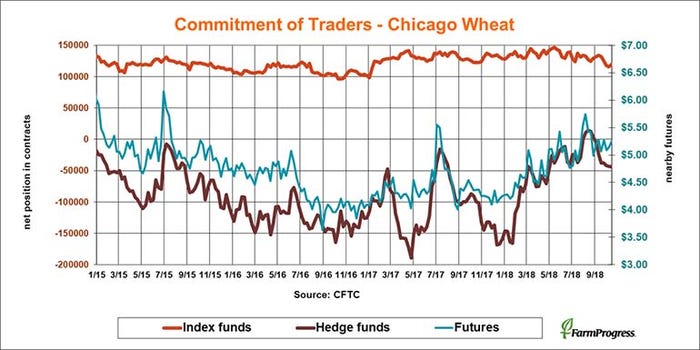

May day

Big speculators sold soft red winter wheat for the ninth straight week, though once again by only a small amount, a net 397 contracts. Still, that took the bearish bet to its widest level since May 1.

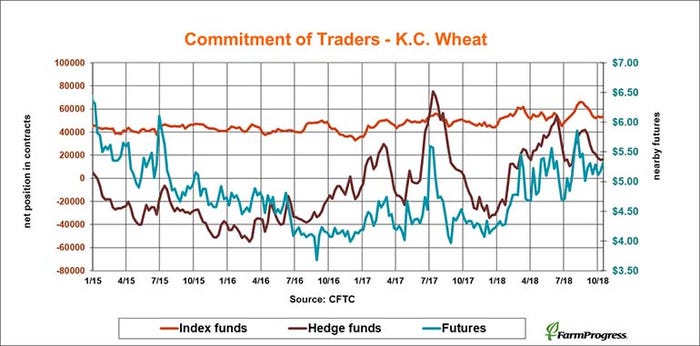

Hardly there

Big speculators bought hard red winter wheat for the fourth straight week, but barely. Hedge funds added only 382 lots to their net long position.

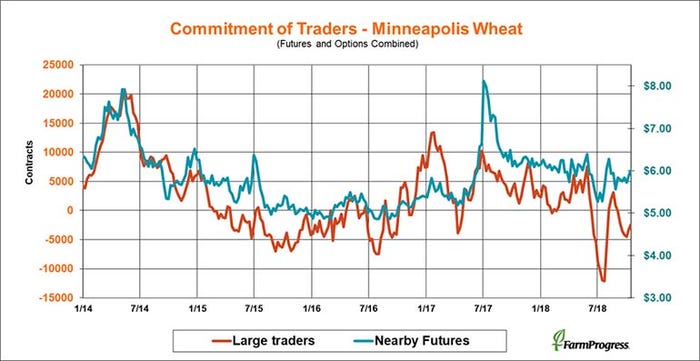

Marking time

Large traders in spring wheat covered bearish bets for the second straight week, buying a net 801 lots before selling reemerged.

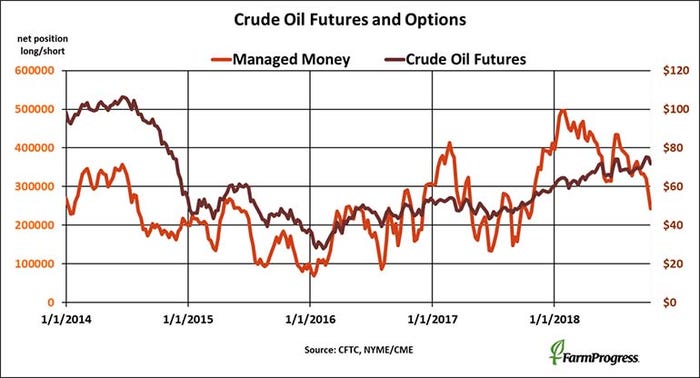

Getting out

Money managers continued to dump holdings in crude oil over the past week even before futures broke below $70 a barrel. The big traders sold another $2.8 billion in futures and options.

About the Author(s)

You May Also Like