Markets can change quickly. Consider, for example, the recent case of Dec’22 corn futures. Over the course of eleven trading days – from the close of June 16 to the close of July 5 – new crop prices fell off a cliff, dropping $1.56/bu. and losing 21% of its value.

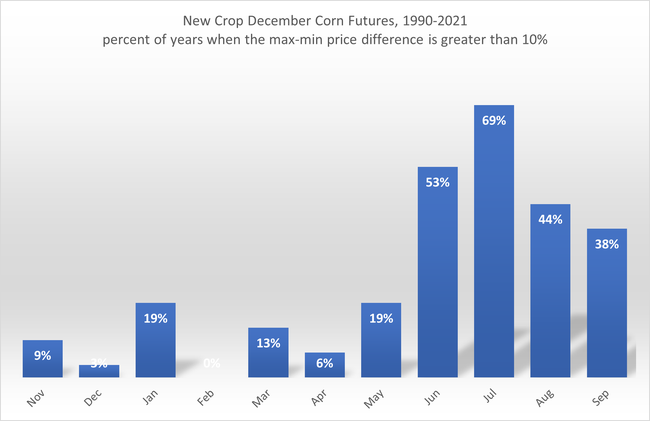

Should we be shocked by such a dramatic price move? Not if we look at the history of price changes in new crop corn futures. Since 1990, the difference between the monthly maximum and minimum closing price has been greater than 10% in 22 of 32 years (69%) in the month of July (see accompanying chart). The month of June has seen max/min spreads greater than 10% in 17 of 32 years (53%).

A simple tally of years with max/min differences greater than 10% does not speak to price direction – higher or lower – in December corn futures. The data for the June-September period indicates that months with decreasing prices outnumber the increasing years by a 2 to 1 margin.

Ukraine is an important world player in grain exports, particularly wheat and corn. As war continues, grain traders remain on edge. However, impacts of the war on trade and prices have been thoroughly discounted in the market. The market has turned its attention to crop prospects in the Northern Hemisphere and the 7–10-day weather outlook.

Losing 20% of value in two weeks is harsh but, unfortunately, not unprecedented. I hope that you heeded the 11th Commandment and emptied your bins of old crop before the crash.

Source: Ed Usset, who is solely responsible for the information provided and is wholly owned by the source. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

About the Author(s)

You May Also Like