President Donald Trump looks at the merchandise trade imbalances listed below and says it’s time to reduce these imbalances with our trading partners. His contention is these trade imbalances are limiting U.S. growth, compromising trade relationships, constraining quality U.S. job creation, compromising U.S. security and the list goes on. The list includes:

The top-5, 2017 largest U.S. merchandise trade imbalances:

China: -$375-billion

Mexico: -$71-billion

Japan: -$69-billion

Germany: -$64-billion

Vietnam: -$38-billion

The top-5, 2017 sources of U.S. merchandise imports:

China: $506-billion

Mexico: $314-billion

Canada: $300-billion

Japan: $137-billion

Germany $118-billion

Consider: In a world of more than 7 billion people, racing toward 9 billion, the U.S. can no longer be the economic and military backbone of the world without countries contributing their share to economic growth, social progress, and homeland security. Decades of U.S. outsourcing has been about efficiency, but it has evolved into elevated levels of greed and increasingly has compromised efficiency. Consider:

China is predatory and protectionist, a clear and present danger to U.S. security, growth, and global leadership.

Mexico’s growth and development model is highly inefficient. Mexico is at least two decades away from emerging as a progressive economy.

Japan’s debt-burdened deflationary economy is dependent on their government’s ongoing purchases of their sovereign debt.

Germany, like the European Union, is economically dying due to heavy socialist entitlement programs, an immigration nightmare, and predatory attitude toward fellow European member countries.

Vietnam, a frontier country, represents a source of cheap merchandise, but at what price to American economic activity and viability?

The European Union is a flawed model with little hope of success due in-part to a fragmented sovereign bond and political system.

Globally, countries are increasingly focused on nationalism, regionalism, bilateral relationships, etc. due to fiscal, monetary, trade, and regulatory policy inefficiencies. Most of the world’s population is pro authoritarian governments (China and Russia) of varying types and increasingly hostile to open and capitalist driven governments.

President Trump is in search of fair balanced global trade relationships, which in the manufacturing sector implies rebuilding the U.S. manufacturing sector. This will be especially beneficial for the Southern United States.

How important is trade to the U.S. economy?

In 2017, the United States exported $2.3 trillion in goods and services and imported $2.9 trillion.

In 2016 what countries were the largest global trading economies?

In 2016, the top-five largest trading economies (in terms of the value of goods and services trade) were the United States, China, Germany, Japan, and the United Kingdom.

However, if the 28 EU members are treated as a single trading bloc, the EU would be the largest trading economy, with extra-EU trade of $5,512 billion.

China was the largest exporter, while the United States was the largest importer.

In goods trade, the United States was the largest importer and second-largest exporter (behind China).

In services trade, the United States was both the largest importer and exporter.

The U.S. share of global goods exports fell from 15 percent in 1960 to 9 percent in 2016, largely due to the rapid increase of global trade, especially among developing countries and emerging markets.

The U.S. export share of global services is 15 percent.

In 2016, U.S. exports and imports were equivalent to 26 percent of GDP. Although the United States is a major global trader, the size of trade relative to the size of the U.S. economy is smaller compared to other major trading economies.

Trade Source: Congressional Research Service

The Week Ahead July 9, 2018

10-Year US Treasury Yield: Weakening and defining a new trading range due to ongoing global weakness. For the week of June 29, 2018, the 10-year US Treasury Yield ended the week down 1.05 percent at 2.82 percent. The 10-Year U.S. Treasury Yield is building a lower trading range. For a multi-month period this market likely trades in an interest rate range of 2.5-percent to 3.0-percent before moving higher.

The Fed Fund Rate was increased .25 percent at the June 13, 2018, meeting to 2 percent. Global fiscal, monetary, and trade policy friction may stand in the way of the anticipated rate hike of .25 percent at the next Federal Reserve Open Market Committee (FOMC) meeting on September 25-26, 2018. (Charts A1-A4)

Presently, I have no expectation of a rate increase at their December 2018 meeting. The Fed is positioning to maintain a balanced yield curve as the year progresses by continuing to shrink their balance sheet.The upward trend of U.S. interest rates is essential to the financial health of pension funds, individuals, and businesses dependent on a more normalized interest rate.

Prolonged Business Cycle: Global governments and central banks continue positioning to prolong the business cycle for an extended period of two to three or more years, which implies slowly rising interest rates and inflation over that period.

U.S. Dollar Index: Sideways consolidation likely this week, but bullish bias near term remains dominant until global weakness and uncertainties dissipate. With the dollar index presently at 93.77, down .61 percent for the week, (Charts A5-A8) and off its low of 88.15, the index is in a slow determined corrective grind to the upside. Why? The corrective global slowdown is normally bullish for the U.S. dollar and this time is no different.

The dollar has entered a possible two to three or more months of more strength than weakness, with an upside potential target of 97 to 100 before resuming its downside trend. A resumption of the dollar’s downside trend will be a function of the resumption of global growth.

Challenging Market

This is an extremely challenging market, and chart strength or weakness is highly dependent on global government and central bank orchestrated fiscal, monetary, trade, and regulatory policy objectives achieved and resulting in collective global growth.

Since the U.S. Dollar strength has negative economic consequences to frontier, emerging, and developing economies who mostly borrow in dollars, a prolonged rise in the dollar moves country after country toward their own economic slowdown. This is a key reason for the collective ongoing global economic slowdown; therefore, we will closely monitor this market and adjust expectations accordingly. What could keep the dollar index rising? Inaction of global governments and central banks to achieve individual and collective growth.

S&P 500: Prices continue range bound between 2538 and 2831. Bottom-line: Just let price action provide guidance until stronger momentum is regained. Note the collection of attached Equity Charts A14 to A28.

$WTIC Light Crude Oil: Bullish with prices sideways to up. Why would oil prices move higher? Stimulus driven global growth over the next two to three or more years remains the driver as supply increasingly struggles to keep up with demand. The length of the current global economic slowdown is increasingly debatable. I have anticipated a slowdown into mid-August, but that expectation may need to be advanced forward one or more months.

Two major supply concerns:

The Venezuelan economic, social, and political crisis has their country and oil sector near collapse.

Likely Iranian sanctions have the potential to contract global supply, even though significant Iranian oil will likely move through the global black oil market or directly into China.

An interesting array of factors from fundamentals, to global policy drivers, to social, economic, political, and military uncertainties keep this market at elevated levels, and they do not appear to be losing their influence anytime soon.

CRB Commodity Index: Correction completion dependent on oil prices remaining bullish.

Commodity bulls need to see this index push through resistance at 205 (currently at 198).

Commodity bears need to see this index not hold support at 185. This would likely imply major across the board commodity weakness for a period.

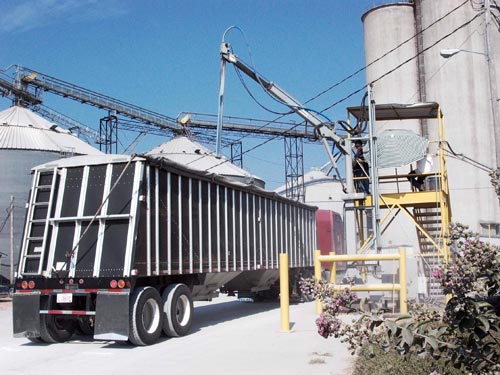

Rice, Grain and Cotton Video

Ted Nelson, a Risk Management Consultant for INTL FCStone Financial Inc., FCM Division, looked forward at corn, rice, soybeans, wheat and cotton markets and the market factors/outside influences that are at play in a July 5 Rice, Grain and Cotton video, (https://bit.ly/2E2BEla).

Rice, Grain and Cotton Charts B1-B28 in Chart Book

Soybeans: Key consideration: Massive chart damage. Soybeans need to finish the week of July 8, 2018, above $9.80 per bushel for consideration that bullish momentum possibly could be regained. Charts (B10-B13)

Corn: Key consideration: Corn needs to finish the week of July 8, 2018, above $3.85 per bushel for consideration that bullish momentum possibly could be regained. Charts (B14-B17)

Wheat: Key consideration: Potentially Bullish. Wheat needs to finish the week of July 8, 2018, above $5.60 per bushel and hold to imply bullish momentum is real. Charts (B14-B17)

Long Grain Rice: Finishing the week of July 9, 2018, above $12.60 September would be bullish. Next closing and holding above $13.16 opens the door for a price move to $14.50 to $15.00 dollars per cwt. (Chart B18-B20)

Cotton: Remains Bullish. Key consideration: If cotton can remain above 78.6 cents, this market still has a bullish bias given today’s global economic setting. Charts (B21-B24)

Cuba Rice Webinar

Little is known about the state of the Cuban rice value chain. Dr. Alvaro Durand-Morat, Assistant Professor in the Department of Agricultural Economics and Agribusiness at the University of Arkansas, will cut through some of the haze in a Cuba Rice webinar, July 12 at 3:00 p.m. central time.

Durand-Morat will describe production, processing, and market features of the Cuban rice sector and discuss the potential implications for U.S. rice. He specializes in agricultural trade, grain economics with an emphasis on rice, and food policy.

Registration Link: http://bit.ly/UAEX-Cuba-Alvaro

Why soybeans are at the heart of the U.S.-China Trade War, Bloomberg,

By Megan Durisin and Sam Dodge, July 5, 2018

China’s newly imposed tariffs against U.S. soybeans herald a major trade shift for a crop that’s soared to prominence in recent decades. Continue reading at https://bit.ly/2u7etAf

Bobby Coats is a professor in the Department of Agricultural Economics and Agribusiness, University of Arkansas System, Division of Agriculture, Cooperative Extension Service. E-mail: [email protected].

Download Slide Show for charts and expanded details, Click Download Link

DISCLAIMER-FOR-EDUCATIONAL-PURPOSES-ONLY

About the Author(s)

You May Also Like