It’s easy to push important jobs to the back burner. How often have we had a critical task to accomplish but dreaded the effort it would take, and ultimately ended up scrambling at the last second to get it finished?

This mindset often prevails in grain marketing, but there are 5 keys to why now is the time to put a long-term marketing plan into play.

Take the long view

How do you view the marketing of your crop? Is it, “I’ll wait for the right time, when prices are rallying toward the summer highs and then sell most of my crop?”

This would be comparable to a 40-meter dash; a tremendous amount of focused effort for a very short time.

Conversely, seeing marketing as a marathon -- a much longer period of time that requires hard work and discipline with little emotion – has a much greater chance of success.

Don’t look back

If you’re driving and looking in the rearview mirror 85% of the time, your chances of arriving at the destination without an accident are not very good. Likewise, if your marketing decisions are heavily influenced by what futures prices did last week, last month, or last year, you could be setting yourself up for big problems.

A case in point: if you sold too early back in 2012 before corn prices rallied to $8, it was easy to feel “stung” and hold off on forward pricing or defending (buying puts/selling futures) anything the next year.

On the other hand, if you didn’t sell anything in 2005 due to bullishness on weather/crop conditions, and prices then crashed to low levels by harvest, it was natural to get aggressive the next crop year in forward selling – all just before the ethanol boom pushed prices higher for multiple years in a row.

The lesson is simple: each marketing year stands on its own. Staying consistent in a marketing plan, while building in flexibility for higher or lower prices, will produce much better results.

Pay attention to what really matters

At this time of year the focus tends to be on the production side of your business. However, it is important to also keep your antenna up on the marketing side, as opportunities can appear when you are extremely busy trying to prepare and plant ground.

If a grain buyer doesn’t have much coverage in place, and producers are busy in the field, basis can get pushed to much improved levels for May or June delivery, for example. This can provide an opportunity to sell the cash grain and re-own the upside with July, August or September call options in the event prices rally later this spring/summer.

Look ahead for opportunities

An even better focus of time in marketing efforts needs to be on the crop that will be harvested 16-18 months from now. December21 corn futures are currently 45 cents a bushel above July20 futures. However, if you have 40% of the old crop unsold/unprotected, as well as 90% of the 2020 crop, is the 2021 crop going to get much attention?

Over the years, some great opportunities have come along many months before a crop is even planted. Unfortunately, many of these pass by unnoticed with near-term production & marketing being the focus.

Align inputs and outputs

Ask yourself, “When I lock in my inputs at certain times of the year, am I doing anything to defend the output (sales) side?” Too often this first leg (inputs) gets locked in, but nothing is executed in a timely manner to protect the price of the crop to be grown. Why is this a risk? Inputs get cheaper and the price for your expected production slides lower.

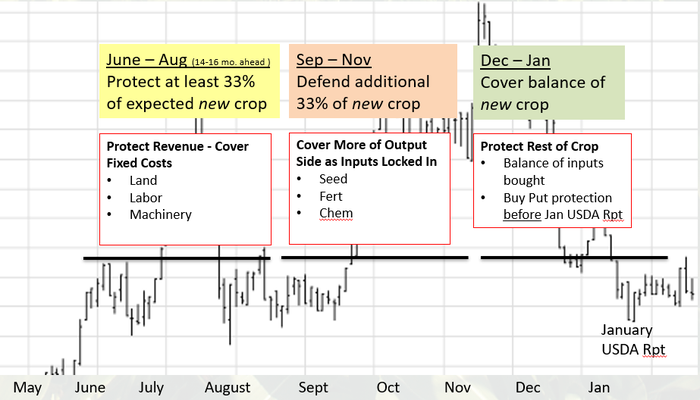

Instead, implement an initial minimum price protection strategy at the time your costs are being locked in. We consistently help producers defend, at a minimum, 33% of the crop’s expected production 14-16 months prior to harvest, with a combination of mostly put option purchases, along with some sales (Futures/HTA’s/Cash Sales) and call options for upside.

How would this strategy work for 2021? Right now most input costs are unknown but we do know land, labor, and machinery costs are coming, so we recommend that this portion also gets defended on the output side. As time moves forward inputs like seed, fertilizer, and chemicals get locked in (September-November, 11-13 months pre-harvest); we recommend executing downside protection with upside ability strategies (puts, sales with calls) on an additional 33% of the crop.

Finally, as the balance of input costs get locked in by January, and with the major January government reports looming, we recommend protecting the rest of that crop with the tools mentioned earlier.

This strategy ensures that as costs are locked in, the worst case is known on the marketing side. At this point, the floors for marketing might be lower than the total cost of production. However, if prices declined to much lower levels, a small loss would be much preferred to a substantially larger loss. On the other hand, if prices moved significantly higher, bushels covered with puts (unsold) still have all of their upside, and bushels that are sold with call options attached can still benefit from the rally.

Managing those positions to raise floors in a rising market is of paramount importance.

Marketing can’t wait for a more convenient time

The decision to push off marketing to a more convenient season and trying to “time” the market over a shorter period simply does not work well. Understanding that marketing is hard work and needs focused attention over a much longer timeframe, utilizing a disciplined, consistent and flexible approach in managing higher and lower prices, will produce much better results over the long haul.

Contact Dietz at (800) 664-2321 or go to www.advance-trading.com

The risk of trading futures and options can be substantial. All information, publications, and material used and distributed by Advance Trading Inc. shall be construed as a solicitation. ATI does not maintain an independent research department as defined in CFTC Regulation 1.71. Information obtained from third-party sources is believed to be reliable, but its accuracy is not guaranteed by Advance Trading Inc. Past performance is not necessarily indicative of future results.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like