As we wrap up the growing season, traditional weather-driven grain market moves tend to wane. Historically, the market trends lower into harvest. But there are many factors this year that could cause the traditional sell-off not to happen, or accelerate. Here’s a closer look:

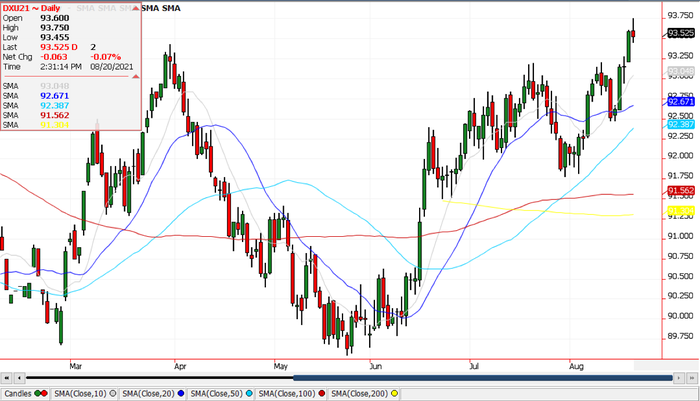

Stronger dollar

Earlier in the week, the Fed released its latest minutes which suggested that our government might be closer to tapering than what the market was thinking. (This means reduced bond-buying). The U.S. Dollar's reaction to this news was to break out above its near-term resistance; futures are now at levels not seen since November of 2020. This Dollar rally drove most commodities lower as a higher dollar makes our commodities less affordable on the international market. This is especially true for soybeans as the Brazilian Real is at the lowest level versus the U.S. Dollar since April.

Sinking consumer confidence

The rebound in COVID 19 cases has led to some of the lowest University of Michigan consumer confidence readings since December 2011. The weak readings are a concern as they could lead to a lack of consumer spending and travel, which will be negative for commodities, especially the energy complex, which leads to weakness in biofuels as well.

Late in Friday's trading session, a news article was released suggesting that the U.S. EPA was expected to recommend that the White House lower the national biofuel blending mandates below 2020 levels. This would be bearish demand for biofuels, and the market's reaction to the story was to make new weekly lows on this news. The EPA did not officially comment for the article, and the sources which provided the information were unnamed.

A look at technicals

On the technical front, we did some damage to both the corn and soybeans charts this week.

The November soybeans contract traded above the 10, 20, 50, and 100-day moving averages late last week and earlier this week, but failed to take out the near-term downtrend resistance. The market then reversed midweek and ended up closing below all those critical moving averages.

November Soybeans also breached the long-term technical uptrend drawn off of the low made on January 25 and the secondary low made on June 17, which is the critical long-term support. Now that it has been taken out, it will open the door to go down and test the 200-day moving average, which is at $12.41 1/4.

The December corn contract took out technical resistance after the release of the bullish August WASDE numbers but has had a technically disappointing reaction this week. The December corn market has fallen right back down to the $5.50 zone that corn has been stuck trading near for the past month and a half.

Like soybeans, the corn market has taken out the 10, 20, 50, and 100-day moving average this week, which is technically negative. The long-term uptrend support drawn off the lows scored on March 30 low of $4.49 ½ and the July 9 low at $5.07 trend comes in at $5.32 and a quarter which held.

Export demand mixed

The export demand situation for beans is looking up, as we have seen purchases from China in the last 11 trading days. Corn exports, on the other hand, have been disappointing. After a heavy run of purchases early this spring by China, the country has not been in the market recently. We are optimistic that they will eventually show up, as lost production in Brazil due to drought and multiple freeze damage will lead to more demand for U.S. corn.

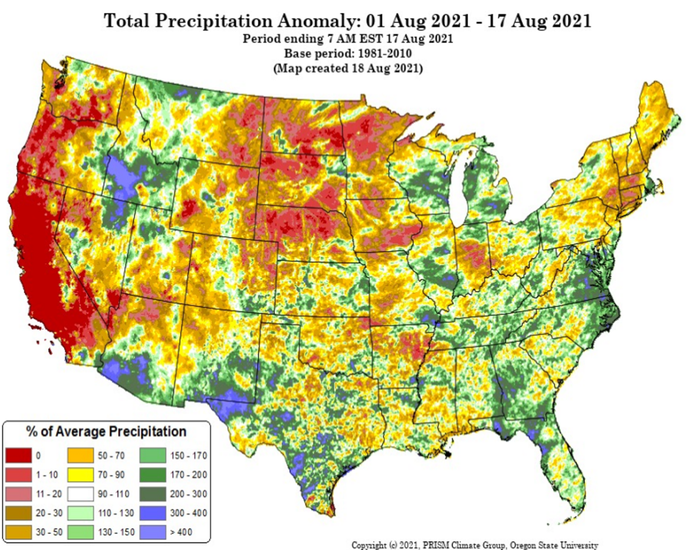

Supplies still unsettled

The supply situation for corn and beans is far from finalized. Much of the country has seen below-average rainfall for the past 30 days, leading to smaller beans in fewer pods. The dryness has affected the corn crop as well. We are seeing smaller ears. In addition to ear size, the corn crop is moving into dent earlier than usual, and when this happens, it tends to lead to a low-quality test weight crop corn, which will negatively impact cash price.

With the mix of potentially bullish, bearish, and Black Swan events that can overtake these markets at a moment's notice, we encourage producers to reevaluate their marketing plans before harvest kicks into full gear. Some might even be surprised at the profit potential they can lock in if they have not run their breakeven recently. This is a great place to employ some risk management if you don't want to sell any cash corn or beans. Placing a put under prices that are $5 per bu. higher for beans and $2 per bu. higher than we saw a year ago isn't a bad strategy by any means. As always, feel free to contact me directly at 815-665-0461 or anyone on the AgMarket.Net team at 844-4AGMRKT. We are here to help.

About the Author(s)

You May Also Like