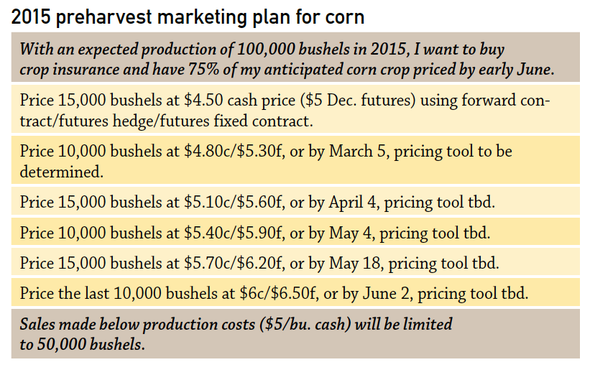

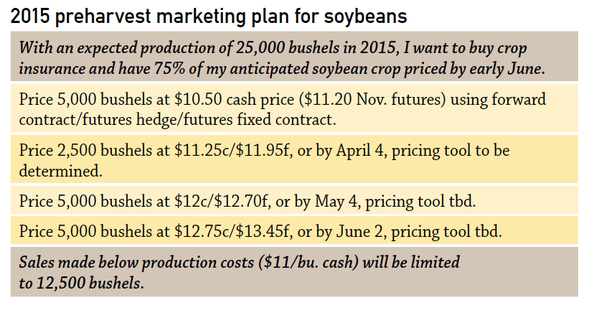

Corn and soybean prices are higher today than they were in early October. However, despite an impressive “dead cat” bounce, prices remain below production costs. Marketing plans are difficult to write when prices are below costs, but write one we must. Here are my pre-harvest marketing plans for 2015.

To write a pre-harvest marketing plan involves the selection of a number of price targets and decision dates. However, the single most important selection is where to establish a minimum price objective – the starting point for pricing grain in 2015.

My minimum price objectives for corn and soybeans are $4.50 and $10.50/bu., cash prices ($5.00 and $11.20/bu. new crop futures prices). I estimate 2015 production costs for corn and soybeans close to $5.00 and $11.00/bu. This is the first time in 14 years that I have written pre-harvest marketing plans with minimum price objectives less than production costs. Why would I be willing to start pricing grain below production costs? Because commodity markets can be cruel and there is no guarantee of profitability. While I would like to maximize profits with selling prices above production costs, in some years we settle for minimizing losses. This year looks like one of those years.

The minimum price is important because it affects decision dates, too. Decision dates are dates when grain is priced, regardless of whether or not a price objective was reached, as long as the price is higher than my minimum price objective. While I am willing to take action below costs, I put a limit on these sales. I don’t want to be caught being overly aggressive in a down market.

Pricing tools are also important. However, tool selection is ultimately a tactical choice based on your opinion of basis, your storage capacity, and your appetite for risk.

New crop pricing opportunities are currently well below my minimum price objectives. Marketing demands patience, and I’m willing to be patient for a little while longer. But don’t be surprised if I elect to lower my minimum prices even further this spring.

A plan to minimize losses? Commodity markets can be cruel.

About the Author(s)

You May Also Like