Thanks to a friendly April 9 USDA report, May corn futures have been able to push higher to the $6 per bu. level. Old crop futures are well supported now that ending stocks for the 2020/21 crop year have been reduced to 1.352 billion bushels, down from 1.5 billion bushels the month prior. All demand aspects on the April USDA supply/demand report for corn were increased. More corn is expected to be used for ethanol, feed, and exports.

This is welcomed, and mostly expected news.

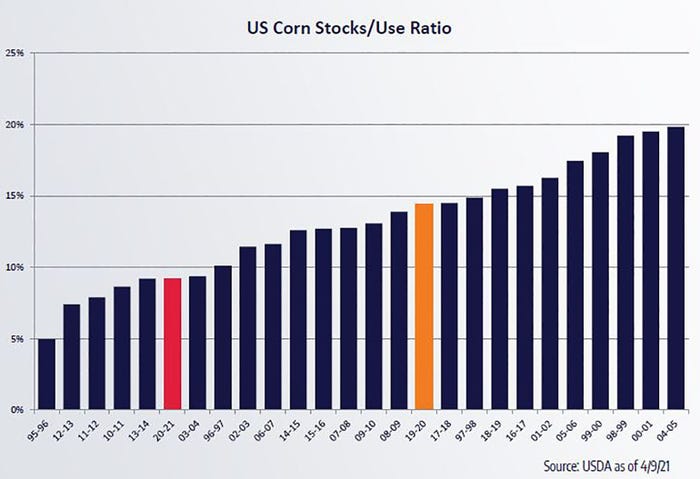

Stocks-to-use ratio

The stocks-to-use ratio is now quite low at 9.2%. The have only been 5 crop years with a tighter stocks-to-use ratio. Those crop years were: 1995-96, 2010-11, 2011-12, 2012-13, and 2013-14. And if you remember in those more recent crop marketing years, the price of corn was extremely high and volatile with a $6.00 to $8.00 price range.

$6 is technical resistance

While the news continues to friendly overall for corn, a note of short term caution is warranted. $6 is a major psychological and technical resistance point on long term monthly charts. It will take additional fresh, friendly news to justify a price move higher than $6 in the short term. Also a lot of cash corn has likely been moved recently ahead of the spring planting season to reward these lofty price levels. With a likely swift planting pace this spring, trade may see a short term price correction in the coming weeks, as there will be little additional bullish news to trade on.

Two steps forward, one step back

Should this price set back occur, the short term down side is to the $5.55 area for May 2021 futures. A pull back like that would keep prices in the overall uptrend. The $5.55 area is important for two reasons, one it is the bottom up the up trending channel on daily charts, and the other is that the 40 and 50 day moving are in that area.

In the big picture, simple corrections like this along the way are healthy for bull markets. Trade will still be sensitive to weather issues going forward from now until pollination, and depending on weather this summer, there could be price fireworks yet to come. However, keep vigilant on cash opportunities in front of you. This $6.00 price level is the highest corn futures prices have been since July of 2013.

Reach Naomi Blohm: 800-334-9779 Twitter: @naomiblohm and [email protected]

Disclaimer: The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Individuals acting on this information are responsible for their own actions. Commodity trading may not be suitable for all recipients of this report. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. No representation is being made that scenario planning, strategy or discipline will guarantee success or profits. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing. Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services, LLC is an insurance agency and an equal opportunity provider. Stewart-Peterson Inc. is a publishing company. A customer may have relationships with all three companies. SP Risk Services LLC and Stewart-Peterson Inc. are wholly owned by Stewart-Peterson Group Inc. unless otherwise noted, services referenced are services of Stewart-Peterson Group Inc. Presented for solicitation.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like