There's just not a lot of fresh or new headlines. Trade talk with China is clearly dominating and directing the soybean market and corn is obviously being tugged around a bit in its wake.

Bears are looking deeper at "demand" and wondering if some of the USDA's current estimates aren't a bit too overly optimistic? There was a good sale announced to South Korea, but weekly export inspections were again somewhat of a disappointment. Negative ethanol headlines are also making some wonder about corn used for ethanol demand?

From a technical perspective, the DEC18 contract hasn't closed sub-$3.60 since late-September. The MAR19 contract hasn't closed sub-$3.70 since late-September. Both contracts are extremely close to breaking nearby support, so be paying close attention.

As a spec, I've been waiting for another leg lower to start building a longer-term bullish position. It looks like I might soon get my opportunity. It will be interesting to see if we can hold the lower end of nearby chart support.

Clearly, we need some help from the macro market headlines i.e. improved global economic growth outlook, or some type of positive confirmation involving Chinese trade negotiations. A bullish wild-card could obviously be South American weather, but as of right now the trade doesn't seem to be paying that much attention, and there's really nothing to get the bulls overly excited.

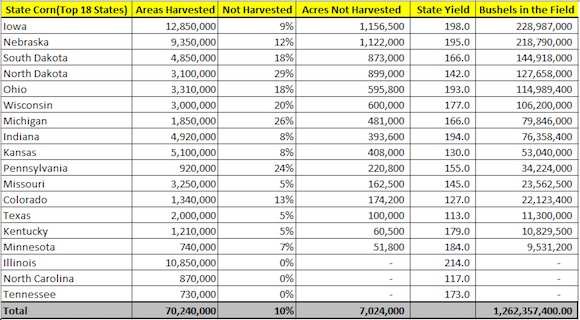

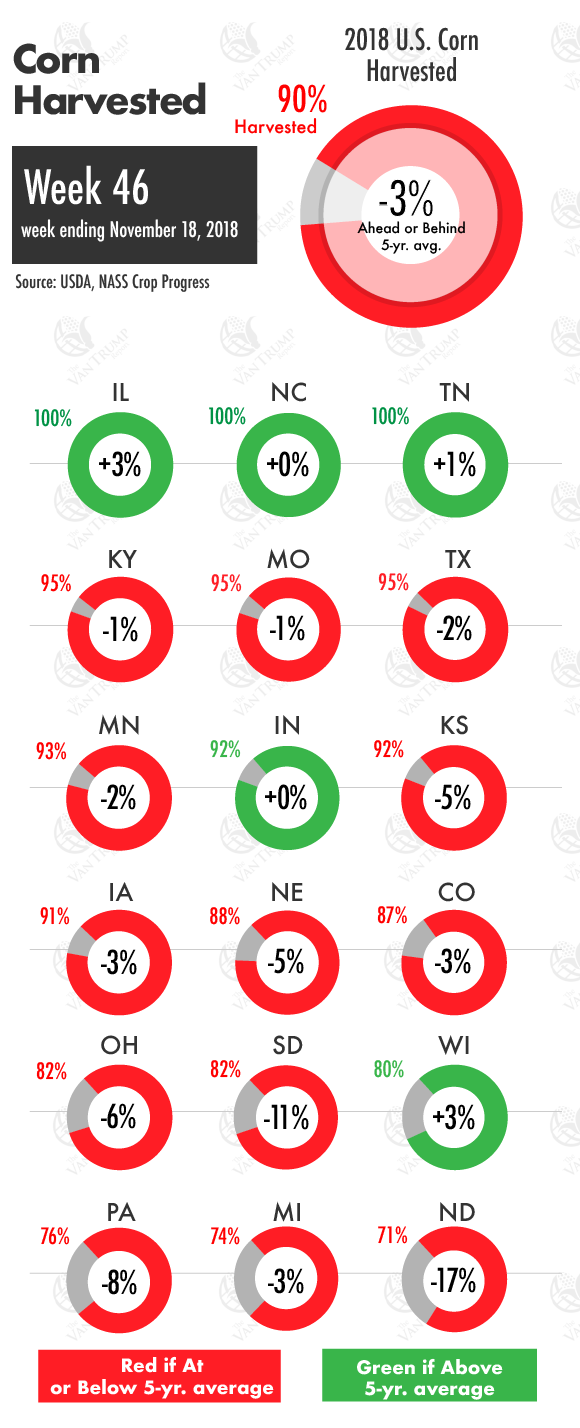

Here at home, the USDA is now estimating the U.S. corn harvest at 90% complete which is -3% below the 5-year average and a bit less than most in the trade were expecting to see. The only states running ahead of schedule include: Illinois which is 100% complete and +3% ahead of historical pace; Tennessee and Wisconsin are slightly ahead of schedule. Indiana and North Carolina are running right on schedule. States the furthest behind their traditional pace include: North Carolina -17% behind with 71% now complete; South Dakota -11% behind with 82% now complete; Pennsylvania -8%, Ohio -6%, Kansas and Nebraska -5%, Colorado, Iowa and Michigan -3%, Minnesota and Texas -2%, Kentucky and Missouri -1%.

For a 30-day free trial to my daily report click HERE

The opinions of the author are not necessarily those of Corn+Soybean Digest or Farm Progress.

About the Author(s)

You May Also Like