Corn continues to struggle and fight to stay alive in what appears to be fundamentally bearish quicksand. Many insiders are thinking domestic ending stocks could eventually push north of 2.5 billion bushels and at the same time several sources are forecasting U.S. planted corn acres will push higher in 2018.

Prices currently remain just a hair above the recent all-time contract lows. I know there were a lot of analysts projecting that the low was in place back in late-August, but I wasn't a believer then and I'm still not a believer today, thinking there's yet another leg lower, especially while South American weather stays cooperative. If there is any bright spot, I guess I could argue that the "basis" in several parts of the country has improved a bit on the lack of producers wanting to trade corn for cash at new contract lows.

There's also the thought that with the funds now holding near record short positions the downside might be fairly limited. I'm a little bit apprehensive in buying that argument, as I've personally been on the wrong side of several markets in my life that I thought could no way continue doing what they were doing...Those were very costly lessons to learn and the scars are somewhat deep. Bottom-line, I think we still grind sideways to lower. I always remind myself of Newton's first law, "an object in motion tends to stay in motion with the same speed and in the same direction unless acted upon by an unbalanced force."

As of right now, I'm just not seeing that so-called "unbalanced force". Yes, South American weather complications could ultimately provide that influence, but that doesn't appear to be the case at this juncture. Here at home, the USDA reported the U.S. harvest is now 83% complete vs. 91% last year. I personally thought we would be closer to 85% complete, but the trade overall was thinking 83% so no there doesn't really seem to be much worry.

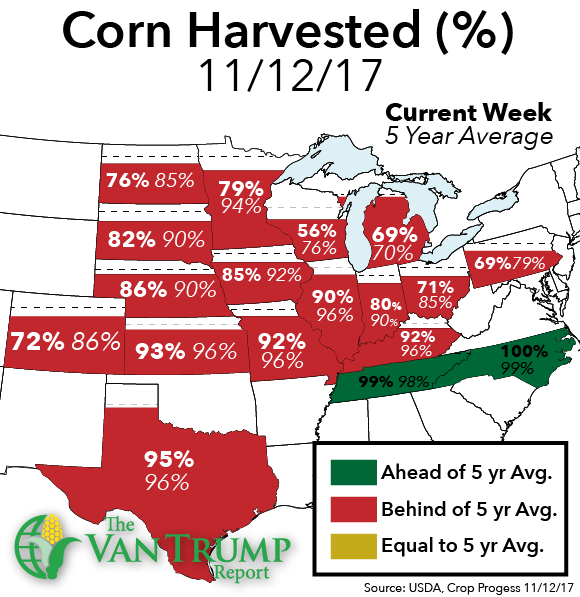

Below are some of the state-by-state specifics:

State-by-State Corn Harvest Numbers

Wisconsin (-20% behind) +19% to 56% harvested vs. 5-year average of 76%

Minnesota (-15% behind) +19% to 79% harvested vs. 5-year average of 94%

Colorado (-14% behind) +22% to 72% harvested vs. 5-year average of 86%

Ohio (-14% behind) +11% to 71% harvested vs. 5-year average of 85%

Indiana (-10% behind) +10% to 80% harvested vs. 5-year average of 90%

Pennsylvania (-10% behind) +11% to 69% harvested vs. 5-year average of 79%

North Dakota (-9% behind) +11% to 76% harvested vs. 5-year average of 85%

South Dakota (-8% behind) +21% to 82% harvested vs. 5-year average of 90%

Iowa (-7% behind) +18% to 85% harvested vs. 5-year average of 92%

Illinois (-6%) +7% to 90% harvested vs. 5-year average of 96%

Kentucky (-4%) +2% to 92% harvested vs. 5-year average of 96%

Missouri (-4%) +5% to 92% harvested vs. 5-year average of 96%

Nebraska (-4%) +18% to 86% harvested vs. 5-year average of 90%

Kansas (-3%) +5% to 93% harvested vs. 5-year average of 96%

Michigan (-1%) +12% to 57% harvested vs. 5-year average of 70%

Texas (-1% ) +3% to 95% harvested vs. 5-year average of 96%

North Carolina (+1% ahead) +2% to 100% harvested vs. 5-year average of 99%

Tennessee (+1% ahead) +1% to 99% harvested vs. 5-year average of 98%

About the Author(s)

You May Also Like