Soybean prices are higher this morning, but are still down -35 cents from last weeks highs. The bears are talking about possibly improved weather conditions in the U.S. and a somewhat disappointing NOPA crush report. There seems to be a bit more rain in the nearby forecast for some areas the trade has been keeping a close eye on.

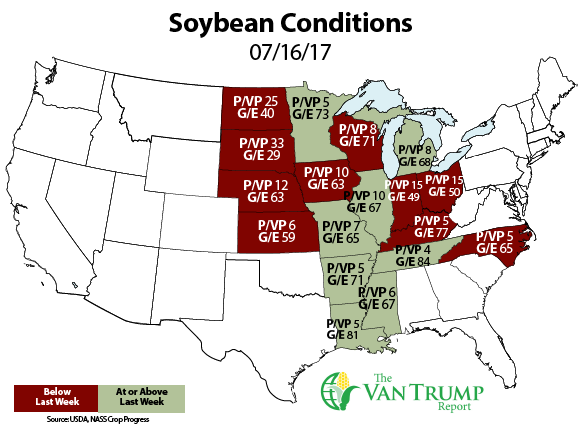

The NOPA crush data for June came in short of expectations, just north of 138 million bushels, which was down from 149.2 million last month and down from 145 million a year ago. Bottom-line, this means the bears can argue the USDA's current crush estimate might be over estimated by 10 to 20 million bushels. On the flip side, bulls argue that weekly crop-conditions now show the U.S. crop rated at just 61% "Good-to-Excellent," down -1% compared to last week and down -10% compared to last year.

Data shows 52% of U.S. soybeans are blooming, up from 34% last week and slightly ahead of the 5-year average at 51%. We also learned that 16% of U.S. soybeans are now "setting pods" vs. 7% last week vs. the 5-year average of 13%. From a technical perspective, it still feels like nearby support in the NOV17 contract is somewhere in the $9.60 to $9.80 range. Last Tuesday's high at $10.47 now becomes major upside resistance. Similar to corn, I believe the crop is overstated. As both a producer and a spec I remain cautious and on the sideline while the trade tries to find nearby direction.

It's early and the trade seems as if it can still argue either side...bulls arguing weather and bears arguing record South American supply and perhaps a slowdown in U.S. demand. Below are some specifics regarding current corn crop- conditions and comparisons to last week and last year.

GET ALL MY DAILY GRAIN THOUGHTS HERE.

States where conditions improved last week

Michigan improved +3% to 68% vs 60% last year

Missouri improved +3% to 65% vs 67% last year

Tennessee improved +3% to 84% vs 76% last year

Louisiana improved +2% to 81% vs 74% last year

Mississippi improved +2% to 67% vs 67% last year

Arkansas improved +1% to 71% vs 56% last year

Illinois improved +1% to 67% vs 76% last year

States where conditions deteriorated last week

North Dakota lowered -7% to 40% vs 72% last year

Kansas lowered -5% to 59% vs. 60% last year

South Dakota lowered -5% to 29% vs 66% last year

Iowa lowered -4% to 63% vs 80% last year

North Carolina lowered -4% to 75% vs 71% last year

Nebraska lowered -3% to 63% vs 77% last year

Ohio lowered -3% to 50% vs 66% last year

Wisconsin lowered -3% to 71% vs 85% last year

Indiana lowered -1% to 49% vs 72% last year

Kentucky lowered -1% to 77% vs 70% last year

Minnesota lowered -1% to 72% vs 78% last year

About the Author(s)

You May Also Like