USDA’s cuts to Ukraine and Russian export supplies in today’s World Agricultural Supply and Demand Estimates (WASDE) report were partially offset by rapid export paces from India and Australia. In the corn market, U.S. export and ethanol forecasts soared, alleviated some short-term concerns about global corn availability. Larger than expected cuts to the Brazilian soybean crop also continued early morning gains for the soybean market.

“The market received enough reassurance from today’s USDA reports to at the very least, take some time to breathe,” according to Farm Futures grain market analyst Jacqueline Holland. “While wheat futures continued their limit-down descent, markets appeared to take some comfort in a more stable view of realigned trade flows amid the Russian-Ukrainian conflict.”

Corn

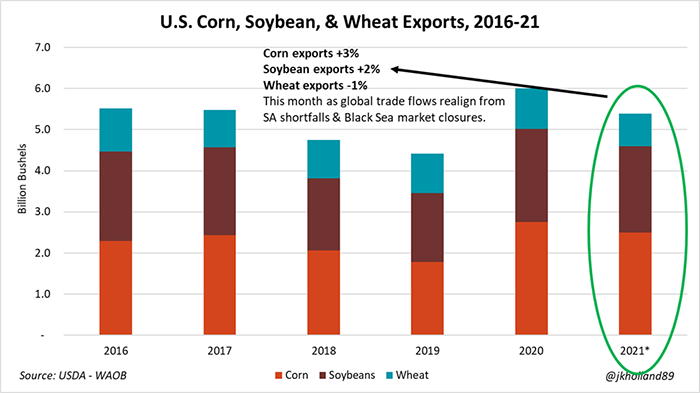

USDA served up some bullish data for corn after citing “increased food, seed, and industrial use, larger exports, and smaller stocks relative to last month.” Ethanol usage improved 25 million bushels to 5.350 billion. Exports also moved 75 million bushels higher, to 2.500 billion in the wake of sharply lower exports from Ukraine. The season-average farm price firmed 20 cents to reach $5.65 per bushel.

Consequently, U.S. corn ending stocks dropped from 1.540 billion bushels in February down to 1.440 billion bushels this month. That was lower than analysts had anticipated, offering an average trade guess of 1.479 billion bushels prior to today’s report.

“A 135-million bushel increase in 2021/22 U.S. corn export paces could not stop losses in the corn futures market following the report’s release,” Holland says. “It signals that the short-term trade flow will be somewhat adequate enough to compensate for depleted South American corn crops and inaccessible Black Sea supplies.”

Global production moved 59 million bushels above last month’s estimate. Overseas production is “modestly higher” after USDA noted increases for India and Russia that are partially offset by reductions for Argentina and South Africa. Global ending stocks declined slightly to 11.849 billion bushels.

Holland points out that USDA left 2021/22 Brazilian corn production estimates unchanged at 4.49 billion bushels while only slashing a mere 39 million bushels of production from the Argentine crop, now forecast at 2.09 billion bushels for the season.

“But with planting for Brazil’s safrinha (second crop) corn underway amid a La Niña weather pattern this year, there is still more potential for future cuts to South American exportable corn supplies,” Holland says. “Recent rains have helped coax along crop development, but time will be the deciding factor if Brazil and Argentina can be reliable global suppliers of corn in the coming months.”

Meanwhile, Holland says the U.S. will likely be the chief beneficiary of realigned trade flows with the largest current stockpile on the market until harvest begins in Argentina later this month. The combination of high fuel prices and Black Sea market closures mean that $7/bushel old crop corn prices are likely here to stay, she says.

Soybeans

For soybeans, USDA anticipates higher exports and lower ending stocks versus a month ago. Export estimates improved 40 million bushels to 2.09 billion. And ending stocks declined by an equal amount, landing at 285 million bushels. Analysts were expecting an even bigger drop, with an average trade guess of 278 million.

“Soybean futures continued the early morning’s modest rally, rising between $0.01-$0.10/bushel after USDA cut 257 million bushels from Brazil’s 2021/22 crop, leaving it at 4.67 billion bushels – Brazil’s smallest crop since 2018/19,” Holland says. “It was a much steeper cut than the market had originally been expecting as pre-report trade estimates averaged 4.74 billion bushels.”

Season-average prices for the entire soybean matrix saw increases from a month ago. Soybean prices improved 25 cents to $13.25 per bushel. Soymeal prices increased 10 dollars per short ton to reach $420. And soyoil prices firmed 2 cents to 68.0 cents per pound.

As for global demand, USDA reports “lower production, crush, exports and stocks.” Of particular note, Brazil’s production estimates plummeted 257 million bushels lower to 4.666 billion bushels. Total global stocks fell from 3.411 billion bushels in February down to 3.305 billion bushels.

“USDA cut a combined 356 million bushels of 2021/22 soybean production from Brazil, Argentina, and Paraguay in today’s report from February 2022 estimates,” Holland says. “That represents a 5% decrease from February 2022 South American production volumes. Just to quantify the scale of the South American crop losses, since early December 2021, nearly 1.04 billion bushels of combined Brazilian, Argentine, and Paraguayan soybean production for the 2021/22 has been erased – a 13.6% loss in three months.”

Farm Futures rarely discusses sunflower oil production in our WASDE coverage, but the situation in Ukraine makes it worth mentioning today. Ukraine is a major exporter of sunflower oil, and USDA expects major impacts to markets such as India and the European Union. “Lower sunflower product supplies in these markets are partly offset by higher [soyoil] imports for India and rapeseed imports for the EU,” USDA adds.

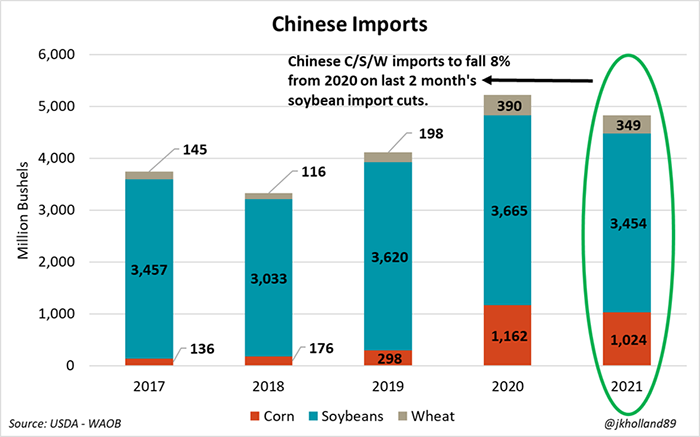

High soybean prices are likely to keep the U.S. domestic soybean processing industry from further expanding capacity in the coming months, Holland notes. But the tight global supply dynamic means that many global buyers – namely China – are likely to turn to the U.S. for what supplies are left from the 2021 crop, she says.

Wheat

USDA’s latest outlook for wheat includes “lower supplies, unchanged domestic use, reduced exports, and higher ending stocks. Exports slid 10 million bushels lower to 800 million, due to lower-than-expected sales of hard and soft red winter wheat. Ending stocks inched 5 million bushels higher to 653 million, versus analyst estimates of 628 million. Still, stocks remain 23% lower year-over-year for now.

The season-average farm price firmed 20 cents to $7.50 per bushel. That may seem low after looking at the recent price run-up, but USDA notes: “Despite the recent sharp increases in futures and cash prices, a significant majority of U.S. wheat has already been marketed this MY, limiting the SAFP increase.”

World ending stocks also moved higher, trending from 10.221 billion bushels in February up to 10.343 billion. Analysts were predicting a modest decline, with an average trade guess of 10.199 billion bushels.

“India and Australia are poised to partially offset 257 million bushels of exports from Russia and Ukraine, according to the latest World Agricultural Supply and Demand Estimates (WASDE) report from USDA issued this morning,” Holland notes. “The revision kept wheat prices down the daily limit ($0.85/bushel for Kansas City and Chicago contracts, $0.60/bushel for Minneapolis contracts) as the Black Sea conflict continues to be the prevailing force for global wheat markets.”

Top global wheat buyers North Africa and the Middle East are expected to be the most sensitive to high wheat prices, with USDA slashing nearly 2% of the regions’ collective wheat imports for the year, Holland adds.

“Markets saw real-time evidence of this dynamic after Tunisia did not accept any offers on a tender yesterday, citing too high prices,” she says.

Also, USDA did not add any additional wheat exporting volumes to this year’s top wheat shipper, the European Union. An aggressive early export season means that the E.U. will be less likely than India and Australia to step in and fulfil global wheat purchase contracts.

“More importantly, it somewhat eased market concerns about wheat availability – at least for the short term,” Holland says. “Even if global buyers do not turn to the U.S. for additional wheat supplies as indicated in today’s report, the global wheat pipeline is expected to remain liquid enough to meet supply needs until harvest begins in the Northern Hemisphere.”

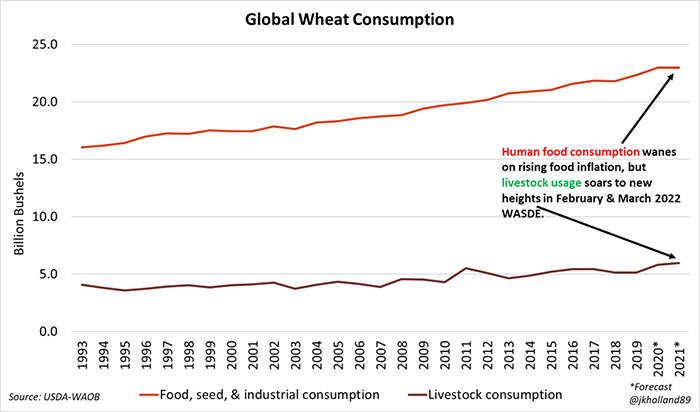

But Holland also notes that high prices are likely going to price out human consumer of food before livestock. For a second straight month, USDA cut global food consumption estimates for wheat but this time by a staggering 82.7 million bushels to 23.0 billion bushels for 2021/22. Much of that cut went to increased livestock feedings as global alternative livestock feed costs remain high.

Read more about:

WASDEAbout the Author(s)

You May Also Like