Soybean prices are up almost +50 cents from the mid-August lows despite the fact most inside the trade have increased their U.S. yield forecast and producers here at home are in the process of harvesting yet another record crop. Bear's point to the fact the U.S. yield is much closer to 50 bushels per acre than it is the sub-47 bushels the bulls where talking about just a few weeks ago.

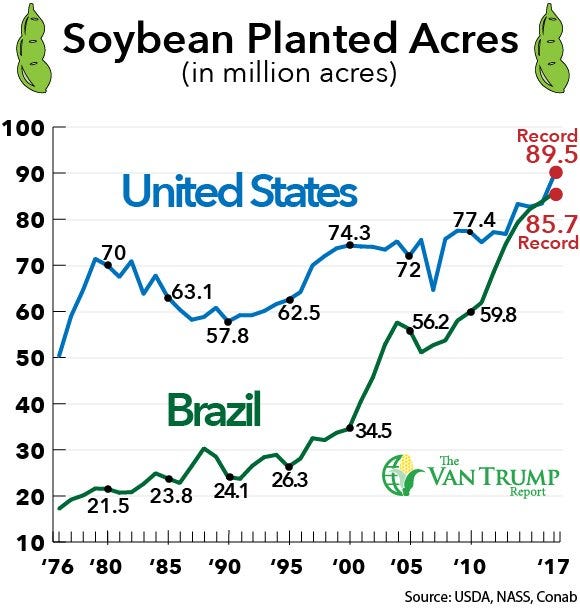

In fact, I heard yesterday that Informa pushed their latest yield estimate to 50.0 bushels per acre on a record number of planted acres. Bulls are saying global demand is so strong that we needed to produce another record crop and that the pressure of another record will now be passed to South America. If they run into any type of widespread production hiccup then additional price-risk will need to be added as the world needs record production.

There's also a bit of nearby strength on thoughts we could see surging Chinese buying next week once they return from vacation, and that the U.S. forecasts could continue to slow harvest, ultimately putting a larger portion of the U.S. crop in harms way. There also seems to be a bit more pushback in regard to the EPA entertaining comments about reductions to the current biofuel mandates.

As a producer I'm keeping a close eye on the JAN18 contract which is approaching $10.00 per bushel. As a spec, I'm on the sideline scratching my head a bit, as I'm not really certain what music the market is dancing too. I'm also not real certain right now what the trade deems to be "noise" and what headlines are being heard as "music."

Tough to dance when you can't pickup the rhythm...

Get more from Van Trump's daily blog here.

About the Author(s)

You May Also Like