Grain futures are mixed this morning with selling noted in corn after bearish old and new crop ending stocks forecasts put out by USDA this morning in the agency’s monthly World Agricultural Supply and Demand Estimates (WASDE) report. Grain prices were mixed but mostly higher immediately following the report.

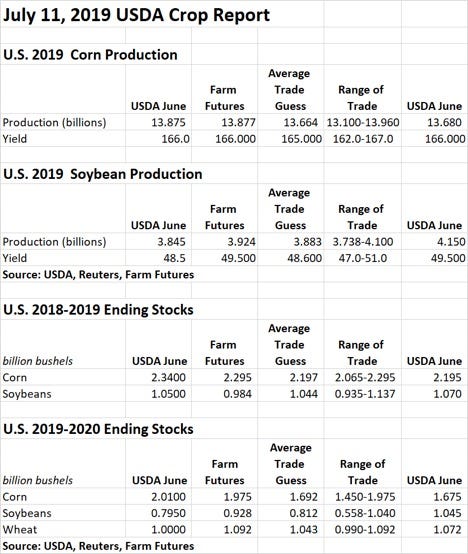

USDA is now pegging the 2019 U.S. corn crop at 13.875 billion bushels, slightly ahead of the agency’s June tally of 13.680 billion bushels. Analysts were expecting a small decline to 13.664 billion bushels, with Farm Futures contributing a nearly on-the-nose guess of 13.877 billion bushels. Average yields remain unchanged, at 166.0 bushels per acre.

“USDA did what I expected with its corn production estimate, which caught some in the trade off-guard,” says Farm Futures senior grain market analyst Bryce Knorr. “But after making a yield reduction in June there was no statistically significant basis for further cuts in July. I had the most bearish old and new crop carryout estimates coming into the report, and my updated forecast for 2018 corn carryout put out this week was right in line with what USDA published today.”

Higher prices are rationing demand, Knorr says, but that doesn’t mean the market won’t be able to rally.

“Indeed, today’s updated ENSO forecast showing and end to the El Niño may be the most significant news out today,” he says. “It increases potential for yield variability compared to what could be expected if El Niño continued. That doesn’t mean lower yields, but the hotter and somewhat drier pattern emerging could be significant for both corn and soybeans.”

For soybeans, USDA made moderate cuts, moving production estimates from 4.150 billion bushels in June down to 3.845 billion bushels. Analysts were predicting the agency would shift production to 3.883 billion bushels. Average yield potential declined to 48.5 bushels per acre.

“The big surprise in today’s report is for soybeans, with USDA knocking a bushel per acre off its yield projection,” Knorr says. “Coupled with lower acreage reported June 28 that reduced production even more than I expected.”

Even so, the government’s forecast for 2019 crop carryout is only about 50 million bushels less than the updated supply and demand table Farm Futures published earlier this week after estimates were collected by wire services, Knorr adds.

“The new USDA outlook isn’t out of the question, though acreage as well as yields are very much up in the air due to the unusual growing season,” he says. “Export demand is also a guess, because no one knows how the trade dispute with China will play out or how many soybeans they’ll even need to import this year due to the lingering effects of African Swine Fever.”

The bottom line for soybean growers will be patience, Knorr concludes.

“With prices at unprofitable levels, now is no time to be selling, especially with yields so uncertain,” he says.

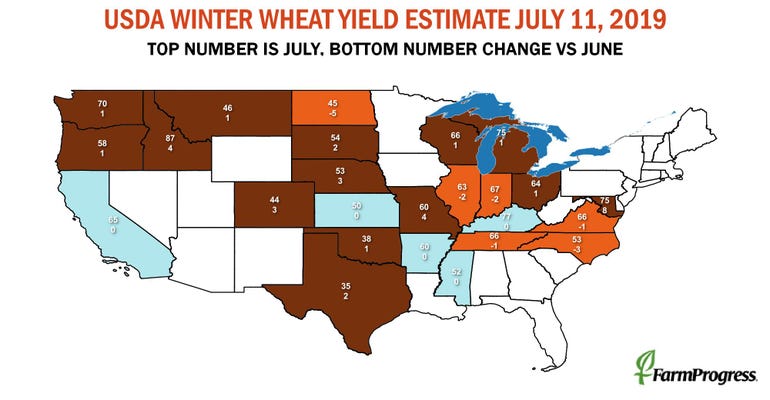

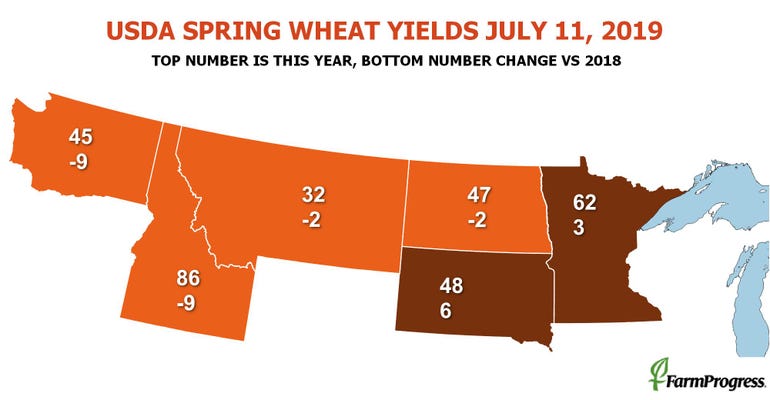

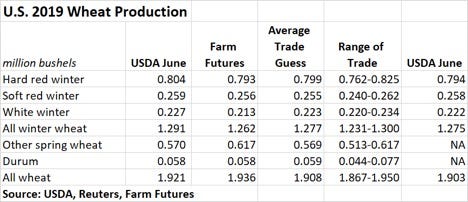

Anchored by an increase in winter wheat, USDA revised its all-wheat production estimates from 1.903 billion bushels in June to 1.921 billion bushels in this month’s WASDE report. Analysts were expecting a more modest incline to 1.908 billion bushels.

“USDA’s forecasts for wheat should be supportive, but the agency’s hopes for export sales may be too optimistic,” Knorr says. “Time will tell if global production is down enough to make a difference. The end to El Niño could play a role here too. Neutral El Niño readings are associated with lower production in both Europe and Argentina, where a dry pattern appears to be emerging.”

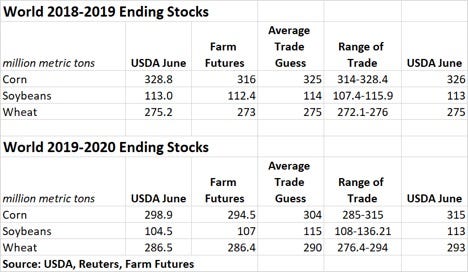

Corn ending stocks for 2018/19 moved from 2.195 billion bushels last month to 2.340 billion bushels. Analysts were expecting a smaller shift to 2.197 billion bushels, however. Soybean ending stocks declined slightly, from 1.070 billion bushels down to 1.050 billion bushels, mostly in line with the average trade guess of 1.044 billion bushels.

USDA offered a mixed set of data for 2019/20 grain ending stocks. Corn stocks moved moderately higher, from 1.675 billion bushels a month ago up to 2.010 billion bushels, bucking trade estimates of 1.692 billion bushels. Soybean stocks declined moderately, meantime, from 1.045 billion bushels last month down to 795 million bushels. That was mostly in line with trade expectations of 812 million bushels. And wheat ending stocks saw a small decline from 1.072 billion bushels down to 1.000 billion bushels.

In South America, USDA is still predicting massive grain yields this year. Brazil’s 2018/19 soybean production estimates are for 4.299 billion bushels, with corn production expected to top 3.976 billion bushels. In Argentina, soybean production could reach 2.058 billion bushels, with the country’s corn crop expected to top 2.088 billion bushels.

Worldwide, corn ending stocks for 2019/20 are now at 298.92 million metric tons, which is moderately higher than analyst estimates of 292.48 MMT. Soybean ending stocks, in contrast, were lower than analyst estimates of 109.17 MMT after USDA updated its number to 104.53 MMT. Wheat ending stocks are also moderately below trade estimates of 292.43 MMT after USDA reported them at 286.46 MMT.

About the Author(s)

You May Also Like