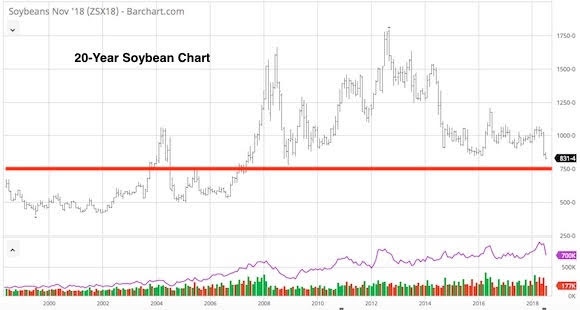

Soybeans are able to rally back a bit following yesterdays updated USDA data. The numbers themselves were initially viewed as bearish, but as I suspected, a short-covering rally gave the market a bit of a lift. I'm just not sure there will be enough "short-covering" to keep prices moving higher for an extended period.

Here at home, the USDA showed old-crop ending stocks were lowered from 505 million down to 465 million bushels. As both "crush" and "export" demand were raised higher. The bad news is, new-crop ending stocks jumped from 385 million to 580 million. The two biggest headwinds were the fact new-crop "exports" were lowered by -250 million as the USDA considers trade tariffs into their equation.

The other headwind is that "harvested acres" jumped from 88.2 to 88.9 million. Globally, Brazil soybean production was bumped higher to a new record of 119.5 MMTs. Brazils new-crop estimate jumped from 118.0 MMTs to 120.5 MMTs. Argentine soybean production for next year raised from 56 to 57 MMTs. Keep in mind their production this past year was only 33 MMTs.

World soybean production for new-crop was raised from 355.24 MMTs to 359.49 MMTs. Interestingly, total global 2018/19 oilseed production was forecast down -1.4 million tons to 592.6 million on lower rapeseed and sunflower production. Rapeseed production is reduced -2.6 million tons with lower production for the EU, Australia, Ukraine, and Russia. Rapeseed production was also lowered for Germany and the UK on persistent dryness while production is lowered for France on pest pressure.

Sunflower seed production is down -2.9 million tons mainly for Russia and Ukraine on lower yields from dry conditions.

Bottom-line, the bulls can't be too overly excited to see U.S. new-crop ending stocks forecast at 580 million bushels with the soybean yields staying "unchanged" at 48.5 bushels per acre. Bears believe the U.S. average yield should be higher, closer to 50 bushels per acre. Which means, if all things stay equal with demand, we would be adding +130 million bushels to production and ultimately ending stocks. I can't imagine bulls wanting to run aggressively into a +700 million bushel ending stock number.

As both a producer and a spec I remain extremely patient.

About the Author(s)

You May Also Like