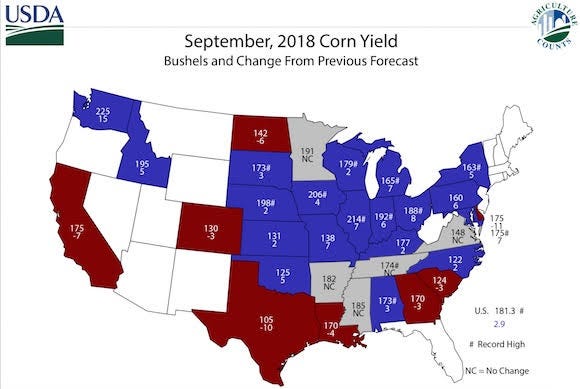

Corn bulls are scratching their head as the USDA catches the trade by surprise, raising their record August yield estimate of 178.4, even higher to 181.3 bushels per acre. In the stroke of a pen or tap on the keyboard this added another +241 million bushels to total U.S. production, which is now forecast at 14.827 billion bushels. Among the major producing states where yields are forecast to be record high are: Illinois, Iowa, Nebraska, Indiana, Ohio, and South Dakota.

If there was good news to digest, again it all came from "demand". Feed and Residual was raised higher by +50 million bushels; Exports also raised higher by +50 million bushels; Ethanol raised higher by +25 million bushels. Unfortunately, the jump in demand just isn't enough to offset the jump in yield, hence, total ending stocks are raised higher by +90 million bushels to 1.774 billion.

Foreign corn production is also forecast higher than last month with projected increases for the EU, Angola, Paraguay, Turkey, and Serbia more than offsetting declines for Canada, South Africa, and Guatemala. Corn exports for 2018/19 are raised for Ukraine, Serbia, and Paraguay, but lowered for Canada and South Africa. Global corn stocks, at 157.0 million tons, are up +1.5 million from last month. The season-average corn price received by producers is now projected -10 cents lower with a midpoint of $3.50 per bushel.

As I mentioned the past several days, I just couldn't get my head around the majority of the trade looking for a reduction in yield, especially considering how big of step the USDA took in August to bump it higher. Just didn't make sense that they would immediately backpedal with fairly cooperative weather in play. From a technical perspective, the bears believe the market is eyeing the contract low at $3.50^2 posted back on July 12th.

As both a producer and a spec, I continue to believe it's only a matter of time before we post another leg lower, perhaps a break into the $3.30's. Yesterday actually marked our lowest close at $3.52^4. Bulls argue that this has to be the highest yield estimate of the year and from here the USDA can only reduce their estimate, there's no way they can raise it higher.

I understand the frustration, but I learned many years ago to never say never and that anything is always possible. Staying extremely patient, targeting late-2018 or early-2019 as next marketing window. Thinking sideways trade action in a narrow range though harvest, often this can mean a slow bleed lower...

The opinions of the author are not necessarily those of Corn+Soybean Digest or Farm Progress.

About the Author(s)

You May Also Like