Updated

Soybean futures soared after USDA cut 2020/21 ending stocks to a mere 290 million bushels on tightened ending stocks and increasing exports – 170 million bushels lower than the agency’s September 2020 estimate. Yield estimates were largely unchanged this month, despite analyst expectations of significantly reduced production forecasts. Global soy stocks also fell on decreased South American production estimates.

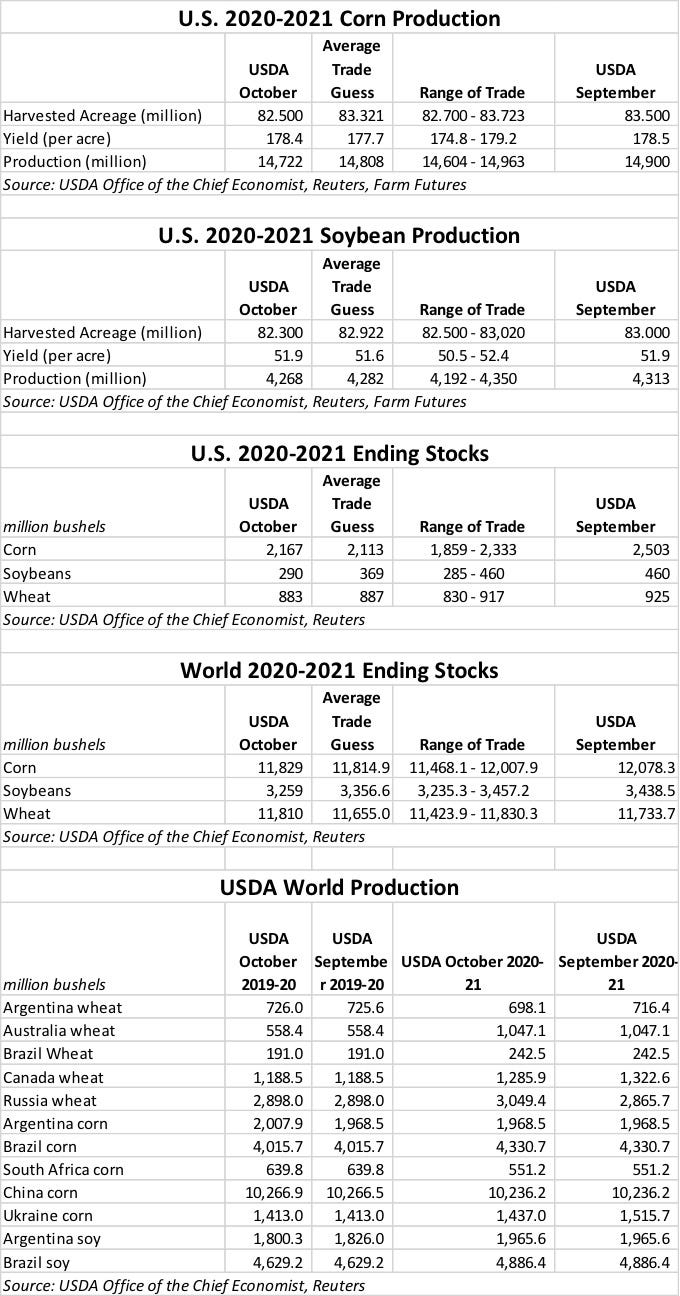

USDA estimates that 2020 soybean production potential is now at 4.268 billion bushels, which is 45 million bushels lower than September estimates based on lower harvested area. The agency trimmed 700,000 acres from its harvested acreage estimates to 82.3 million acres, noting reductions in Kansas and the Dakotas. Nationwide yields held steady, at 51.9 bushels per acre.

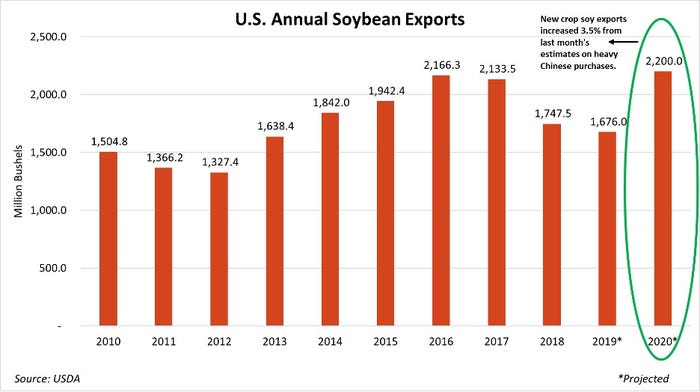

A record pace for 2020/21 sales so far had USDA raise its export forecast sales by 75 million bushels, meantime. Based on the current trend of smaller supplies and higher exports, USDA boosted its season-average farm price 55 cents to $9.80 per bushel.

“Increases to U.S. soybean export forecasts drove demand for U.S. soybeans to record highs,” says Farm Futures grain market analyst Jacquie Holland. “At 2.2 billion bushels, 2020/21 soy export demand will be the largest on record, if realized. Combined with shrinking yield projections due to dry weather in South America, farmers could pick up more export soy business next spring when the South American crop traditionally dominates export channels.”

A 36.7-million-bushel increase to Chinese soy imports helped the cause for U.S. soy growers, Holland notes. Chinese soy imports in 2020/21 will now top 3.674 billion bushels. Also supporting U.S. prices was an 18-million-bushel decrease in Argentine soybean exports expected next spring, she says.

“USDA cut Argentina’s new crop soy estimate by 79 million bushels to 1.97 billion bushels, supporting prospects for U.S. soy exports,” Holland says. “Argentina is the world’s third largest exporter of soybeans.”

World ending stocks dropped more than analysts anticipated, moving from 3.439 billion bushels in September down to 3.259 billion bushels this month, based largely on lower domestic stocks and an uptick in foreign use.

For corn, USDA revised domestic production down another 178 million bushels, due to lower harvested area and a modest decline in average yields, now at 178.4 bushels per acre. That puts the agency’s current production estimates at 14.722 billion bushels.

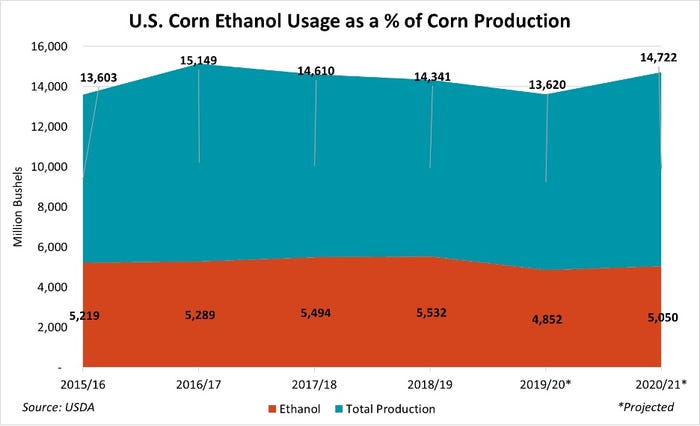

USDA lowered its estimates for corn used for ethanol by another 50 million bushels after assessing the latest U.S. Energy Information Administration data. The agency also dropped its projected feed and residual use by 50 million bushels. In total, ending stocks fell by 336 million bushels. USDA also raised the season-average farm price by 10 cents to $3.60 per bushel, given recent price gains.

“Corn demand for ethanol continues to struggle as fuel demand remains muted amid the pandemic,” Holland notes. “Weekly stocks saw a bump this week as more schools resumed in-person instruction around the country, which could help the energy outlook in the months to come.”

But old crop ethanol demand was 9.8% lower than 2018/19 levels, Holland adds. A 50-million-bushel cut to 2020/21 corn demand for ethanol hints at USDA’s increasingly pessimistic outlook on fuel demand next year as the pandemic continues to halt normal traffic flows, she says.

U.S. ending stocks for corn fell from 2.503 billion bushels in September down to 2.167 billion bushels this month. Analysts generally expected a larger decline, with an average trade guess of 2.113 billion bushels. World ending stocks were also down, falling from 12.078 billion bushels in September down to 11.829 billion bushels. Analysts expected to see steeper cuts, with an average trade guess of 11.815 billion bushels.

USDA’s latest outlook for wheat noted “reduced supplies, higher domestic use, unchanged exports and lower ending stocks.” Domestic stocks dropped another 32 million bushels to 883 million bushels. Analyst estimates were nearly on the mark with this number, with an average trade guess of 887 million bushels. Still, domestic stocks have fallen to a six-year low.

Given the recent rally in wheat prices, USDA raised the season-average farm price another 20 cents to $4.70 per bushel.

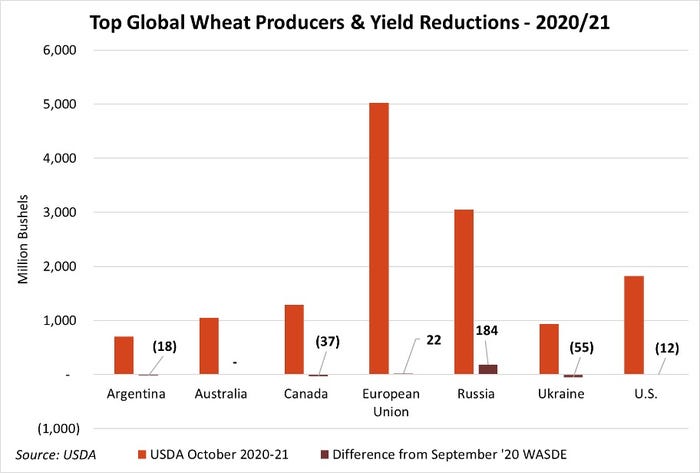

The latest global wheat outlook assumes larger supplies, increased consumption, improved exports and higher stocks. An increase in Russian production more than offsets reductions in other areas, including Argentina, Canada, Ukraine and the U.S. That leaves world ending stocks moving from 11.734 billion bushels in September up to 11.810 billion bushels. Analysts expected a modest decline, in contrast, with an average trade guess of 11.655 billion bushels.

“Dry weather across the globe due in large part to a La Niña weather event this fall led USDA to cut production estimates for 2020/21 wheat production,” Holland says. “But global stocks bucked analyst estimates to climb to new record highs on upward production revisions to the Russian and European Union wheat crop.”

Click here to read the entire October WASDE report from USDA.

About the Author(s)

You May Also Like