Soybean traders have watched the bottom fall out of meal prices this week as bids around the country start to dry up. As I suspected, the basis is many locations has really started to widen. I've heard some friends and clients reporting a -$1.70 under is the best they can get now in parts of South Dakota.

The flat-price in the soybean market has fallen by over -40 cents this week, while some areas have also seen a -20 cent hit to the basis. Technical traders are wondering if psychological support at $8.50 can hold or will the market prefer to re-test the July low down at $8.26^2? Below that level we start to move into uncharted waters, with most technical guru's throwing darts at a possible $7.77 number.

Bears continue to point to the fact the U.S. yield might get larger and in turn the balance sheet widen towards a massive 1.0 billion bushel carry. Where do prices trade if that plays itself out? I don't think anyone truly knows. The recent rounds of cooperative rains and seasonal temps certainly makes the trade wonder if a yield north of +52 bushels per acre is coming our direction.

With little news or positive headlines surrounding Chinese trade negations, this makes the trade nervous that the balance sheet could continue to expand nearby. We have to also keep in mind, the Brazilian currency has tumbled to multi-month lows against the U.S. dollar and is doing very little to help attract any macro bulls. I also continue to hear more talk of increasing soybean acres in Brazil. Bottom-line, it's just wave after wave of bearish headlines right now.

We don't have a weather story of any sort. The funds clearly don't have any macro interest with the strength of the U.S. dollar, the Chinese trade uncertainties, and the doubts surrounding global economic growth. We can argue that we have a nearby "demand" story, but a few months out it certainly is up for debate. As a producer, I remain patient and hope to see better pricing opportunities in early-October to early-November.

As a spec, I am becoming more interested in a longer-term bullish position. But still see no reason to be in a hurry to be a buyer.

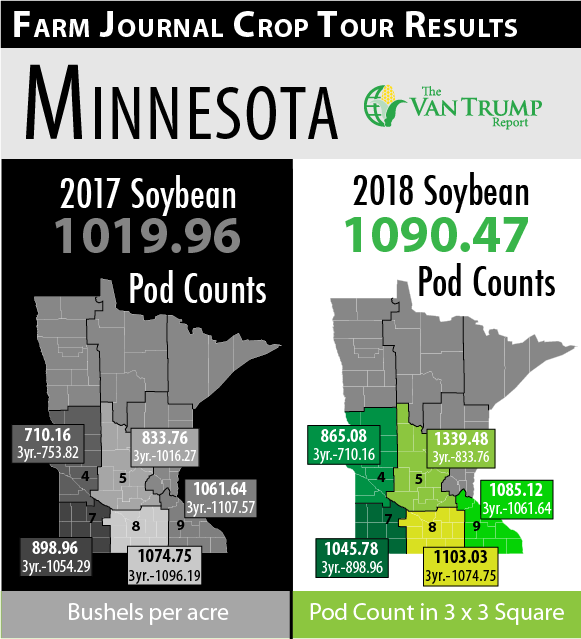

The Pro Farmer Crop Tour released estimates fro Minnesota and Iowa last night. The Minnesota numbers showed 1090.47 pods in a 3x3' plot, up +6.9% from last year's 1019.96 estimate and up substantially from the 1082.26 three-year average pod-count.

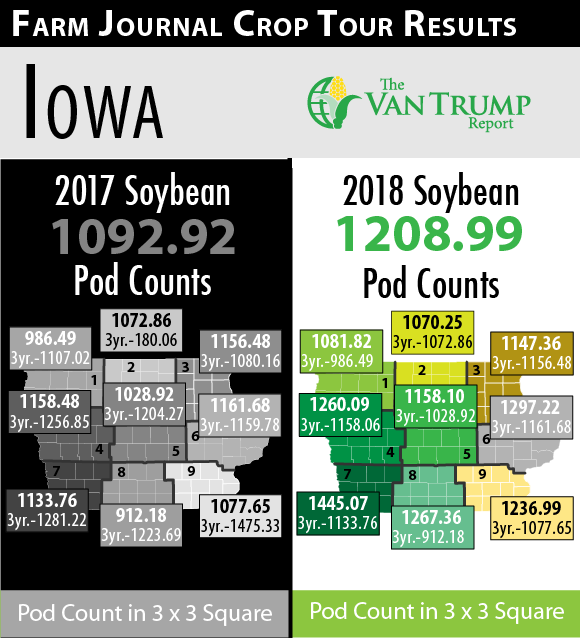

The USDA is currently forecasting the Minnesota crop at 49 bushels per acre vs 47 last year. The Iowa estimates showed an average pod-count of 1208.99 in a 3x3' plot, up +10.6% from last year's 1092.92 estimates. The USDA is currently forecasting the Iowa crop at 59 bushels per acre vs. 56.5 last year.

The opinions of the author are not necessarily those of Corn+Soybean Digest or Farm Progress.

CHECK OUT ALL THE DAILY INFORMATION IN THE VAN TRUMP REPORT

About the Author(s)

You May Also Like